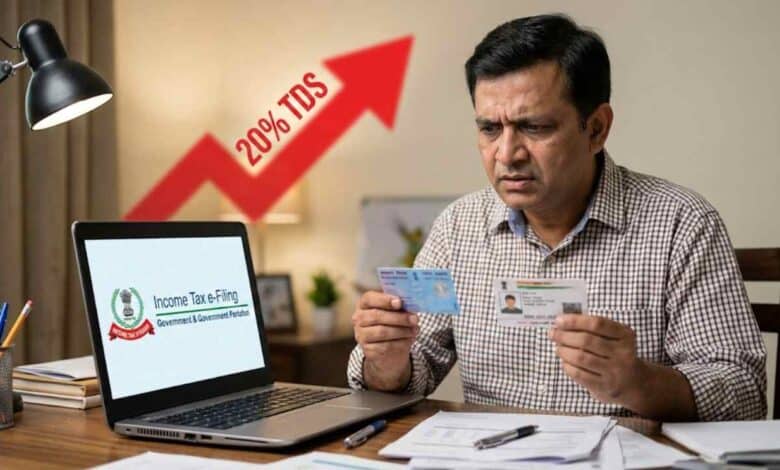

Income Tax Warning: Is Your Money Safe? Ignoring This Tax Rule, Banks Will Deduct Double TDS!

Aadhaar PAN Linking: The Income Tax Department has issued a fresh and critical warning regarding a vital tax compliance procedure in India that affects every taxpayer. The department has made it clear that linking your Aadhaar and PAN is no longer merely a “formality” or an optional exercise; it has become a necessary step to ensure your financial stability. Failure to link these two documents could lead to your PAN card becoming inoperative, resulting in severe financial consequences that will directly impact your bank account and hard-earned savings.

The Cost of Ignoring the Rule: Higher TDS

The most immediate and hitting consequence of an unlinked, inoperative PAN is the deduction of Tax Deducted at Source (TDS) at a much higher rate. Under the current tax rules, if your PAN is not linked with Aadhaar, banks and financial institutions are mandated to deduct TDS at a higher rate.

Here is how it impacts your pocket:

- Normal Scenario: Usually, a 10% TDS might be deducted from your annual income or interest earnings.

- Inoperative PAN Scenario: If your PAN becomes inoperative due to non-linking, this rate can skyrocket to 20%.

This effectively means that twice as much money will be deducted from your income. While many individuals tend to ignore this as a minor procedural requirement, in reality, it can significantly disrupt your financial planning and reduce your in-hand cash flow.

Why is Aadhaar-PAN Linking Mandatory?

The government has made this process mandatory to streamline the tax system. If your PAN is considered inoperative, you face multiple hurdles beyond just higher taxes:

- ITR Filing Issues: You will not be able to file your Income Tax Returns (ITR) correctly.

- Refund Delays: Any tax refund due to you will be stuck, as the department cannot process refunds for inoperative PANs.

Steps to Link Your Aadhaar and PAN

Fortunately, the process to rectify this is straightforward and can be done quickly.

- Online Method: Visit the official Income Tax Department’s e-filing website. Look for the “Link Aadhaar” option and follow the on-screen instructions.

- Offline Method: If you are not comfortable with digital tools, you can visit a designated PAN service center to complete the process.

- Data Verification: Before initiating the request, strictly ensure that your name, date of birth, and gender details match exactly on both your Aadhaar and PAN cards. Any mismatch will cause the linking to fail.

Expert Opinion on Financial Security

Financial advisors warn that taking the Aadhaar-PAN linking lightly is dangerous for your financial health. It is not just about saving the extra tax deduction; it is about maintaining your financial credibility. In the modern digital tax system, even small acts of negligence can cause significant losses. Completing this linking process is a guarantee of your financial security and ensures you do not lose a significant portion of your money to avoidable penalties.