ITR Filing

- Income Tax

ITR Filing: File Your Income Tax Return Through the Mobile App, Complete it Before the Deadline

ITR Filing: Filing your Income Tax Return (ITR) is now much easier than before. The Income Tax Department has launched…

Read More » - Finance

High-Value Transactions: 11 Transactions to Be Cautious About to Avoid an Income Tax Notice

High-Value Transactions: Nowadays, many of us are accustomed to various types of digital transactions. But did you know that some…

Read More » - Income Tax

ITR Late Fine: Delayed in Filing Income Tax Return? Know How Much Penalty You May Face

ITR Late Fine: This is important news for taxpayers. A significant financial penalty can be imposed for not submitting the…

Read More » - Income Tax

ITR Refund Not Received? This One Mistake Could Be Costing You! Step-by-Step Guide

ITR Refund: After filing the Income Tax Return (ITR), many people eagerly wait for their refund. But it’s natural to…

Read More » - Income Tax

ITR Filing: Filed Your ITR? Don’t Forget This Crucial Step Or Your Return is Invalid

ITR Filing: After filing the Income Tax Return (ITR), the most crucial step is its verification. Without verification, your return…

Read More » - Income Tax

ITR Rectification: Made an Error in Your ITR? Correct It Easily Using Your Mobile

ITR Rectification: If you discover a mistake after filing your Income Tax Return (ITR), there’s no need to worry. The…

Read More » - Finance

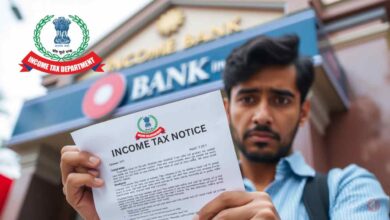

Getting an Income Tax Notice? Avoid These Savings Account Mistakes!

Income Tax Notice: North Dumdum, July 29, 2025: It is currently very important for every Indian citizen to be aware…

Read More » - Income Tax

ITR Exemption: No More Hassle of Filing Income Tax Returns! Fill This One Form to Get Exemption

ITR Exemption: The Government of India has introduced a significant change in the Income Tax Act for the convenience of…

Read More » - Income Tax

Income Tax Refund: Is Your Tax Refund Delayed? Avoid These Common Mistakes

Income Tax Refund: After filing their income tax, many people eagerly await their refund. However, it often happens that this…

Read More » - Income Tax

Digital Form 16: File Your Income Tax Return More Easily, Know the Details

Digital Form 16: Filing an Income Tax Return (ITR) is a mandatory task for all taxpayers. However, this process is…

Read More »