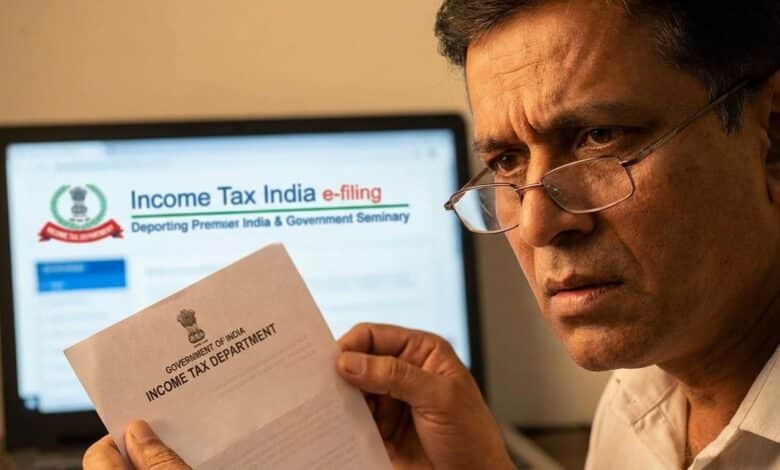

Income Tax Advisory: Worried About Income Tax Message? Know What To Do By December 31

Income Tax Advisory: Recently, many taxpayers across the country have received messages via SMS or email from the Income Tax Department (ITD). Receiving such sudden communication from the tax authorities has naturally caused concern among many. However, the Income Tax Department clarified on Thursday that there is no need to panic regarding these messages. These are primarily advisory in nature and aimed at facilitating voluntary compliance, not initiating any enforcement action or raids.

Why Are These Messages Being Sent?

In a post on the social media platform X (formerly Twitter), the department explained that these messages have not been sent to all taxpayers. Communication has been initiated only in specific cases where a significant discrepancy or gap has been observed between the disclosures made in the Income Tax Returns (ITRs) filed by the taxpayers and the information received by the tax department from various reporting entities.

The ITD collects financial transaction data throughout the year from different sources. When a mismatch appears prima facie between the declared income and the information available with the department, these “advisories” are sent. The objective is to make taxpayers aware of the transaction details available with the ITD.

What Should Taxpayers Do Now?

The Income Tax Department has advised that taxpayers need not worry upon receiving this message. Instead, they should take the following steps:

Get Instant News Updates!

Join on Telegram- Check AIS: Log in to the Compliance Portal and carefully review the Annual Information Statement (AIS).

- Verify Information: If discrepancies exist and the department’s data is correct, taxpayers should take immediate corrective action.

- Revise Returns: Where required, taxpayers can revise their already filed returns or file a Belated Return if they haven’t filed one yet.

- Submit Feedback: If a taxpayer believes their filing is correct and the discrepancy is invalid, they can simply submit a response via the Compliance Portal. In such cases, no further action is needed.

Important Deadline and Context

The department has reminded taxpayers that the last date for filing a revised or belated return for the Assessment Year 2025–26 is December 31, 2025. With the deadline approaching fast, it is advisable to make necessary corrections promptly to avoid potential penalties.

Additionally, the department mentioned earlier that it has identified approximately 25,000 “high-risk” cases where foreign assets or income were not disclosed in ITRs, based on data from the Automatic Exchange of Information (AEOI) framework. These taxpayers are also being “nudged” through advisories to correct their returns.

Meanwhile, CBDT Chairman Ravi Agrawal noted that tax refunds have been delayed in some instances due to scrutiny of high-value or red-flagged refund claims. This review aims to prevent wrongful deductions and incorrect claims. However, the department has assured that legitimate refunds are being processed and released.