Tax Planning

- Income Tax

Income Tax Calculation: Old vs New Tax Regime: Which is Better for Income Between 8 Lakh to 15 Lakh? Check Detailed Calculation

Income Tax Calculation: Choosing the right income tax regime—Old or New—remains a persistent dilemma for taxpayers every year before filing…

Read More » - Income Tax

Union Budget 2026: Will Old Tax Regime Be Scrapped As 80 Percent Taxpayers Shift to New System?

Union Budget 2026: With less than three weeks remaining for the Union Budget 2026–27, the spotlight is firmly on tax…

Read More » - Income Tax

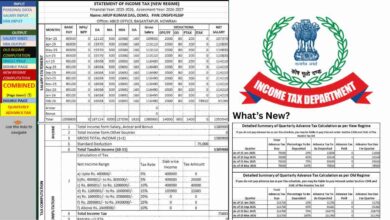

All-in-One Income Tax Calculator for FY 2025-26 (Excel): Simplify Your Tax Calculations

The financial year is moving forward, and so are your financial responsibilities. For many, navigating the complexities of income tax…

Read More » - Income Tax

ITR E-filing: Difference Between AIS and Form 26AS, Crucial Information for Taxpayers

ITR E-filing: The deadline for filing Income Tax Returns (ITR) is approaching. During this time, two important documents for taxpayers…

Read More » - Income Tax

Income Tax Return 2025: How Many Times Can You Switch Tax Regimes? Know The Details

As the time for filing Income Tax Returns (ITR) approaches, a crucial decision for taxpayers is choosing the right tax…

Read More » - Income Tax

Income Tax Benefits for Retired Employees, New Notification of ITAX Department

Income Tax: Retirement marks a new chapter, and understanding the tax implications of your hard-earned savings is crucial for financial…

Read More » - Calculators

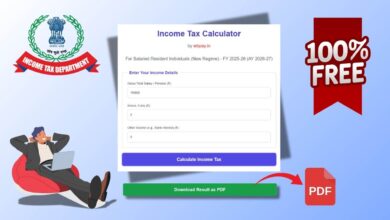

FY 2025-26 Income Tax Calculator for Salaried: Free PDF Download!

Income Tax Calculator: Navigating income tax calculations can often feel overwhelming, especially with evolving tax regimes. For salaried individuals across…

Read More » - Income Tax

Income Tax: How Salary Up to ₹14.65 Lakh Can Be Tax-Free! View New Regime Rules

In a significant relief for salaried taxpayers, announcements from Budget 2025 indicate that under specific conditions, individuals with an annual…

Read More »