Income Tax Calculator, Salary Statement and Form 16 generator for the FY 2019-20

Introducing all in one Income Tax Calculator for the FY 2019-20 for all employees, pensioners, and Employer/ Professionals. This is a lightweight but powerful excel tools for calculation, generation and printing of Salary Statement, Income-tax Computation sheet, HRA rebate and Form 16.

What are the uses of this utility?

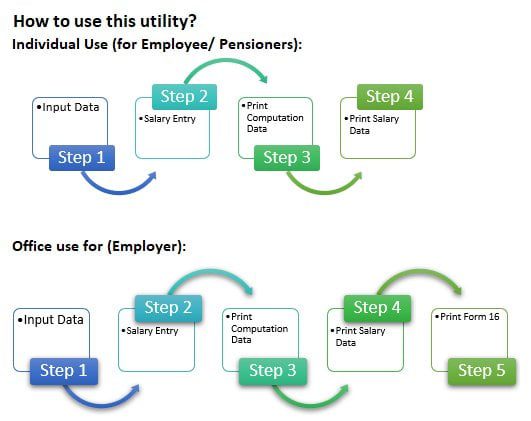

1) A salaried individual (Employee/Pensioner) can calculate his/her income tax liability.

2) Both individuals and senior citizens can use this utility.

3) Individual/ Senior citizens can generate yearly salary statements.

4) Users can also print Salary Statement, Income tax statement details, HRA rebate details.

5) An employer can use this utility to generate Form 16.

Tax Slab for the Financial Year 2019-20 the Assessment Year 2020-21

1) Individual (resident or non-resident), who is of the age of less than 60 years on the last day of the relevant previous year:

| Net Income Range | Income-Tax Rate |

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001- Rs. 5,00,000 | 5% * (Nil, if income upto Rs 5 lakh) |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

2) Resident senior citizen, i.e., every individual, being a resident in India, who is of the age of 60 years or more but less than 80 years at any time during the previous year:

| Net income range | Income-Tax Rate |

| Up to Rs. 3,00,000 | Nil |

| Rs. 3,00,001 – Rs. 5,00,000 | 5% (Nil, if income upto Rs 5 lakh) |

| Rs. 5,00,001- Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

2) Resident senior citizen, i.e., every individual, being a resident in India, who is of the age of 60 years or more but less than 80 years at any time during the previous year:

Some important notes about FY 2019-20, AY 2020-21

1) Standard deduction for all salaried individuals and pensioners is Rs. 50000/-

2) Medical Reimbursement and Conveyance/Transport Allowance is included in the standard deduction and can not be claimed separately.

3) Total admissible deduction u/s 80C is Rs. 150000/-

4) Exemption of Savings Bank Interest [u/s 80TTA] is upto Rs. 10000/-

5) u/s 80TTA is not applicable for Senior Citizens from FY 2018-19. From FY 2018-19 a new section 80TTB is introduced for senior citizens only. Section 80TTB can be applied in case of savings accounts, term deposits, fixed deposits or recurring deposits.

6) Senior citizens can claim the exemption on upto Rs. 50000/- under section 80TTB.

7) Mediclaim Insurance Premium for self, spouse, children [u/s 80D] can be claimed upto Rs 25000/- for age below 60 years and upto Rs 50000/- for above 60 years of age.

8) Mediclaim Insurance Premium for parents [u/s 80D] can be claimed upto Rs 25000/- for age below 60 years and upto Rs 50000 for above 60 years of age.

Watch the video tutorial: How to use this calculator?

Subscribe our Youtube Channel:

when my taxable income is 533000/- then 533000-(minus)250000(as 250000 is nil =283000 x (entu) 5% =14150 x (entu) 4% (education cess= 566+ (plus) 14150=14716 to be payable as income tax for the year 2019-20. if any correction/suggetion/ advice please intimate.

It will be total Rs. 19860/-

Calculation: 533000-250000 (250000 nil)= 283000

Next slab 250000x 5% = 12500

283000-250000 = 33000 * 20%= 6600

Total : 19100

Health and Edu cess 19100×4% = 764

Total Tax Payable: 19864

Rounded off: 19860

Ok , many many thanks

i am a forest employee, my style of salary is very different that you have showed here. i have washing allowance, ration allowance which i cannot include here. now it is not possible for me to use it. i need to change some options which is not possible. so help me.

Please add this total allowances to the column named “Other Allowances”.

But there are some other allowance like interim allowance which need to show there.

You can add this all to “Other Allowances”. The total income will reflect including these.

I want to change the value of white cell but password is required for that. what is the password? how I change the value of white cell? plz help me.

Thanks for design such a simple & easy IT calculator. But when I am trying to data in the Month of Jan & Feb the same are marge. How can I input data in this row specially In Pay Band and Grade Pay. Kindly acknowledge

After 6th pay commission there is no Band Pay and Grade pay for WB Gov employees. Enter only basic pay on the specific cell. Also if your salary structure included Grade Pay and Band Pay, you can add the both and enter in the Basic Pay column.

Thanks for your valuable comment.

How to fix pay through HRMS for the month Feb 2020 for implementing Carrier Advancement Scheme. Actual effect will be from 09/08/2018.

Your kind clarification in this regard is urgently required.

Thanks

sir

please keep all salary input cells editable.

When we are getting Income tax calculator for Fy 2020 2021 in excel