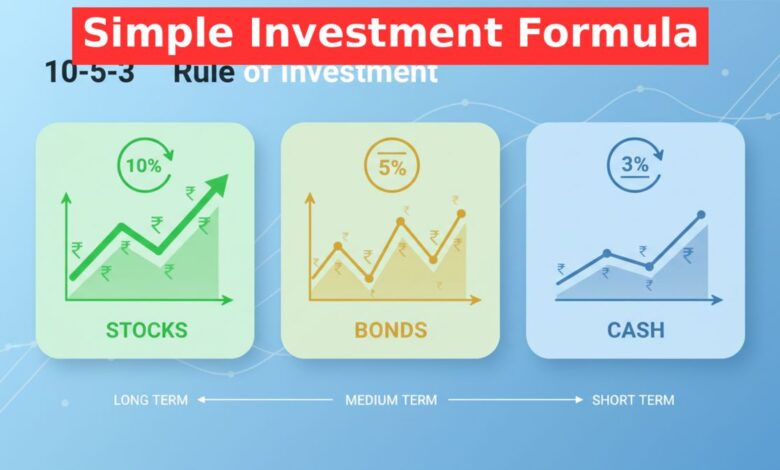

What is the 10-5-3 Rule of Investment? Know the Simple Formula for Potential Returns from Different Assets!

10-5-3 Rule of Investment: Entering the world of investment can often be confusing, with numerous options and returns to consider. Questions about where, how, and how much to invest are common among many individuals. In such situations, the 10-5-3 rule serves as a simple guide for investors. It is not a strict law but a general guideline for long-term investing that helps in setting realistic expectations.

This rule essentially provides an idea of the average annual returns from different asset classes. It helps an investor understand what kind of returns can be anticipated from various types of investments. Let’s explore this rule in detail.

What Exactly is the 10-5-3 Rule of Investment?

The 10-5-3 rule refers to the average annual rate of return for three major investment categories: stocks, bonds, and cash. According to this rule:

- 10% from Stocks: The rule suggests that investing in stocks or equities has the potential to generate an average annual return of 10% over the long term. While the stock market carries higher risk, it also offers the highest potential for returns.

- 5% from Bonds: An average annual return of 5% can be expected from investing in bonds. Bonds are relatively less risky and provide a more stable income.

- 3% from Cash or Savings: Keeping money in cash or a savings account may yield an average annual return of around 3%. This is the safest option, but its real return can often be diminished by inflation.

Importance and Application of the Rule

The primary purpose of the 10-5-3 rule is to create a clear and realistic framework of expectations for investors. When an investor knows the average expected return from each asset class, it becomes easier to build a portfolio aligned with their financial goals.

The rule is summarized in the table below:

| Asset Class | Expected Average Annual Return |

|---|---|

| Stocks | 10% |

| Bonds | 5% |

| Cash/Savings Account | 3% |

Using this rule, investors can create the right investment mix (asset allocation) based on their risk tolerance and financial objectives. For instance, a young investor with a higher risk appetite might allocate a larger portion of their portfolio to stocks. Conversely, for someone nearing retirement, bonds or cash might be a more suitable option.

This rule encourages investors to plan for the long term and stay the course without getting swayed by short-term market volatility.

Disclaimer: This article is for informational purposes only. It is not intended as financial advice or an investment recommendation. Please consult with a qualified financial advisor before making any investment decisions.