Income Tax

All in One Income Tax Calculator for FY 2024-25

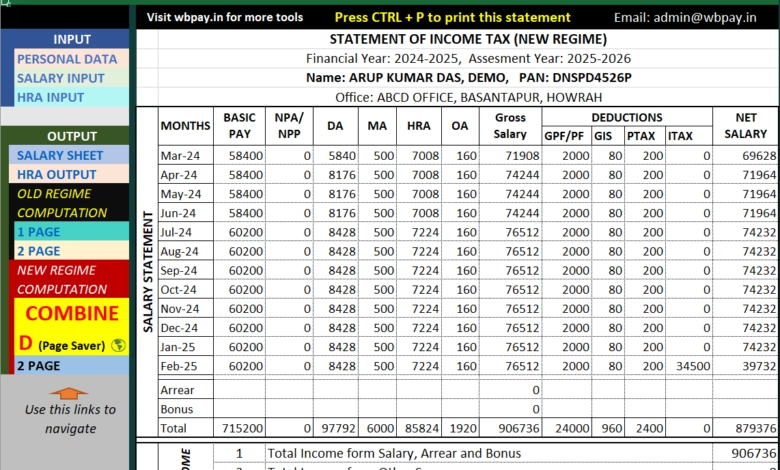

Income Tax Calculator for Salaried person with Yearly Salary Statement.

Income Tax Calculator: Introducing All in One Income Tax Calculator Excel Utility tool for Financial Year 2024-2025. This excel tool is very useful for salaried individuals for generating Salary Statement and for computation of Income Tax for the year 2024-25.

Buy All in One Income Tax Calculator for FY 2024-25

Limited Time Deal: All-in-One Income Tax Calculator

- Original Price: ₹300/-

- Limited Time Offer: ₹ 90 Only!

- Save 70%

Key features of the All in One Income Tax Calculator for FY 2024-25

- All salaried individual (Employees/Pensioners) can calculate and generate statement of income tax for the financial year 2024-2025.

- Both Old and New Tax Regime included in this file. You can compare and choose which is best for you.

- Included calculation options for senior citizens.

- Users can also print Salary Statement, Income tax statement details, HRA rebate details.

- New combined page for salary statement and income tax computation page is page saver, nature friendly.

- File size is very low, that’s the reason for a fast opening and quick calculation.

How to use the Income Tax Calculator Excel tool

To use this tool, you need to follow these simple steps:

- Click on the Buy button.

- Pay the price using UPI/Credit card/ Debit card/ Internet Banking etc.

- Download the Excel file and open it.

- Enter personal details in the personal details page, including name, age group, pan no etc.

- Enter other income details and exemption of income if any.

- Enter deduction details such as 80C, 80D, 80G etc. in the respective cells if applicable.

- Use the links on the left side of the page to navigate from page to page.

- Enter salary details in the Salary Input page.

- Now for output click COMBINED link to print all statement in one page.

- You can also use other output options as well.

- You can now compare the results and decide which tax regime is more beneficial for you.

- You can also print or save the income tax computation sheet and salary statement generated by the tool.

Buy All in One Income Tax Calculator for FY 2024-25

Limited Time Deal: All-in-One Income Tax Calculator

- Original Price: ₹300/-

- Limited Time Offer: ₹ 90 Only!

- Save 70%