FY 2025-26 Income Tax Calculator for Salaried: Free PDF Download!

Income Tax Calculator: Navigating income tax calculations can often feel overwhelming, especially with evolving tax regimes. For salaried individuals across India – whether you’re a Central Government employee, a State Government employee, or working in the private sector – understanding your tax liability for the Financial Year 2025-2026 (Assessment Year 2026-27) under the New Tax Regime is crucial for sound financial planning.

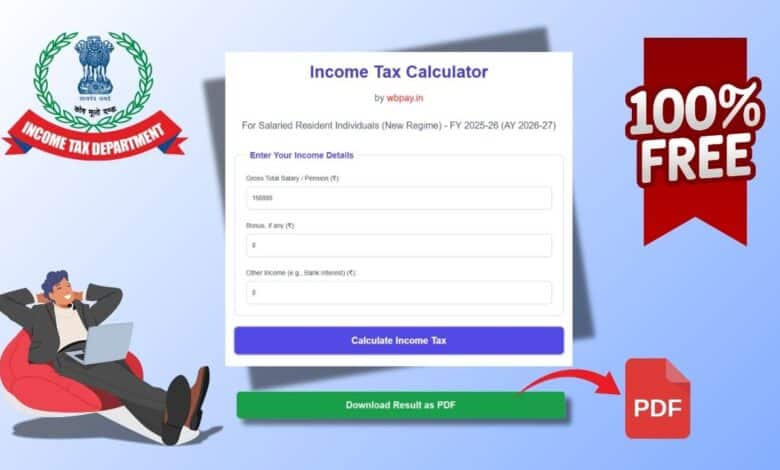

To make this process seamless and straightforward, wbpay.in is thrilled to introduce our New Income Tax Calculator for FY 2025-26, specifically designed for salaried individuals under the New Tax Regime. And the best part? You can instantly download your detailed tax summary as a Free PDF report!

Ready to take control of your tax planning for FY 2025-26?

Income Tax Calculator

by wbpay.in

For Salaried Resident Individuals (New Regime) - FY 2025-26 (AY 2026-27)

Why Choose the wbpay.in Income Tax Calculator?

In a sea of financial tools, our calculator stands out for its simplicity, accuracy, and user-centric features. Here’s what makes it an indispensable tool for every salaried taxpayer:

- Tailored for FY 2025-26 (New Tax Regime): Our calculator incorporates the latest income tax slabs and rules applicable for the current financial year under the New Tax Regime, which is the default option for most taxpayers.

- For All Salaried Individuals: Whether you draw your salary from the Central Government, any State Government (including West Bengal), or a private sector company, this tool is designed for you.

- User-Friendly Interface: No complex jargon or confusing layouts. Just enter your basic income details and get your tax summary in seconds.

- Comprehensive Calculation: Get a detailed breakdown including your Gross Total Income, Standard Deduction (as applicable), Net Taxable Income, Income Tax before Rebate, Rebate u/s 87A, Tax after Rebate, Health & Education Cess, and the final Total Tax Payable.

Spotlight: Free PDF Export for Easy Record-Keeping

One of the standout features of our Income Tax Calculator is the ability to download your complete tax calculation summary as a PDF, absolutely free. This feature offers several practical benefits:

- Offline Access: Save your tax summary on your device for access anytime, anywhere, even without an internet connection.

- Easy Record-Keeping: Maintain a neat digital record for your financial planning, tax filing, or future reference.

- Share with Ease: Conveniently share your tax summary with your financial advisor or for internal documentation.

- Print-Friendly: The PDF is formatted for easy printing if you prefer a hard copy.

This hassle-free PDF export empowers you to manage your tax information efficiently and professionally.

How to Use the Calculator – It’s as Easy as 1-2-3!

- Enter Your Income: Input your Gross Total Salary/Pension, any Bonus received, and Other Income (like bank interest).

- Click Calculate: Hit the “Calculate Income Tax” button.

- View & Download: Instantly see your detailed tax breakdown on the screen. Click the “Download Result as PDF” button to get your free report.

Benefits Across All Sectors

- Central Government Employees: Plan your finances with clarity, understanding your tax outgo under the New Tax Regime.

- State Government Employees (including West Bengal): A dedicated tool that simplifies tax calculations based on the prevailing rules, ensuring you’re well-informed.

- Private Sector Employees: Quickly ascertain your tax liability to better manage investments and savings.

Understanding your tax obligations is the first step towards smart financial management. Our calculator not only provides this clarity but also offers the convenience of a portable PDF report.

Disclaimer: © wbpay.in 2025-2026. The Income Tax Calculator is for illustrative purposes only. While we strive for accuracy, please consult a qualified tax professional for financial advice specific to your situation. Based on New Tax Regime rules for FY 2025-26 (AY 2026-27). Calculator by wbpay.in.