Financial Purpose Mapping: Not Monotonous SIP Or FD, Learn These 5 Magical Formulas Of ‘Purpose Mapping’ To Be Rich Today

Financial Purpose Mapping: Every month, on a specific date, a SIP amount is deducted from your account. At the end of the year, you renew your Fixed Deposit (FD) like clockwork. The numbers in your bank passbook or app are definitely trending upward. But honestly, do you feel any excitement or peace of mind regarding this investment? Or has the whole thing become just a mechanical habit? For most investors, the answer is—yes, it is merely a routine.

Even though investment charts are rising, the emotional connection within seems to be missing somewhere. In reality, many of us invest simply because we have been told we should. But we don’t really know what we specifically want from that money. This lack of clarity creates a massive disconnect. Consequently, after a while, continuing the investment feels exhausting.

Why Does This Disconnect Happen?

The problem begins at the time of goal setting. Whenever someone is asked why they are investing, the cliché answers pop up—”for retirement” or “for future security.” While these sound solid, our brains don’t have a clear picture of these words. The mind cannot attach itself to a goal it cannot see. As a result, your investment becomes emotionless and mechanical.

‘Purpose Mapping’: A New Horizon in Investment

The solution to this problem is ‘Purpose Mapping’. It is a process that re-establishes the relationship between your money and your life. Moving beyond heavy jargon like “long-term savings” or “security”, it introduces you to the real demands of your life.

Let’s look at the difference between generic goals and ‘Purpose Mapping’:

| Generic Goal | Purpose Mapping |

|---|---|

| Retirement Planning | The freedom to live peacefully in a quiet city in your mid-forties. |

| Future Security | The ability to survive for 6 months without working if a career change is needed. |

| Saving Money | To ensure no financial panic arises during a major family emergency. |

5 Effective Steps of Purpose Mapping

Investing with sheer discipline might make you rich, but not necessarily happy. Therefore, follow these 5 steps to make your investment meaningful:

1. Define the Life Scenario, Not the Number

Think about the amount later. First, think about what you want to achieve with that money. For example—”I want my child to study abroad without any loan” or “I want to travel abroad once a year.” These are not just financial terms; these are real-life scenes.

2. Create Separate Structures for Each Dream

Use distinct financial tools for each of your dreams. For instance, start a SIP for the freedom to change careers. Again, use an FD or Liquid Fund for sudden relocation needs. Each instrument should be a tool to fulfill a specific dream.

3. Establish Emotional Anchors

Money becomes meaningful only when emotion is attached to it. Ask yourself, what is this investment giving me? Peace of mind? Control? Or Independence? When you know that this specific SIP will give you the courage to quit a monotonous job, you will never lack the motivation to continue that investment.

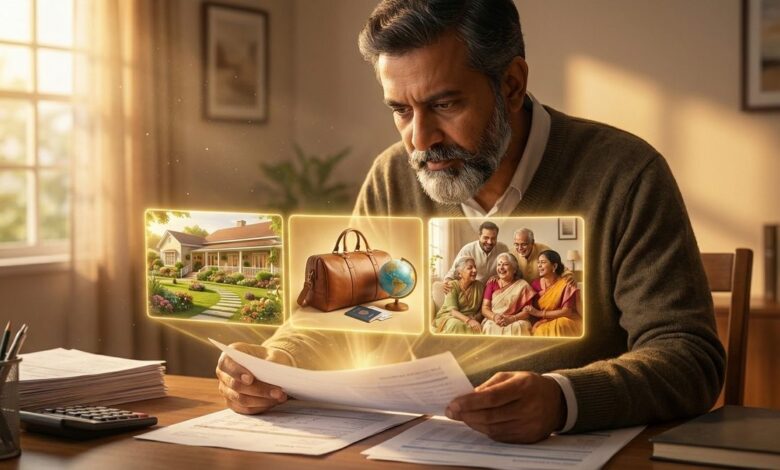

4. Visual Clarity

Purpose mapping is strongest when you can visualize the outcome. Imagine that quiet city, that flexible lifestyle, or that secure family. This visual clarity is what will help you stick to long-term investing.

5. Regular Review

People change, and so do their purposes. Review your ‘Purpose Map’ every year. Check if your investments are aligned with your current goals.

Final Thoughts

Before investing, ask yourself just one question—”Exactly what real-life situation am I saving this money for?” If the answer is clear, only then will your investment be successful. Remember, clarity builds connection, and that connection builds true wealth.

Disclaimer: This article is for informational purposes and educational discussion only. It is not financial advice or a recommendation. You are strongly advised to consult your financial advisor before making any investment decisions. Investments in the share market or mutual funds are subject to market risks.