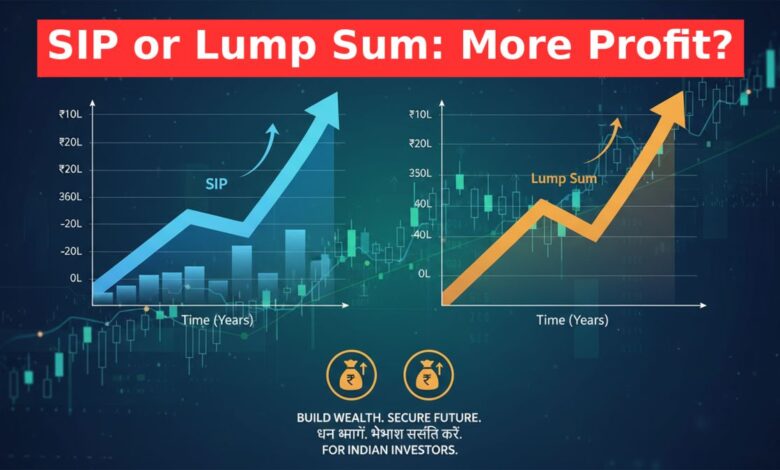

SIP vs Lump Sum Investment? Which is More Profitable in 10 Years with a Rs 3000 monthly vs Rs 3 Lakh one-time investment?

SIP vs Lump Sum: In recent years, mutual funds have emerged as a popular investment option among Indian investors. Offering a wide variety of plans, these schemes provide an opportunity for investors across the spectrum to build wealth systematically. Thanks to the power of compounding, mutual funds often yield higher returns compared to traditional instruments like fixed deposits.

Investors can choose between a Systematic Investment Plan (SIP) or a lump sum investment. When planning for the long term, many investors grapple with a simple question: Is it wiser to invest a lump sum amount or to opt for a SIP scheme? Each method has its own benefits, and the best option ultimately depends on your financial objectives, risk tolerance, and how long you plan to stay invested.

Difference Between SIP and Lump Sum Investment

Systematic Investment Plan (SIP): SIP schemes help investors build wealth by investing small amounts at regular intervals. By investing ₹3,000 each month, you distribute your contributions over time, which helps minimise the impact of market volatility. This strategy follows the principle of rupee cost averaging, meaning you purchase more units when prices are low and fewer when they rise, leading to a balanced average cost in the long run. It is generally suitable for cautious investors and salaried individuals.

Lump Sum Investment: Putting ₹3 lakh into the market all at once exposes your entire investment to current market trends. If the market is at a high and declines shortly after, you might see an immediate dip in your portfolio’s value. However, entering the market during a downturn can work in your favour, as you could profit from future recoveries. This option is suitable for those with a higher risk appetite.

Which is More Profitable in 10 Years? A Comparison

Let’s see how a monthly SIP of ₹3,000 and a lump sum investment of ₹3 lakh would grow over 10 years at an assumed annual interest rate of 12%.

| Investment Type | Total Investment | Tenure | Estimated Returns | Maturity Corpus |

|---|---|---|---|---|

| Monthly SIP (₹3,000) | ₹3.6 Lakh | 10 years | ₹3.12 Lakh | ₹6.72 Lakh |

| Lump Sum | ₹3 Lakh | 10 years | ₹6.32 Lakh | ₹9.32 Lakh |

From the calculation above, it is clear that the maturity corpus is higher in a lump sum investment at the same interest rate. However, for most investors, particularly salaried individuals, SIPs offer a convenient option to accumulate wealth. But if you already have a substantial amount to invest, a lump sum investment might help you earn higher returns.

Disclaimer: This article is for informational purposes only. Mutual fund investments are subject to market risks. Please consult with a financial advisor before making any investment decisions.