WBIFMS Help

WBIFMS Help

West Bengal Integrated Finance Management System (WBIFMS) is a web portal controlling by West Bengal Finance Department. WBIFMS portal is designed for distribution and management of funds for Finance Department of West Bengal (WBFIN). This category of posts helps all WBIFMS users to easily find help and guideline to use WBIFMS portal easily. This category includes-

- Process of Leave application in WBIFMS Portal.

- Process of Joining Report in WBIFMS.

- Process of GPF Loan application.

- Process of e-Biling bill preparation for Office usage and many more related to WBIFMS portal.

-

নতুন WBIFMS 3.0 পোর্টাল: কী কী পরিবর্তন হল? কীভাবে ব্যবহার করবেন? কী কী সমস্যা আছে দেখুন?

WBIFMS 3.0: সরকারি কর্মীদের জন্য ওয়েস্ট বেঙ্গল ইন্টিগ্রেটেড ফিনান্সিয়াল ম্যানেজমেন্ট সিস্টেম (WBIFMS) একটি গুরুত্বপূর্ণ পোর্টাল। সম্প্রতি চালু হওয়া WBIFMS 3.0…

Read More » -

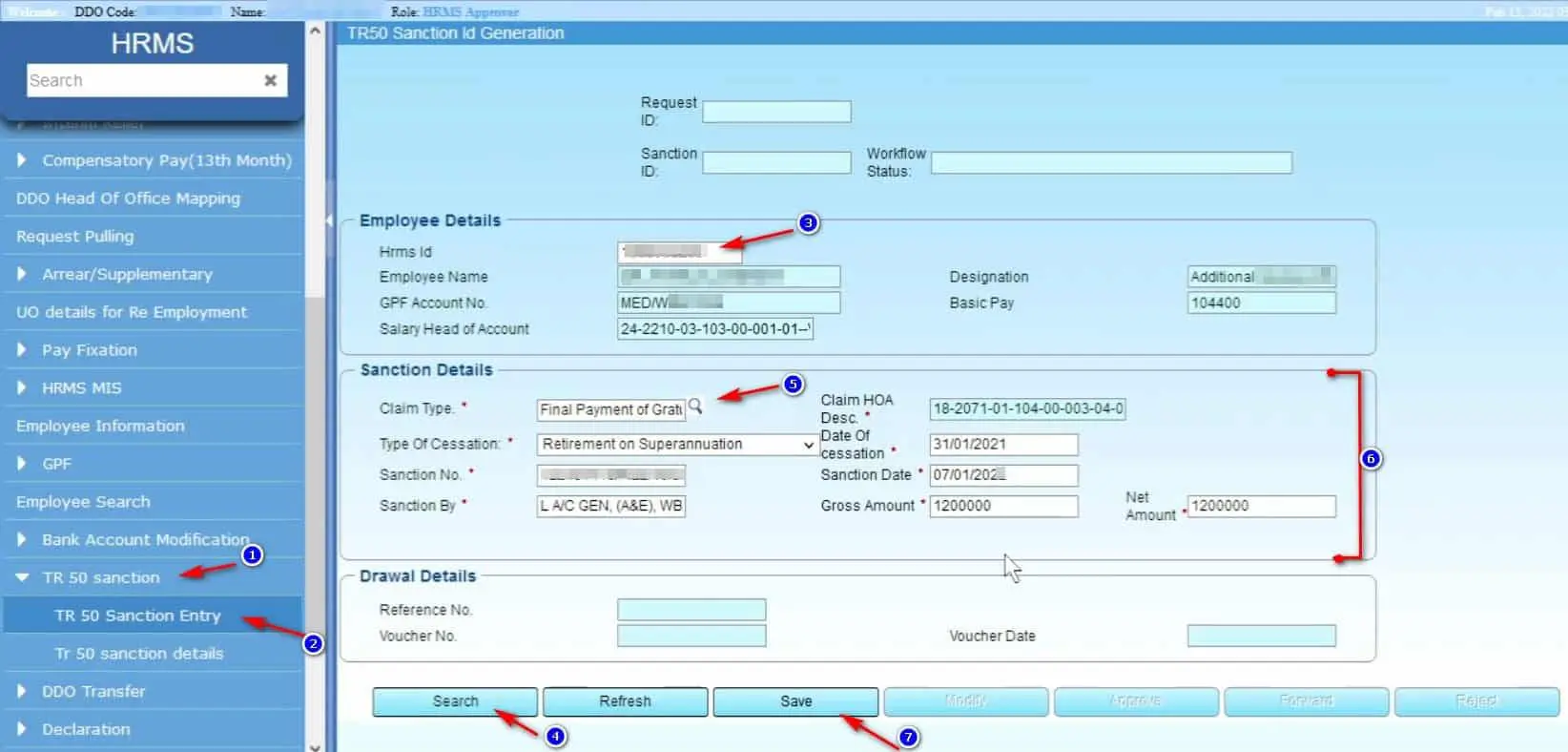

How to prepare Gratuity bill in WBIFMS?

Preparation of gratuity bill in WBIFMS is now mandatory. This article shows the process to prepare gratuity bill in WBIFMS…

Read More » -

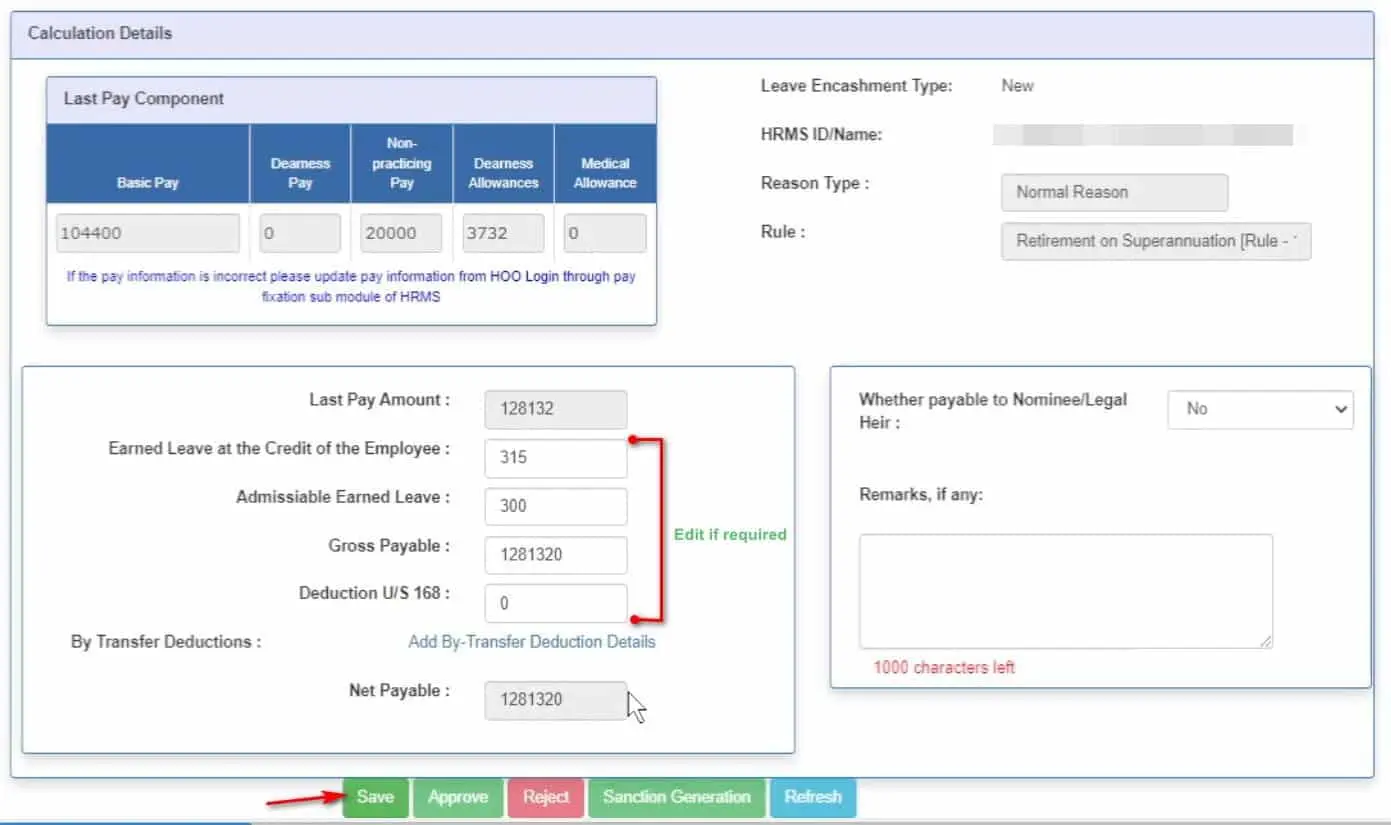

How to Prepare Leave Salary bill in WBIFMS for West Bengal Govt Employees

This is a guideline to Prepare Leave Salary bill in WBIFMS. After superannuation of an employee of West Bengal Government,…

Read More » -

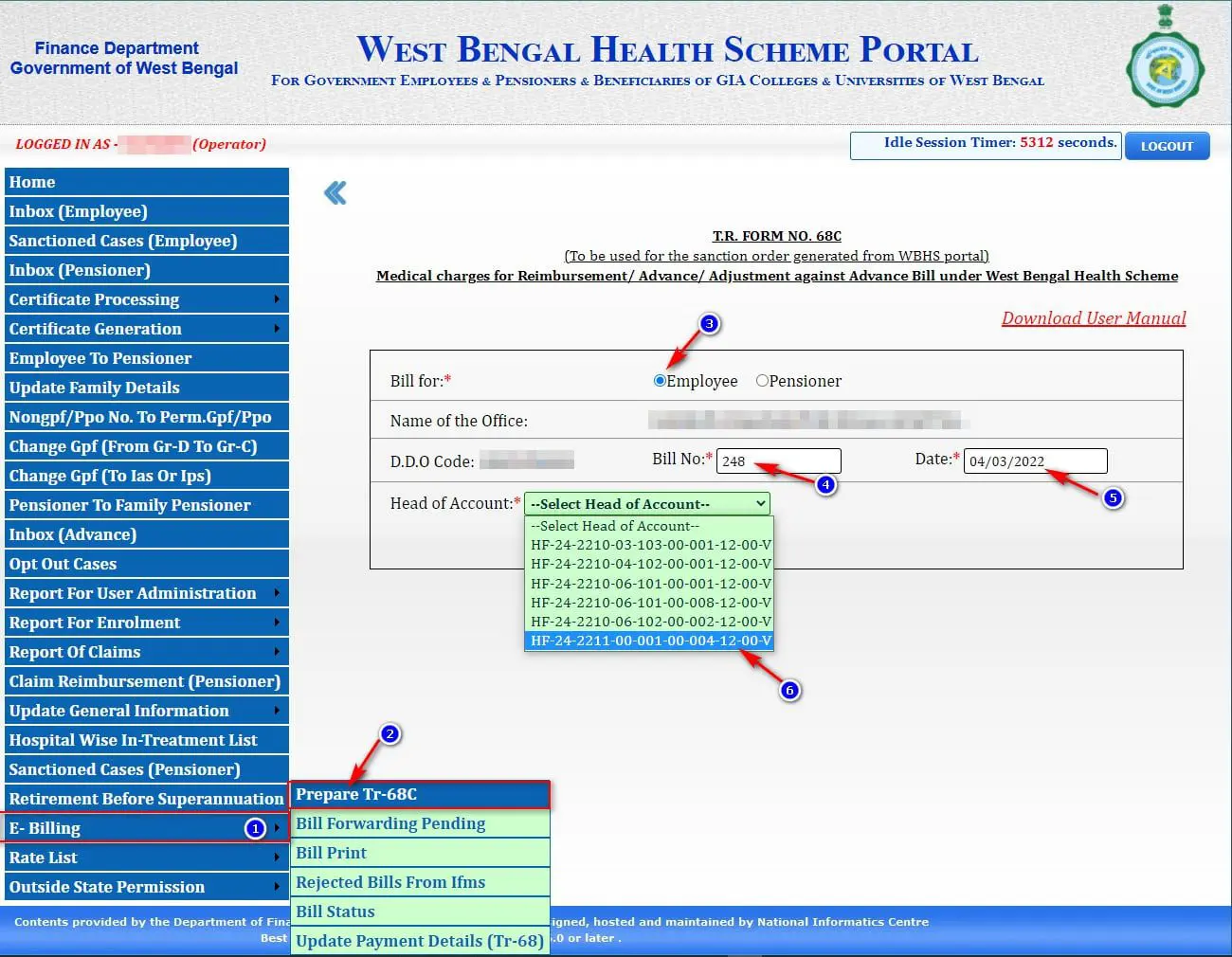

WBHS Reimbursement Bill Generation Process | TR 68C bill preparation in WBIFMS

In this article, showing the process of WBHS reimbursement bill generation process from Operator and DDO login and from WBIFMS…

Read More » -

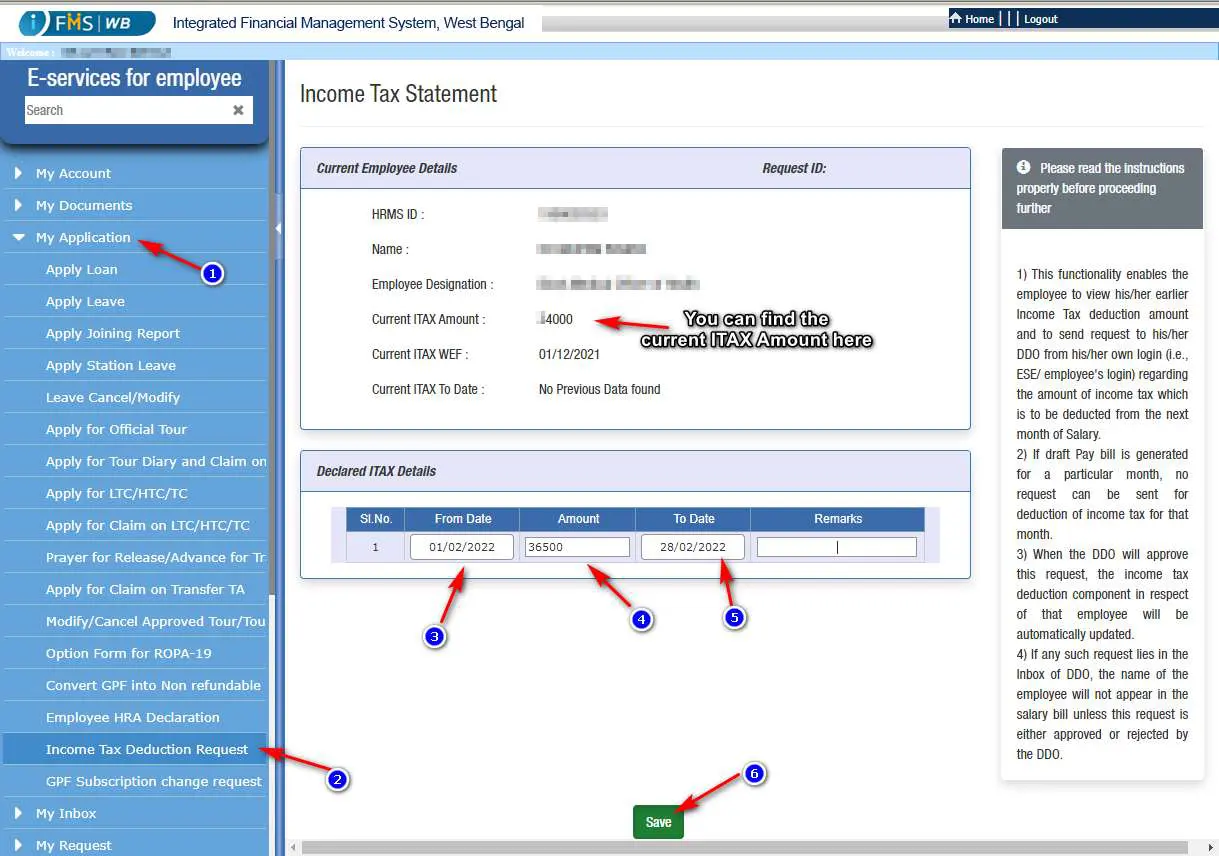

How to Send Income Tax Deduction request online in WBIFMS

Vide order of the Finance Department now an employee of West Bengal Government can send the Income Tax deduction request…

Read More » -

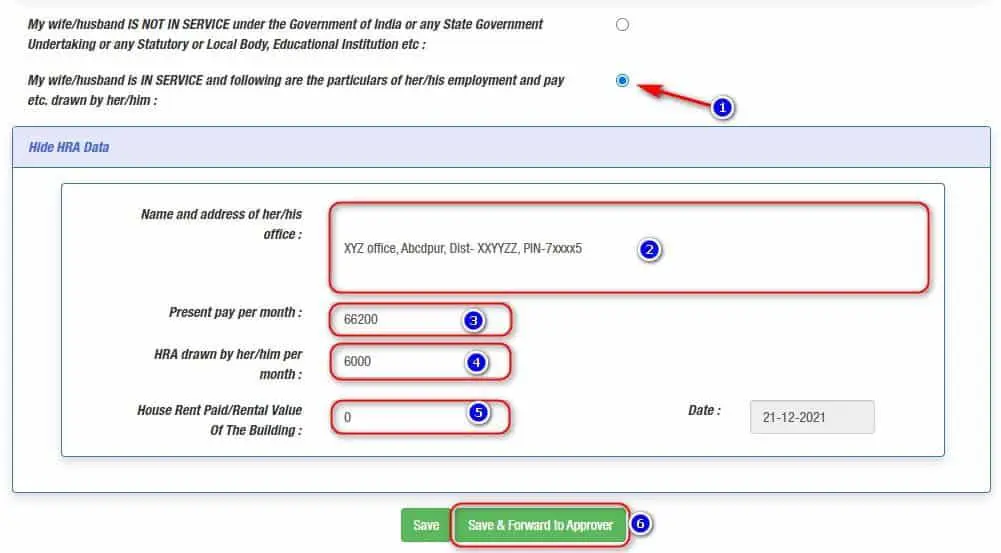

Online HRA Declaration Process in HRMS

As per order number 3972-F(Y) Dated: 17.12.2021 of Finance Department West Bengal, Government Employees of West Bengal can submit Online…

Read More » -

How to configure DSC for working in WBIFMS Portal

Please follow the instruction to configure DSC (Digital Signature Certificate) or Dongol for working in WBIFMS Portal of West Bengal…

Read More » -

GISS Bill Preparation process in WBIFMS for WB Govt Employees

GISS Amount Calculation and Sanction Order generation is now functional in WBIFMS Portal for Newly retired employees of West Bengal…

Read More »