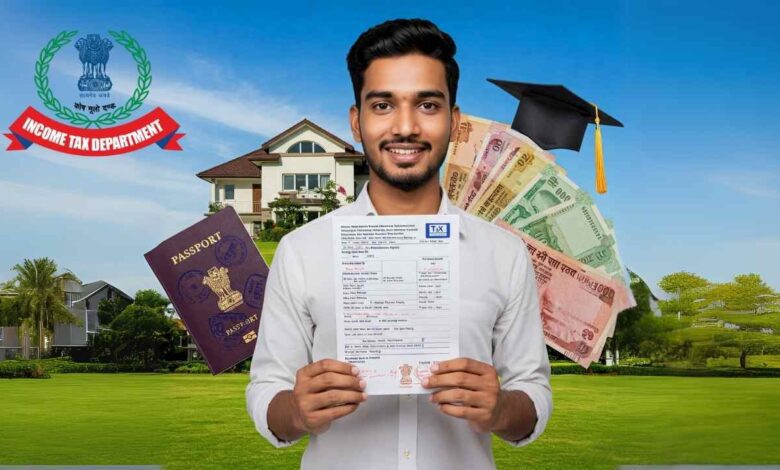

Form 16: Not Just for Income Tax Returns! Discover Its Other Important Uses

Form 16 is an essential document when filing your Income Tax Return (ITR). It’s a familiar form for salaried individuals, typically provided by the employer, detailing the Tax Deducted at Source (TDS) from their salary and their income breakdown. But did you know that Form 16 is crucial for various other significant financial tasks besides just filing your income tax? Let’s explore these lesser-known yet vital aspects.

What is Form 16 and Why is it So Important?

Form 16 is essentially a certificate issued under Section 203 of the Income Tax Act, 1961. It serves as proof that your employer has deducted a specific amount of tax from your salary and deposited it with the government. The form has two parts – Part A and Part B.

- Part A: This mainly includes the employer’s and employee’s PAN numbers, Tax Deduction Account Number (TAN), the amount of tax deducted, and the quarterly details of when it was deposited.

- Part B: This part provides a detailed breakdown of the employee’s salary, various allowances, deductions claimed under different sections of the Income Tax Act (such as 80C, 80D, etc.), and the calculation of total taxable income.

Besides simplifying and ensuring accuracy in the income tax return filing process, Form 16 can be helpful in many other financial situations.

Multiple Uses of Form 16 Beyond Income Tax Returns:

Many believe that the importance of Form 16 is limited to ITR filing. However, it has several other significant uses that you should be aware of:

- Proof of Income: Form 16 is a highly reliable and legally valid proof of your income. It can be submitted as income proof to various financial institutions.

- Facilitates Loan Approval: When applying for home loans, personal loans, or car loans, banks and financial institutions often request Form 16 to verify your income and repayment capacity. This form demonstrates your financial stability and regular income, simplifying the loan approval process.

- Essential for Visa Applications: Embassies of various countries require proof of financial solvency when applying for travel visas. Form 16 serves as evidence of your regular income and tax compliance, increasing the chances of obtaining a visa.

- Credit Card Applications: When applying for a new credit card, banks verify your income. Form 16 acts as an important income document in this case and helps in determining your credit limit.

- During Job Transitions (Switching Jobs): When you join a new organization, you need to provide details of your previous income and tax information. Form 16 simplifies this process. It allows the new employer to correctly structure your tax framework.

- Claiming Tax Refunds: If excess tax has been deducted from your salary, you can accurately file your income tax return with the help of Form 16 and claim the excess amount back as a refund.

- Consolidated Investment Proof: Part B of Form 16 mentions the various tax-saving investments you’ve made (such as life insurance, PPF, etc.). This helps in getting a consolidated view of your investments and planning your future finances.

- Verification by Tax Authorities: If the Income Tax Department ever raises a query regarding your filed returns or finds any discrepancies, Form 16 serves as an important official document to support your case.

- Proof of Tax Paid: This form confirms that your employer has deducted tax on your behalf and deposited it with the government treasury, maintaining transparency regarding tax matters.

Therefore, the next time you receive your Form 16, don’t just see it as a document for filing your income tax return. Remember its other important aspects. This single document can be helpful in various financial needs.