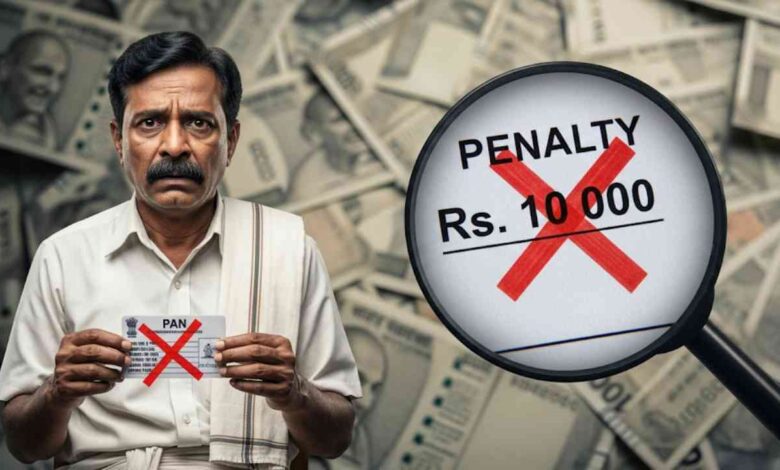

PAN Card Mistake: Do You Have This Error on Your PAN Card? It Could Lead to a ₹10,000 Fine

PAN Card Mistake: In today’s world, a PAN card is an essential document for any kind of financial transaction. It is required for everything from opening a bank account, buying or selling property, taking a loan, or making large-value transactions. But did you know that a small mistake with your PAN card could cost you a penalty of up to ₹10,000? In this report, we will discuss this matter in detail.

Why this Penalty?

According to Section 272B of the Income Tax Act, 1961, if a person’s PAN card is inactive and they use it for any financial transaction, they can be fined up to ₹10,000. Primarily, a PAN card becomes inactive if it is not linked with an Aadhaar card.

Reason for PAN Card Deactivation

As per the rules of the central government, linking a PAN card with an Aadhaar card has been made mandatory. The government had also set a specific deadline for this. The PAN cards of those who did not complete the linking process within this deadline have been deactivated. Currently, there is an option to link PAN and Aadhaar by paying a penalty of ₹1,000. However, if any financial task is carried out using an inactive PAN card, the penalty amount can increase to as much as ₹10,000.

In Which Cases Can This Fine Be Applied?

Using an inactive PAN card in the following situations could lead to a hefty fine:

- For Banking-related work: When opening a new bank account or depositing or withdrawing cash of more than ₹50,000.

- Purchase/Sale of Property: When buying immovable property.

- Investment: When investing in the stock market or mutual funds.

- Taking a Loan: When applying for any type of loan or credit card.

- Purchase/Sale of Vehicles: When buying a vehicle.

How to Check Your PAN Card Status?

You can easily check whether your PAN card is active by visiting the official website of the Income Tax Department. Follow these steps:

- Go to the e-Filing portal of the Income Tax Department.

- Click on the ‘Verify Your PAN’ option.

- Enter your PAN number, full name, date of birth, and mobile number.

- Enter the OTP received on your mobile.

- You will then be able to see the status of your PAN card.

Precaution and What to Do

Before any major financial transaction, be sure to verify the activity status of your PAN card. If your PAN card is inactive, complete the process of linking it with Aadhaar immediately by paying the ₹1,000 penalty. This one small step can save you from a large fine in the future.