TDS under GST Guideline for West Bengal Offices with GSTR7

The concept of Tax Deduction at Source (TDS) was there in the erstwhile VAT Laws. GST Law also mandates Tax Deduction at Source (TDS) vide Section 51 of the CGST/SGST Act 2017, Section 20 of the IGST Act, 2017 and Section 21 of the UTGST Act, 2017. GST Council in its 28th meeting held on 21.07.2018 recommended the introduction of TDS from 01.10.2018.Following would be the deductors of tax in GST under section 51 of the CGST Act, 2017 read with notification No. 33/2017-Central Tax dated 15.09.2017.

- 1. Introduction:

- 2. Relevant provisions of TDS in GST and effective date:

- 2.1 Provisions of Law:

- 2.2 Effective date:

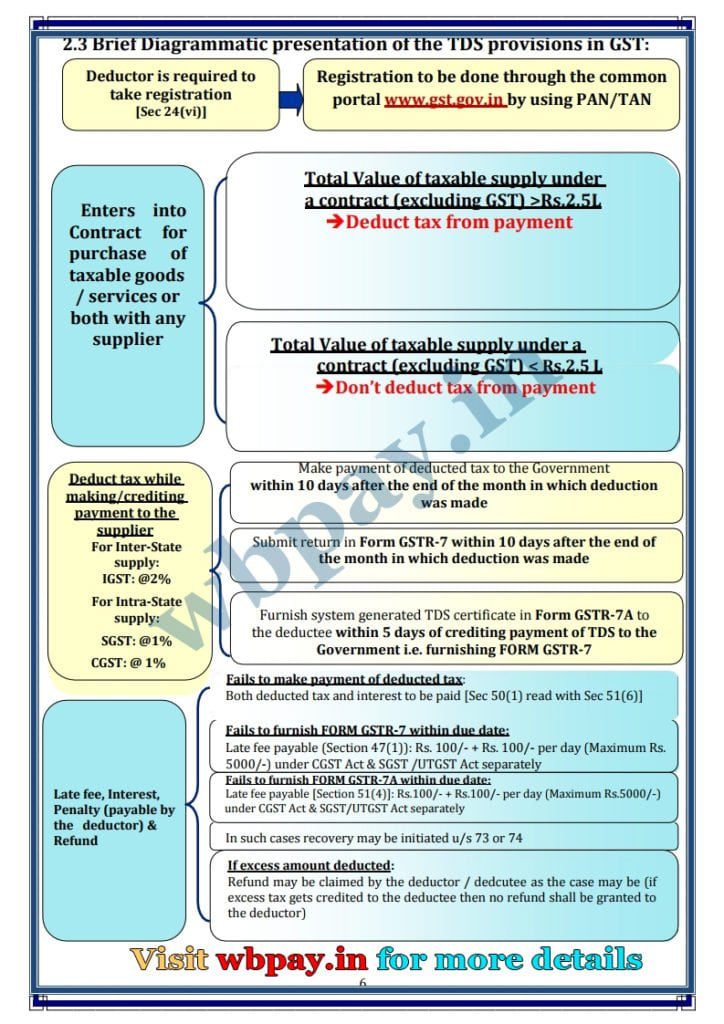

- 2.3 Brief Diagrammatic representation of the TDS provisions in GST

- 2.4 Concept of Supply in GST:

- 3. When tax deduction is required to be made in GST:

- 4. When tax deduction is not required to be made under GST:

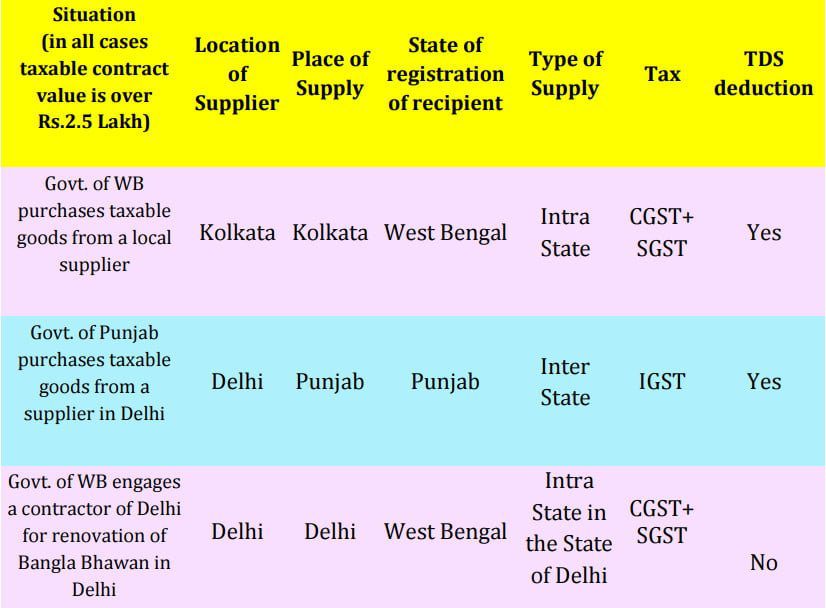

- 5. Illustrations of various situations requiring deduction of tax:

- 6. Valuation of supply for deduction of TDS and applicable rates with illustrations:

- 6.1 Rate of deduction of tax:

- 6.2 Illustration of various situations requiring determination of value of supply for deduction of tax:

- 8. Registration of deductor of tax in GST:

- 8.1 Step by step process of registration of TDS Deductors in GST:

- PART – I : Entering User credentials for Registration Application

- PART – II : OTP Verification

- PART – III : Filling up the registration Form : Entering TRN

- PART – IV : Filling up the registration Form : OTP Verification

- PART – V : Filling up the registration Form : Tab 1 : Business Details

- PART – VI : Filling up the registration Form : Tab 2 : DDO Details

- PART – VII : Filling up the registration Form : Tab 3 : Authorised Signatory Details

- PART – VIII : Filling up the registration Form : Tab 4 : Office Address Details

- PART – IX : Filling up the registration Form : Tab 5 : Verification

- 9. Payment of TDS (provisions and procedure):

- 10.TDS return:

- 11. Benefit of TDS to deductee and TDS certificate:

- 12. Late fee, interest and penalty:

- 13. Legal References

1. Introduction:

The concept of Tax Deduction at Source (TDS) was there in the erstwhile VAT Laws. GST Law also mandates Tax Deduction at Source (TDS) vide Section 51 of the CGST/SGST Act 2017, Section 20 of the IGST Act, 2017 and Section 21 of the UTGST Act, 2017. GST Council in its 28th meeting held on 21.07.2018 recommended the introduction of TDS from 01.10.2018.Following would be the deductors of tax in GST under section 51 of the CGST Act, 2017 read with notification No. 33/2017-Central Tax dated 15.09.2017:

(a) a department or establishment of the Central Government or State Government; or

(b) local authority; or

(c) Governmental agencies; or

(d) an authority or a board or any other body,-

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government, with fifty-one percent. or more participation by way of equity or control, to carry out any function; or

(e) a society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860 (21 of1860); or

(f) public sector undertakings.

The procedures of TDS along with related legal provisions are discussed herein below for the understanding of the stakeholders including the Drawing and Disbursement Officers (DDOs) who are required to deduct tax in accordance with the provisions of the GST Laws.

2. Relevant provisions of TDS in GST and effective date:

2.1 Provisions of Law:

GST Laws provide for tax deduction at source (TDS) by the specified category of persons (herein after referred to as ‘the deductor’)from the payment made or credited to the supplier of taxable goods or services or both (hereinafter referred to as ‘the deductee’) at a prescribed rate.

2.2 Effective date:

Notification No. 33/2017 – Central Tax dated 15.09.2017 was issued by the CBIC to enable registration of tax deductors. However,Government suspended the applicability of TDS till 30.09.2018.Now, it has been decided that the TDS provision would be made operative with effect from 01.10.2018. Notification No. 50/2018-Central Tax dated 13.09.2018 has already been issued in this regard by CBIC. Similar notifications have been issued by respective State Governments.

2.3 Brief Diagrammatic representation of the TDS provisions in GST

2.4 Concept of Supply in GST:

Section 7 of the CGST/SGST Acts 2017: “……..” supply” includes – (a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;………”

⇒ Supply in GST covers both supply of goods as well as supply of services by vendors/suppliers to the Government Departments, local authorities and other recipients as listed in para 1 (a) to (f) above.

Examples of supply of goods to Government/local authorities:

Procurement of stationery items, toilet articles, towels, furniture, air-conditioning machines, electrical goods, books, and periodicals & medicines, etc.

Examples of supply of services to Government/local authorities:

Procurement of security services, car rental services, generator rental services, rental services like office building/land taken on rent, maintenance services, rental of machinery, etc.

⇒ There may be supplies which are composite in nature i.e. taxable supplies of goods and services or both which are naturally bundled and supplied in conjunction with each other in the ordinary course of business [Section 2(30) refers].

Examples of Composite supplies to Government/local authorities:

Works Contract services such as road, bridge, building development/renovation/repairing/maintenance services involving supplies of both goods and services.

⇒ Taxable Supply means supply of goods or services or both which is leviable to tax under GST [Section 2(108) refers]

⇒ Exempt supply means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11 of the CGST / SGST Acts or under section 6 of the IGST Act, and includes non-taxable supply. [Section 2(47) refers]

3. When tax deduction is required to be made in GST:

Tax is required to be deducted from the payment made/credited to a supplier, if the total value of supply under a contract in respect of supply of taxable goods or services or both, exceeds Rs. 2,50,000/- (Rupees two lakh and fifty thousand).

This value shall exclude the taxes leviable under GST (i.e. ‘Central

tax’, ‘State tax’, ‘UT tax’, ‘Integrated tax’ & Cess).

3.1 Conditions for & amount of deduction:

⇒ Tax deduction is required if all the following conditions are satisfied –

a. Total value of taxable supply > Rs.2.5 Lakh under a single contract. This value shall exclude taxes & cess leviable under GST.

b. If the contract is made for both taxable supply and exempted supply, deduction will be made if the total value of taxable supply in the contract > Rs.2.5 Lakh. This value shall exclude taxes & cess leviable under GST.

c. Where the location of the supplier and the place of supply are in the same State/UT, it is an intra-State supply and TDS @ 1% each under CGST Act and SGST/UTGST Act is to be deducted if the deductor is registered in that State or Union territory without legislature.

d. Where the location of the supplier is in State A and the place of supply is in State or Union territory without legislature – B, it is an inter-State supply and TDS @ 2% under IGST Act is to be deducted if the deductor is registered in State or Union territory without legislature – B.

e. Where the location of the supplier is in State A and the place of supply is in State or Union territory without legislature B, it is an inter-State supply and TDS @ 2% under IGST Act is to be deducted if the deductor is registered in State A.

f. When advance is paid to a supplier on or after 01.10.2018 to a

supplier for supply of taxable goods or services or both.

4. When tax deduction is not required to be made under GST:

Tax deduction is not required in following situations:

a) Total value of taxable supply ≤ Rs. 2.5 Lakh under a contract.

b) Contract value > Rs. 2.5 Lakh for both taxable supply and exempted supply, but the value of taxable supply under the said contract ≤ Rs. 2.5 Lakh.

c) Receipt of services which are exempted. For example services exempted under notification No. 12/2017 – Central Tax (Rate) dated 28.06.2017 as amended from time to time.

d) Receipt of goods which are exempted. For example goods exempted under notification No. 2/2017 – Central Tax (Rate) dated 28.06.2017 as amended from time to time.

e) Goods on which GST is not leviable. For example petrol, diesel, petroleum crude, natural gas, aviation turbine fuel (ATF) and alcohol for human consumption.

f) Where a supplier had issued an invoice for any sale of goods in respect of which tax was required to be deducted at source under the VAT Law before 01.07.2017, but where payment for such sale is made on or after 01.07.2017 [Section 142(13) refers].

g) Where the location of the supplier and place of supply is in a State(s)/UT(s) which is different from the State / UT where the deductor is registered.

h) All activities or transactions specified in Schedule III of the CGST/SGST Acts 2017, irrespective of the value.

i) Where the payment relates to a tax invoice that has been issued before 01.10.2018.

j) Where any amount was paid in advance prior to 01.10.2018 and the tax invoice has been issued on or after 01.10.18, to the extent of advance payment made before 01.10.2018.

k) Where the tax is to be paid on reverse charge by the recipient i.e. the deductee.

l) Where the payment is made to an unregistered supplier.

m) Where the payment relates to “Cess” component.

5. Illustrations of various situations requiring deduction of tax:

| Situations / Contracts | Deduction required YES/NO | Remarks |

|---|---|---|

| Finance Department is making a payment of Rs.3 Lakh to a supplier of ‘printing & stationery’ | Yes | Where the total contract value of taxable supply is more than Rs.2.5 Lakh deduction is mandatory |

| Education Department is making payment of Rs.5 Lakh to a supplier of ‘printed books and printed or illustrated post cards’ where payment for books is Rs.2 Lakh and Rs.3 Lakh is for other printed or illustrated post cards. | Yes, deduction is required in respect of payment of Rs.3 Lakh only i.e. for payment in respect of taxable supply | Books are exempted goods; no deduction is required in respect of supply of books. However, payment involving ‘printed or illustrated post cards’ is for supply of taxable goods and value of such supply is > Rs.2.5 Lakh; so deduction is required. |

| Finance Department, is making payment of Rs.1.5 Lakh to a supplier of ‘car rental service’ | See Remarks | Deduction is mandatory in case the total value of taxable supply under the contract > Rs.2.5 Lakh irrespective of the amount paid.However, if the total value of supply under a contract is < Rs.2.5 Lakh,deduction is not required. |

| Health Department executed a contract with a local supplier to supply “medical grade oxygen” of Rs.2.6 Lakh (including GST) and is making full payment. | No | Total value of supply as per the contract is Rs.2.6 Lakh(including GST). Tax rate is 12%. So, taxable value of supply(excluding GST) stands at Rs.2.6L x 100/112= Rs.2.32 L < Rs.2.5 LakhHence, deduction is not required. |

| Municipal Corporation of Kolkata purchases a heavy generator from a supplier in Delhi. Now, it is making payment of Rs.5 Lakh and IGST @18% on Rs.5 Lakh for such purchase. | Yes, deduction is required @2% | Deduction is required in case of inter-State supply and if the value of taxable supply under a contract exceeds Rs.2.5 Lakh. |

| Fisheries Department is making a payment of Rs.10 Lakh to a contractor for supplying labour for digging a pond for the purpose of Fisheries. | No | This supply of service is exempt in terms of Sl. No. 3 of notification No.12/2017 –Central Tax (Rate) dated 28.06.2017 and hence deduction is not required. |

| Municipality is making payment of Rs.5 Lakh to a supplier in respect of cleaning of drains where the value of supply of goods is not more than 25% of the value of composite supply. | No | This supply of service is exempt in terms of Sl. No. 3A of notification No.12/2017 – Central Tax (Rate) dated 28.06.2017 as amended by notification no.2/2018- Central Tax (Rate) dated 25.01.2018 and hence deduction is not required. |

| Government school is making a payment of Rs.3 Lakh to a supplier for supply of cooked food as mid-day meal under a scheme sponsored by Central/State Government. | No | This supply of service is exempt in terms of Sl. No. 66 of notification No. 12/2017 – Central Tax (Rate) dated 28.06.2017 as amended and hence deduction is not required |

| Health Department is making payment of Rs.10 Lakh to a supplier for supply of Hearing Aids. | No | This supply of goods is exempt in terms of Sl. No.142 of notification No.2/2017 – Central Tax (Rate) dated 28.06.2017 as amended and hence deduction is notrequired. |

6. Valuation of supply for deduction of TDS and applicable rates with illustrations:

For the purpose of deduction of TDS, the value of supply shall exclude the taxes leviable under GST (i.e. ‘Central tax’, ‘State tax’, ‘UT tax’, ‘Integrated tax’ & Cess). Thus, no tax shall be deducted on ‘Central tax’, ‘State tax’, ‘UT tax’, ‘Integrated tax’ and cess component levied on supply. No deduction of tax and cess should also be made on the value of exempted goods or services or both even if the exempt and taxable supply are billed together.

NOTE: Suppose three separate contracts for supply are given to M/S ABC by the Health Department of the Government of West Bengal and the value of taxable supply is below Rs.2.5 Lakh in case of each contract though their combined value is more than Rs.2.5 Lakh; in such case no deduction is required to be made since value of taxable supply in neither of the contract exceeds Rs. 2.5 Lakh.

6.1 Rate of deduction of tax:

There are 4 types of taxes in GST – Integrated Tax (IGST), Central Tax (CGST) and State Tax (SGST) / Union territory Tax (UTGST). The deduction in case of intra-State supply (supply within a State) will be CGST & SGST (in case of Union territory without legislature, it will be CGST & UTGST), and the deduction in case of inter-State supply (supply from one State to another) will be IGST. Rate of such deduction is @ 2% [i.e. 1% each on CGST & SGST/UTGST component] on the amount paid/credited in respect of intra-State supply & @ 2% [as IGST] on the amount paid/credited in respect of inter-State supply.

6.2 Illustration of various situations requiring determination of value of supply for deduction of tax:

6.2.1 Supplier is registered and contract value is excluding GST:

Example 1: Supplier X makes taxable supply worth Rs. 10,000/- to a Municipality where contract for supply is for Rs.15,00,000/-. The rate of GST is 18%. Supplier and the deductor are in the same State. Following payment is being made by this Municipality to X:

Rs. 10,000 (value of Supply) + Rs 900 (Central Tax) + Rs 900 (State Tax).

Value of supply = Rs.10,000/-

Tax to be deducted from payment:

Central Tax = 1% on Rs.10,000/- = Rs.100/- ; State Tax = 1% on Rs.10,000/- = Rs.100/-

Payment due to X after TDS as per GST provisions: Rs. 11600/-

6.2.2 Supplier is registered and contract value is inclusive of GST:

Example 2: Supplier Y of Mumbai makes taxable supply worth Rs. 10,000/- & exempted supply worth Rs. 20,000/- in an invoice/bill of supply to Finance Deptt. of GoI located in New Delhi where contract for supply is for Rs.6,00,000/-(Rs.2,60,000 for taxable supply including GST and Rs.3,40,000 for exempted supply). The rate of GST is 18%. Following payment is being made by GoI to Y:

Rs.10,000/-(value of taxable Supply) + Rs.1,800 (Integrated Tax) + Rs.20, 000/-

(value of exempted Supply).

Whether any deduction of tax is required?

Value of taxable supply in the contract= Rs.2,60, 000/- (including GST) Value of such contract excluding tax= 260000×100/118= Rs.220340/-

Since the value of taxable supply in the contract does not exceed Rs.2.5 Lakh, deduction of tax is not required.

6.2.3 Supplier is registered under composition scheme:

Example 4: Supplier ZA is a person registered under the composition scheme in Jharkhand who makes taxable supply worth Rs. 10,000/-to a Local Authority of Jharkhand where value of taxable supply under the contract is for Rs.2, 55,000/-

Following payment is being made by the Local Authority of Jharkhand to ZA:

Rs.10, 000/- Value of taxable supply under the contract is Rs.2, 55, 000/- which is more than Rs.2.5 Lakh and hence deduction of tax is required.

7. Persons liable to deduct tax under GST Law:

As per the provisions of the GST Law, the following persons are mandatorily required to deduct TDS:-

(a) a department or establishment of the Central/ State Government; or

(b) local authority; or

(c) Governmental agencies; or

(d) such persons or category of persons as may be notified by the Government on the recommendations of the Council.

The following class of persons under clause (d) of section 51(1) of the CGST Act, 2017 has been notified vide notification No. 33/2017 – Central Tax dated 15.09.2017:-

(a)an authority or a board or any other body,—

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government, with fifty-one percent or more participation by way of equity or control, to carry out any function;

(b) society established by the Central/ State Government or a Local Authority under the Societies Registration Act,1860;

(c) public sector undertakings.

Local authority:

Section 2(69): “local authority” means––

(a) a “Panchayat” as defined in clause (d) of article 243 of the Constitution;

(b) a “Municipality” as defined in clause (e) of article 243P of the Constitution;

(c) a Municipal Committee, a Zilla Parishad, a District Board, and any other authority legally entitled to, or entrusted by the Central Government or any State Government with the control or management of a municipal or local fund;

(d) a Cantonment Board as defined in section 3 of the Cantonments Act, 2006;

(e) a Regional Council or a District Council constituted under the Sixth Schedule to the Constitution;

(f) a Development Board constituted under article 371 of the Constitution; or

a Regional Council constituted under article 371A of the Constitution.

(g) a Regional Council constituted under article 371A of the Constitution.

8. Registration of deductor of tax in GST:

- The existing deductors of STDS/TCS under VAT Act will not be automatically migrated to GST.

- Section 24(vi) of the CGST Act, 2017 provides for compulsory liability for registration for the deductors of TDS.

- A deductor in GST will be required to get registered and obtain a GSTIN[Goods & Services Tax Identification Number] as a TDS deductor even if he is separately registered as a supplier.

- A deductor has to get himself registered through the portal www.gst.gov.in by using their PAN/TAN. The entire process is online.

8.1 Step by step process of registration of TDS Deductors in GST:

PART – I : Entering User credentials for Registration Application

1. Go to the GST Portal at www.gst.gov.in

2. Click on the “Services” Tab →Click on “Registration” →Select “New Registration”.

3. Find the box “I am a” which will capture your status as an applicant. Select “Tax Deductor” from the drop-down menu.

4. Look below for the options: I have a (a) PAN (b) TAN. Please select the option “TAN”.

5. Enter the TAN in the box below.

6. Now find the box “State” and select your State (e.g. West Bengal) from the drop-down Menu.

7. Select the applicable district (e.g. Howrah) from the drop- down Menu in the “District” box.

8. Find the box “Legal name of the Tax deductor”. Enter the name as mentioned in TAN. Please don’t deviate from such data.

9. Enter your e-mail address and Mobile Number in the respective boxes. Please ensure that this e-mail and mobile are regularly accessed by you. OTP for registration will be sent to these contacts only.

10. Enter the Captcha Code as displayed onscreen.

11. Click on the button “Proceed”.

12. Automatically you will be guided to the next page.

13. The system will also send 2 different OTPs. One to the Mobile Number and another to the e-mail id as entered by you.

PART – II : OTP Verification

1. Enter the individual OTPs sent to your e-mail id & the Mobile number in the respective boxes.

2. In case, you have not received the OTPs due to any reason, you may click on the link “Click here to resend the OTP”.

3. Click on the button “Proceed”.

4. A Temporary Reference Number (TRN) will be generated. Please note this TRN is for further course of action.

5. Now, you have to fill up the rest of the details in the Registration Application against this TRN only.

6. Click on the button “Proceed” to leave this page.

7. This TRN will be valid for 15 days. So you can always come back to the system for filling up the rest of the details at any time within such 15 days. In case this TRN expires beyond 15 days, you will have to follow the steps as detailed in Part I and Part II all afresh.

PART – III : Filling up the registration Form : Entering TRN

1. Go to the GST Portal at www.gst.gov.in

2. Click on the “Services” Tab →Click on “Registration” →Select “TRN”.

3. Enter the TRN as you have noted down previously.

4. Enter the Captcha Code as displayed on screen.

5. Click on the button “Proceed”.

6. You will be guided to the next page.

PART – IV : Filling up the registration Form : OTP Verification

1. This time only 1 OTP will be sent to your e-mail id & the Mobile number.

2. Enter the OTP in the respective box.

3. In case, you have not received the OTPs due to any reason, you may click on the link “Click here to resend the OTP”.

4. Click on the button “Proceed”.

5. You will be guided to the “My saved Applications” page.

6. The link of your application for Registration as a Tax Deductor in Form GST REG 07 will be displayed on screen with the corresponding expiry date of 15 days.

7. Click on the blue coloured box with an icon of Pen under the field “Action” to proceed.

8. Now you will be guided to the main application form for filling up the details.

9. This will have 5 different tabs. Please ensure that all the fields in the individual tabs are duly selected.

PART – V : Filling up the registration Form : Tab 1 : Business Details

1. As per the GST Law, Business includes all activities undertaken by a Govt. Dept. or a Local Authority. So, the Business details as mentioned in this Form will capture your Office details.

2. The Legal Name of Tax Deductor, e-mail address, Mobile No., TAN and Status as a Tax Deductor will be displayed on screen automatically as all these have already been entered by you.

3. Ignore the box “Trade Name”.

4. Select your Office type e.g. Govt. Dept./ Local Authority etc. from the drop-down menu of the box “Constitution of Business”.

5. Select “Type of Government” as State or Central (as applicable) if you have entered your constitution as Govt. Dept.

6. Date of liability will be auto-populated. You need not worry even it shows as the current date because you will be liable to deduct TDS only from the day, Section 51 of the CGST/SGST Acts, 2017 is notified i.e. with effect from 01.10.2018. If you apply for registration after this date, you will be liable from the date of application for registration.

7. Enter the State Jurisdiction details by selecting the applicable “District” and “Sector/Circle/Charge/Unit” from the drop-down menu.

8. Enter the Center Jurisdiction accordingly. To know the Central Jurisdiction, you may click on the designated link given therein and find the appropriate data.

9. Click on “Save and Continue” to proceed to the next tab.

10. Once all the required data are filled up, you will find that the Tab: Business Details will be displayed with a tick (√) mark.

PART – VI : Filling up the registration Form : Tab 2 : DDO Details

1. Enter the Personal details of the DDO in the first part of this page.

2. Here you will have to enter: (a) name of DDO, (b) Father’s name of DDO, (c) Date of Birth, (d) Mobile Number, (e) e- mail address, (f) Gender, (g) Telephone (landline) with STD Code.

3. Enter the Identity Information of the DDO in the second part of this page.

4. Here you will have to enter: (a) Designation of DDO, (b) PAN of DDO, (c) Aadhar Number (not mandatory)

5. Enter the Residential details of the DDO in the third part of this page.

6. Here you will have to enter: (a) Residential address of the DDO.

7. Now, upload a photograph of the DDO in JPEG format (file size max. 100kb)

8. Select the button “Also authorized signatory” as Yes.

9. Click on “Save and Continue” to proceed to the next tab.

10. Once all the required data is filled up, you will find that the Tab: DDO

Details will be displayed with a tick (√) mark.

PART – VII : Filling up the registration Form : Tab 3 : Authorised Signatory Details

1. As you have already selected the button “Also authorized signatory” as Yes in the previous page, the data from DDO details will be auto-populated.

2. Click on “Save and Continue” to proceed to the next tab.

3. Once all the required data is filled up, you will find that the Tab: Authorized Signatory Details will be displayed with a tick (√) mark

PART – VIII : Filling up the registration Form : Tab 4 : Office Address Details

1. Enter the DDO’s Office Address details in the first part of this page.

2. Enter the Office Contact details in the second part of this page.

3. Select the nature of possession of premises from drop-down menu.

4. Now, select from the drop-down menu, a type of document you want to upload as an address proof.

5. Now upload such document accordingly either in PDF or JPEG format (file size max. 2mb)

6. Click on “Save and Continue” to proceed to the next tab.

7. Once all the required data is filled up, you will find that the Tab: Office Address Details will be displayed with a tick (√) mark.

PART – IX : Filling up the registration Form : Tab 5 : Verification

1. Select the Verification CheckBox.

2. Select the DDO’s name (with TAN) from the drop-down menu of “Name of Authorised Signatory”.

3. Enter Place.

4. You can sign the application either with your DSC or with EVC.

5. Select the appropriate option and proceed accordingly.

6. In case you face any glitch regarding attaching your DSC, a designated link for solution is provided in the page itself.

7. If you have entered all the details and have successfully submitted your properly signed application, the page will now display a success message and accordingly an Acknowledgement will be sent to you.

Now, the proper officer will process your application and your 15

digit GSTIN as a Tax Deductor will be generated.

9. Payment of TDS (provisions and procedure):

By nature, the method of depositing TDS under GST is very much similar with the method followed for VAT efs payment in VAT. In GST, there will be a single portal www.gst.gov.in for registration, payment, and filing of Returns. This section to be State-specific and to be written by the State concerned in accordance with the respective Treasury Management System. The Centre has already issued necessary instructions.

9.1 Challan generation for depositing the deducted tax

The deductor has to generate a challan in the portal at www.gst.gov.in and deposit the tax so deducted through e-payment mode [Net Banking/Debit-Credit card/NEFT-RTGS] or OTC Mode [Cash/Cheque/DD].

For further details, circular No. 65/39/2018-DOR dated 14.09.2018 may be referred.

10.TDS return:

The filing the TDS Return in FORM GSTR-7 can be done both through the online mode in the GST portal as well as by using the offline tool.

10.1 TDS return submission procedure:

• In the offline method, the deductor would be required to fill up the designated .xl file and upload the said file with signature validation.

• Every registered TDS deductor is required to file a Return in FORM GSTR 7 electronically within 10th of the month succeeding the month in which deductions have been made to avoid payment of any late fee, interest. [Section 39(3) of the CGST Act, 2017 read with Rule 66 of the CGST Rules, 2017 refers]

• Tax deposited by challan would get credited in the electronic cash ledger of the deductor. The liability of a deductor in FORM GSTR 7 has to be paid by him by debiting his electronic cash ledger.

• The deductor shall furnish to the deductee a system generated certificate in FORM GSTR 7A mentioning therein the contract value, rate of deduction, amount deducted, amount paid to the Government and other related particulars. The said certificate is to be furnished within five days of crediting the amount so deducted to the Government i.e. within five days of furnishing return in FORM GSTR-7.

• The entire exercise has to be completed through www.gst.gov.in.

• The deductee (i.e. the supplier) shall claim the credit of such deduction in his electronic cash ledger.

10.2 Time limit for filing the TDS Returns under GST

The FORM GSTR-7 for a particular month has to be filed online within 10th of the month succeeding to the month in which deductions have been made.

11. Benefit of TDS to deductee and TDS certificate:

With the deduction of tax and submission of return in FORM GSTR 7the amount deducted would be available in FORM GSTR 2A/4A of the registered deductee and the same would be credited in his electronic cash ledger. The deductee would be able to utilize this amount for discharging his tax liabilities.

12. Late fee, interest and penalty:

Provision for late fees for late filing of TDS Returns in GST

• The provision of late Fees in respect of TDS in the GST is a two-layered provision.

• If the deductor fails to furnish the return in FORM GSTR-7 (under Section 39(3)) by the due date (i.e. within 10 days of the month succeeding the month in which deduction was made) he shall pay a late fee of Rs. 100/- per day under CGST Act & SGST/UTGST Act separately during which such failure continues subject to a maximum amount of Rs. 5000/- each under CGST Act & SGST/UTGST Act.

• If any deductor fails to furnish the certificate of TDS deduction to the deductee [i.e. the supplier] within 5 days of crediting the amount so deducted to the Government (i.e. furnishing return in FORM GSTR-7), the deductor shall pay a late fee of Rs. 100/- per day under CGST Act & SGST/UTGST Act separately from the day after the expiry of five day period until the failure is rectified, subject to a maximum amount of Rs.5000/- each under CGST Act & SGST/UTGST Act.

13. Legal References

| Details | Sections of CGST/SGST Act, 2017 | Rules of CGST/SGST Rules, 2017 | GST Forms |

|---|---|---|---|

| Deduction of TDS, Persons liable to deduct, Conditions & Rate of deduction | Section 51 | Rule 66 | |

| Compulsory Liability of Registration for TDS deductors | Section 24(vi) | ||

| Application for registration | Section 25 | Rule 12(1) | GST REG-07 |

| Grant of Registration Certificate | Rule 12(2) | GST REG-06 | |

| Cancellation of Registration | Rule 12(3) read with Rule 22 | GST REG-08 | |

| Payment of TDS | Section 51(2) | Rule 85(4) | GST PMT-05 |

| Payment through GST Challan | Rule 87(2) & Rule 87(3) | GST PMT-06 | |

| Communication to Bank in case amount paid is debited but CIN not generated | Rule 87(8) | GST PMT-07 | |

| TDS Return | Section 51(5) read with Section 39(3) | Rule 66(1) | GSTR-07 |

| Issue of Certificate of deduction | Section 51(3) | Rule 66(3 | GSTR-7A |

| Late Fees (for late filing of GSTR-7 | Section 47(1) | ||

| Late Fees (for late furnishing of GSTR-7A) | Section 51(4) | ||

| Interest | Section 51(6) read with Section 50(1); Sec 20(xxv)of IGST Act readwith section 51(6) & section 50(1) of the CGST/SGST Act | ||

| Penal provisions Demands & recovery | Section 51(7) read with Section 73 & Section 74 & Section 122(1)(v) and Section 20(xxv) & 4th proviso to Section 20 of IGST Act | Rule 142 | DRC 1 to DRC 8 |

| Refund | Section 51(8) read with Section 54 | ||

| Transitional Provisions | Section 142(13) |

TDS on GST FAQ

As a DDO I am deducting TDS from salary and also while making payment of other bills under Income Tax Act. Then why should I need to deduct TDS again?

TDS under Income Tax is different from TDS under GST. There was a provision of TDS under VAT Act also. TDS under the GST Law is different from the above. Deductions of tax under the GST Laws is required to be made wherever applicable while making payments to the suppliers/ vendors of goods or services or both under GST for taxable supply of goods or services or both.

Who are liable to deduct TDS?

All the DDOs of the (a) a department or establishment of the Central Government or State Government; (b) local authority; (c) Governmental agencies; (d) an authority or a board or any other body, -(i) set up by an Act of Parliament or a State Legislature; or (ii) established by any Government, with fifty-one percent or more participation by way of equity or control, to carry out any function; (e) a society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860 (21 of 1860); (f) public sector undertakings.

I am a DDO of a small Government Office. My office has not entered into any contract with any vendor whose taxable value of supply is more than Rs 2.5 Lakh in the recent past. Do I have to take GST registration for my office?

No. You are liable to register only when you make a payment on which tax is required to be deducted.

Do I have to pay any Fees for obtaining a GST registration?

No fee is required to be paid for obtaining a GST Registration on the common portal.

Is there any printed form for registration which I require to fill up?

No. The process of getting registration under GST is a fully online process. Registration should be done in the common portal www.gst.gov.in. There is no need to submit any hardcopy of any form or any document for Registration.

Is there any need to upload any document to complete the registration process?

Yes, (i) a proof of address of the concerned office & (ii) a scanned photo of concerned DDO is required to be uploaded. A valid TAN is also needed.

How do I know that GSTIN has been generated for my office or not?

Information will be given to the DDO in his registered email id as well as registered mobile no.

After getting GSTIN what should I do?

DDO should update his DDO master details with the GSTIN in their respective DDO login in E-bill module of PFMS.

As a DDO, I have to enter some personal information to get TDS registration. What will happen if I get transferred? Will I still be responsible for any lapse committed by the DDO who succeeds me?

It is true that the DDO is personally liable for any lapses regarding TDS deduction. But at the same time, the personal details of the DDO as entered in the Registration Form can always be amended; it is suggested that, the new DDO upon assuming of office should immediately amend such details. However the GSTIN of the deductor will remain unaltered.

If the new DDO does not amend the details of his predecessor in office whether the ex-DDO would be liable for any lapse done by this new DDO?

No, the ex-DDO will not be liable for any lapse by his successor in office. A DDO is required to perform any responsibility in respect of TDS in GST either through a valid DSC (which is person specific) or through an EVC which would be sent to the registered mobile no as well as registered email id of the DDO only.