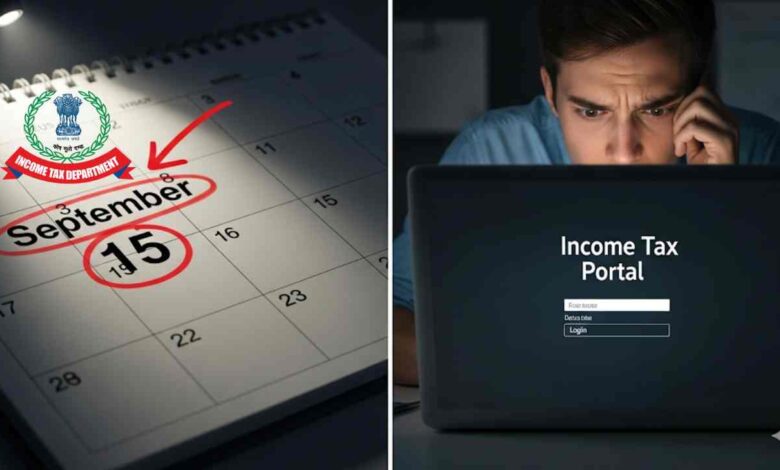

ITR Filing Last Date: Will the Deadline for Filing Income Tax Returns Be Extended? Get the Latest Updates

ITR Filing Last Date: The deadline for filing Income Tax Returns (ITR) is approaching, and speculation about an extension is rampant among taxpayers. The last day to file ITR for the assessment year 2025-26 is September 15. With only two days remaining, the Income Tax Department has not yet made any formal announcement regarding an extension.

Current Situation

According to recent data from the Income Tax Department, more than 6 crore taxpayers have already filed their returns. However, professional bodies are continuously appealing to the government for an extension. The reasons behind these requests include technical glitches on the portal, delays in the release of some utilities, flood situations in several parts of the country, and the ongoing festive season.

Experts note that the pace of filing this year is slightly slower than last year. By July 31 last year, 7.6 crore returns had been submitted, whereas this year, the number stands at nearly 6 crore as of September 13.

Reasons and Possibility of Extension

This year, the government had already extended the deadline for non-audit taxpayers from the usual July 31 to September 15 due to a delay in the release of ITR forms. The delay was caused by necessary amendments to the ITR forms following changes in the capital gains tax framework in the interim Budget.

Get Instant News Updates!

Join on TelegramOrganizations such as the Karnataka State Chartered Accountants Association (KSCAA), ICAI’s Central India Regional Council, and the Advocates Tax Bar Association (ATBA) have formally requested an extension from the Central Board of Direct Taxes (CBDT). However, the government has not yet given any positive indication on this matter.

Who Does This Deadline Apply To?

The September 15 deadline is primarily for taxpayers whose accounts do not require an audit. This includes:

- Salaried employees

- Pensioners

- Non-Resident Indians (NRIs)

For businesses or professionals whose accounts are required to be audited, the deadline for submitting the audit report is September 30, and the deadline for filing the ITR is October 31.

Penalty for Late Filing

Taxpayers may face a penalty for not filing their ITR by the due date. A penalty of up to ₹5,000 may be levied for returns filed after September 15. However, for those with an income of less than ₹5 lakh, the penalty amount is ₹1,000.

There are other disadvantages to filing late. For instance, taxpayers may not be able to carry forward certain losses to subsequent years and may experience delays in receiving refunds.

The Income Tax Department is urging all taxpayers to file their returns as soon as possible to avoid the last-minute rush. Their helpdesk is available 24/7 for assistance.