Financial Planning

- Finance

Financial Purpose Mapping: Not Monotonous SIP Or FD, Learn These 5 Magical Formulas Of ‘Purpose Mapping’ To Be Rich Today

Financial Purpose Mapping: Every month, on a specific date, a SIP amount is deducted from your account. At the end…

Read More » - Finance

SIP vs Lumpsum: 5000 Rupee SIP Or Lumpsum? 2 Crore Vs 7 Crore Profit In 30 Years! Here Is The Real Truth

SIP vs Lumpsum: When stepping into the world of investing, the biggest question that haunts the common individual is regarding…

Read More » - Finance

SIP Investment Plan: You can become a Crorepati by saving Rs 450 daily! Know the brilliant math of SIP

SIP Investment Plan: Dreaming of becoming rich early in life is something we all share. Achieving financial freedom and building…

Read More » - Finance

SIP Investment Strategy: 1 Crore with 25k Monthly Investment! Know the Mutual Fund SIP Math

SIP Investment Strategy: Who doesn’t dream of becoming a Crorepati? However, most people believe that without a huge sum of…

Read More » - Finance

Emergency Fund: What to do in case of sudden job loss or illness? Learn why an Emergency Fund is essential for financial security

Emergency Fund: Imagine this situation – You wake up one morning to an email from your employer announcing sudden layoffs.…

Read More » - Finance

SIP vs Lump Sum: Stock Market at All-Time High! Invest Lump Sum Now or Trust SIP? Know the Profitable Strategy

SIP vs Lump Sum: On November 27, the Indian stock market scaled dazzling new heights. Both the Sensex and Nifty…

Read More » - Finance

Real Estate Investment: Will You Buy a Flat or Rent? Know the Best Investment Strategies with Expert Advice

Real Estate Investment: For the Bengali middle class, owning a home or a flat is a lifelong dream. However, considering…

Read More » - Finance

SIP vs Lump Sum Investment? Which is More Profitable in 10 Years with a Rs 3000 monthly vs Rs 3 Lakh one-time investment?

SIP vs Lump Sum: In recent years, mutual funds have emerged as a popular investment option among Indian investors. Offering…

Read More » - Finance

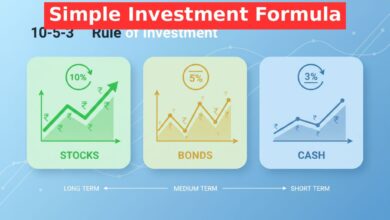

What is the 10-5-3 Rule of Investment? Know the Simple Formula for Potential Returns from Different Assets!

10-5-3 Rule of Investment: Entering the world of investment can often be confusing, with numerous options and returns to consider.…

Read More »