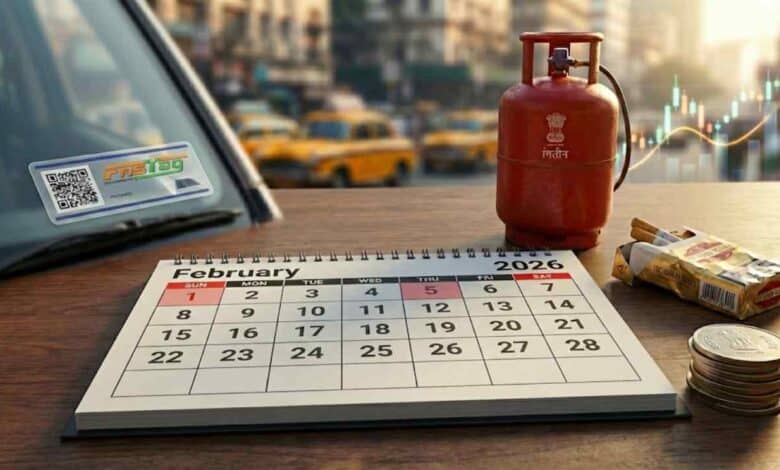

February Rules Change: New Rules From February 1 Impacting LPG Prices FASTag KYC And Tobacco Rates

February Rules Change: Starting Sunday, February 1, 2026, several key regulations are set to change, which will have a direct impact on the household budget and daily life of the common man. While some changes might tighten the purse strings, others aim to simplify procedural compliances. The major updates revolve around LPG cylinder prices, FASTag verification rules, and the taxation of tobacco products. Let’s delve into the specific changes coming into effect from the first day of the month.

Major Relief for FASTag Users

There is significant relief news for vehicle owners regarding toll payments. Starting February 1st, the mandatory requirement for separate KYC (Know Your Customer) verification for FASTags will be completely eliminated. The National Highways Authority of India (NHAI) has already made an announcement in this regard. Under the new guidelines, the banks issuing the FASTags will be responsible for conducting all necessary background checks before issuance. This implies that users will no longer need to undergo the hassle of repetitive KYC submissions, making the process smoother.

Revision in LPG and Fuel Prices

As per standard practice, Oil Marketing Companies (OMCs) review the prices of Liquefied Petroleum Gas (LPG) on the first day of every month. Consequently, on February 1, the retail prices for both domestic 14.2 kg cylinders and commercial 19 kg cylinders may witness a revision. Prices are adjusted—either increased or decreased—based on international market trends.

In addition to LPG, the prices for Compressed Natural Gas (CNG), Piped Natural Gas (PNG), and Aviation Turbine Fuel (ATF) will also be reviewed. This monthly revision could impact transportation costs for CNG vehicle owners and cooking budgets for households using PNG.

Cigarettes and Tobacco to Cost More

February 1st brings tougher news for consumers of tobacco products. A new tax regime is being implemented nationwide affecting cigarettes and other tobacco items. The government is set to increase the excise duty and cess on these products, which will be levied over and above the Goods and Services Tax (GST). This hike in duties is expected to significantly drive up the retail prices of cigarettes and tobacco, making them more expensive for the end consumer.

Deadline for Bank Privatization Bids

Apart from consumer-centric rule changes, a significant development is occurring in the banking sector. The government has invited final bids for the privatization of a specific bank, with the deadline set for February 5. While this does not directly change a rule on February 1, it marks a crucial week for financial policy and banking reforms.

Citizens are advised to plan their monthly budget keeping these potential price fluctuations and regulatory changes in mind.