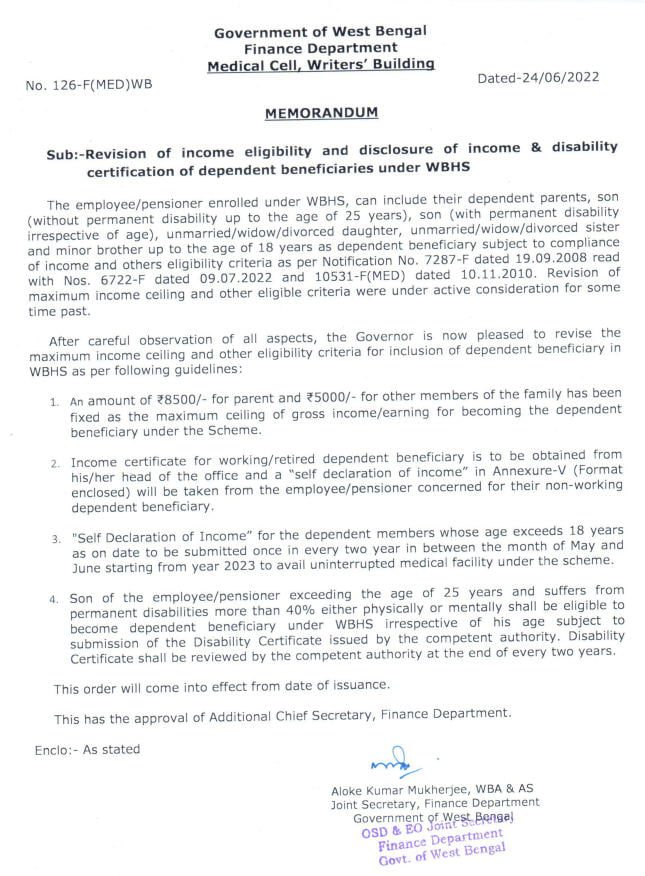

Revision of income eligibility and disability certification under WBHS

Medical cell of West Bengal Finance Department of West Bengal published memorandum on Revision of income eligibility and disability certification under WBHS (West Bengal Health Scheme). As per the new memorandum, one employee/pensioner can add his/her dependent member with the income limit upto Rs. 8500/- for parent and Rs. 5000/- for other dependent member of the family. Earlier the income limit was set upto Rs. 3500/- and Rs. 1500/- respectively.

Summery of the Memorandum

| Memo No | 126-F(MED)WB |

| Date | 24/06/2022 |

| Issued by | Medical cell of the Finance Department of West Bengal |

| Subject | Revision of income eligibility and disclosure of income & disability certification of dependent beneficiaries under WBHS |

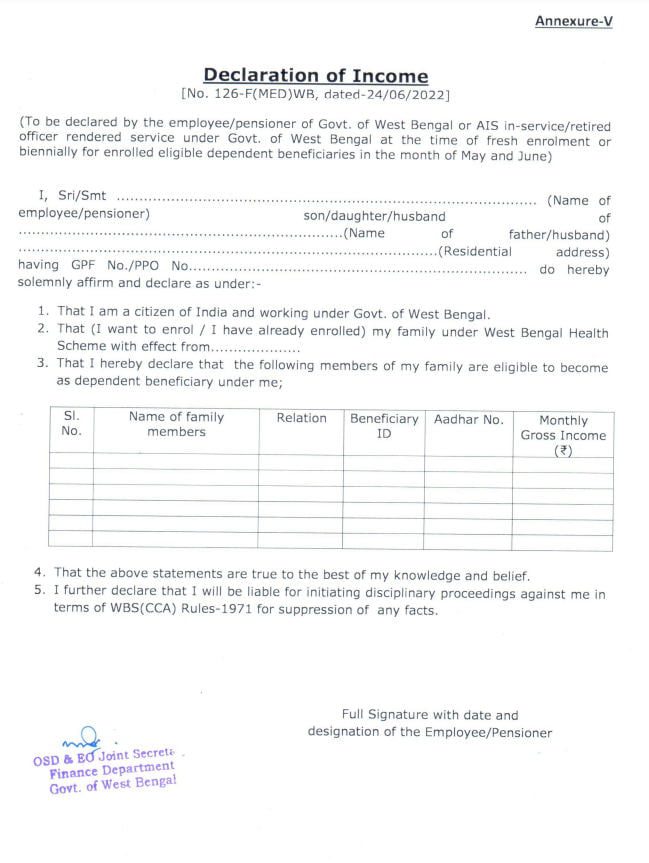

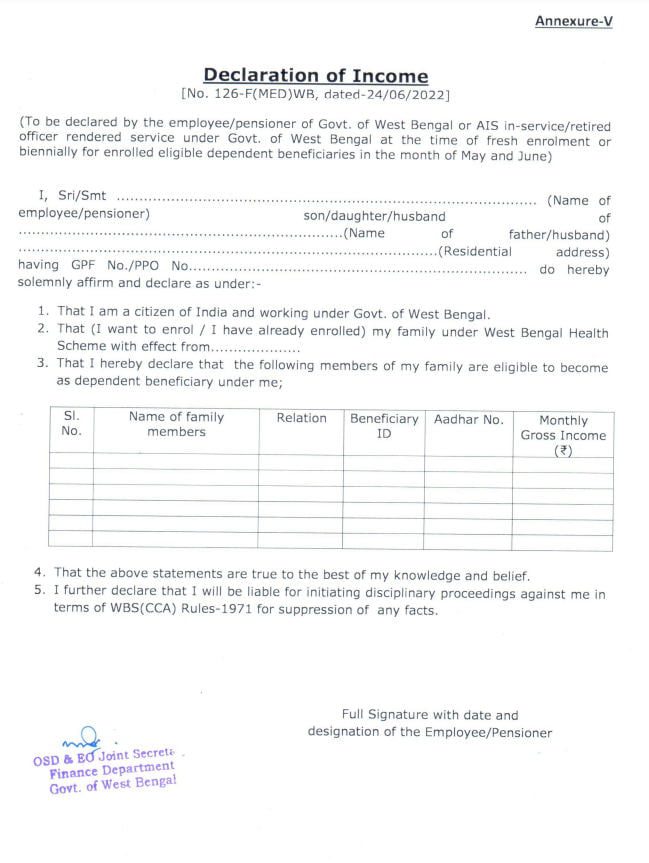

View order for Revision of income eligibility under WBHS

What is the income limit for dependent beneficiaries of the West Bengal Health Scheme?

Income limit for parent is Rs. 8500/- and for other is Rs. 5000/- as per memorandum no 126-F(MED)WB dated 24/06/2022 of the Medical Cell of the finance department of the West Bengal.

What is the income limit for the spouse (husband/ wife) under West Bengal Health Scheme?

No income limit is applicable in case of spouse, for enrolled under West Bengal Health Scheme. It is applicable only for parent and other dependent beneficiaries.