All in One Income Tax Calculator for the FY 2021-2022 Old and New Regime

Income Tax Calculator and Salary Statement generator for the FY 2021-22

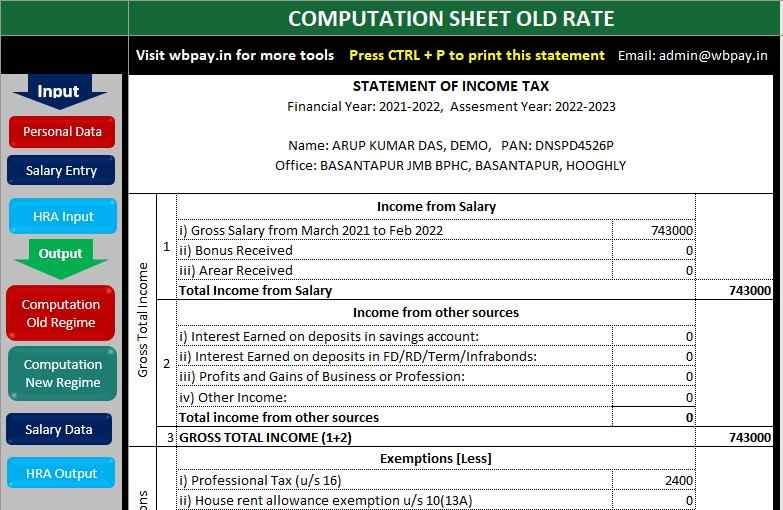

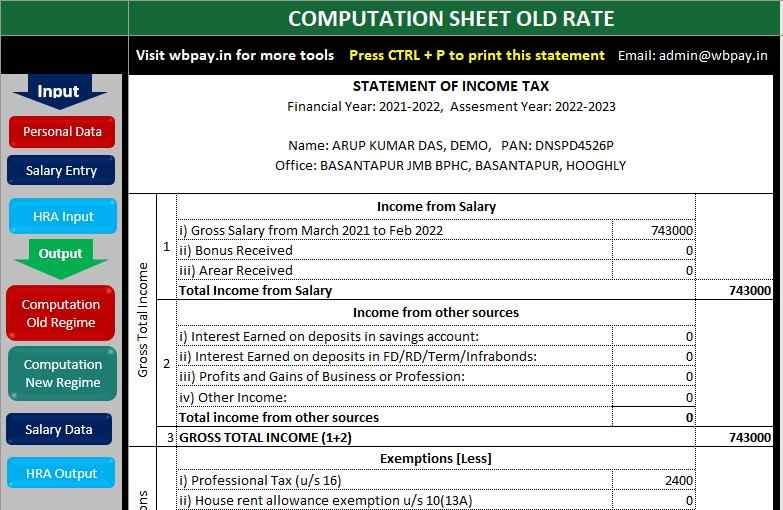

Introducing all in one Income Tax Calculator for the Financial Year 2021-22 for all employees, pensioners, and Professionals. This is a lightweight but powerful excel tools for calculation, generation and printing of Salary Statement, Income-tax Computation sheet and HRA rebate. This tax calculator specially help for West Bengal Government Employees and Pensioners to submit their Itax statement.

What are the uses of this utility?

1) A salaried individual (Employee/Pensioner) can calculate his/her income tax liability.

2) Both individuals and senior citizens can use this utility.

3) Individual/ Senior citizens can generate yearly salary statements.

4) Users can also print Salary Statement, Income tax statement details, HRA rebate details.

5) Users can calculate tax for new and old tax regime.

Tax Slab for the Financial Year 2019-20 the Assessment Year 2020-21

Old Tax regime:

1) Individual (resident or non-resident), who is of the age of less than 60 years on the last day of the relevant previous year:

| Net Income Range | Income-Tax Rate |

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001- Rs. 5,00,000 | 5% * (Nil, if income upto Rs 5 lakh) |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

2) Resident senior citizen, i.e., every individual, being a resident in India, who is of the age of 60 years or more but less than 80 years at any time during the previous year:

| Net income range | Income-Tax Rate |

| Up to Rs. 3,00,000 | Nil |

| Rs. 3,00,001 – Rs. 5,00,000 | 5% (Nil, if income upto Rs 5 lakh) |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

2) Resident senior citizen, i.e., every individual, being a resident in India, who is of the age of 60 years or more but less than 80 years at any time during the previous year:

New Tax Regime:

| Net Income Range | Income-Tax Rate |

| a) Up to Rs. 250000/- | 0% |

| b)Rs. 250001/- to Rs. 500000/- | 5% |

| c) Rs. 500001/- to Rs. 750000/- | 10% |

| d) Rs. 750001/- to Rs. 1000000/- | 15% |

| e) Rs. 1000001/- to Rs. 1250000/- | 20% |

| f) Rs. 1250001/- to Rs. 1500000/- | 25% |

| g) Above Rs. 1500000/- | 30% |

Some important notes about FY 2021-22, AY 2022-23

1) Standard deduction for all salaried individuals and pensioners is Rs. 50000/-

2) Medical Reimbursement and Conveyance/Transport Allowance is included in the standard deduction and can not be claimed separately.

3) Total admissible deduction u/s 80C is Rs. 150000/-

4) Exemption of Savings Bank Interest [u/s 80TTA] is up to Rs. 10000/-

5) u/s 80TTA is not applicable for Senior Citizens from FY 2018-19. From FY 2018-19 a new section 80TTB is introduced for senior citizens only. Section 80TTB can be applied in case of savings accounts, term deposits, fixed deposits or recurring deposits.

6) Senior citizens can claim the exemption on up to Rs. 50000/- under section 80TTB.

7) Mediclaim Insurance Premium for self, spouse, children [u/s 80D] can be claimed up to Rs 25000/- for age below 60 years and up to Rs 50000/- for above 60 years of age.

8) Mediclaim Insurance Premium for parents [u/s 80D] can be claimed up to Rs 25000/- for age below 60 years and up to Rs 50000 for above 60 years of age.

Download the All in one income tax calculator by clicking the below button:

Also view: 19 Income Tax Saving Tips that also have good returns