7 Easy Steps to e-filing Income Tax Return for West Bengal Government Employees

Simple way to file Income Tax Return for West Bengal Government Employees is described here.

Income tax return e-filing for West Bengal Government Employees: If you are a government employee or pensioner of the West Bengal Government, you may be unsure about how to file your income tax return on your own. This article showing seven simple and easy steps for West Bengal Government employees and pensioners to file their income tax returns.

Last Date of Filing Income Tax Return is: 31st July

The last date of filing Income Tax Return is 31st July every year for the current Assessment Year.

Importance of filing income tax return online

- Filing income tax returns is mandatory for government employees in India whose income exceeds the basic exemption limit of the Income Tax Act.

- Online filing of income tax returns can provide proof of income to banks and other financial institutions, which can help in securing loans.

- Filing income tax returns online may also result in a refund if tax has been deducted at source (TDS) for any transactions or income.

- From the government’s perspective, income tax filing helps with welfare management passively.

Income Tax Return e-filing in 7 Easy Steps

Here are the steps to e-file income tax return for West Bengal Government Employees as well as any salaried person residing in India.

Step 1: Gather Required Documents and Information

- Information required to register, submit and e-verify income tax return are:

- PAN number/ e-PAN number is mandatory to e-file income tax return and make sure the OAN is linked with your Aadhaar number.

- Form-16 received by your office/ employer helps to verify and enter income details.

- Bank Account Number required for refund purposes.

- Aadhaar number required to file ITR online and it to e-Verify the return with Aadhaar number is an easy and quick process.

- Mobile and Email ID needed to create ID and password and to e-verify the return.

Step 2: Register on Income tax India website

Before going to e-file the income tax return, you need to register to the income tax return portal of India. If you have already done registration in this portal, please skip this step.

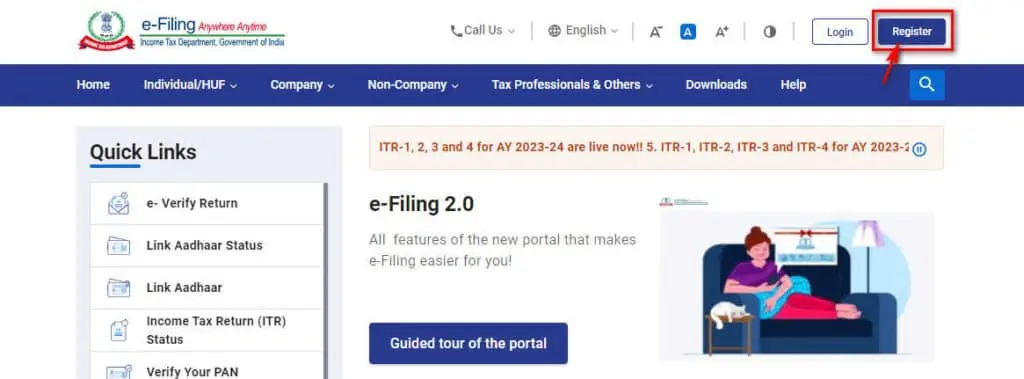

- Visit https://www.incometax.gov.in/ to register in Income Tax e-Filing Website.

- Click on register button in the upper right corner of the screen.

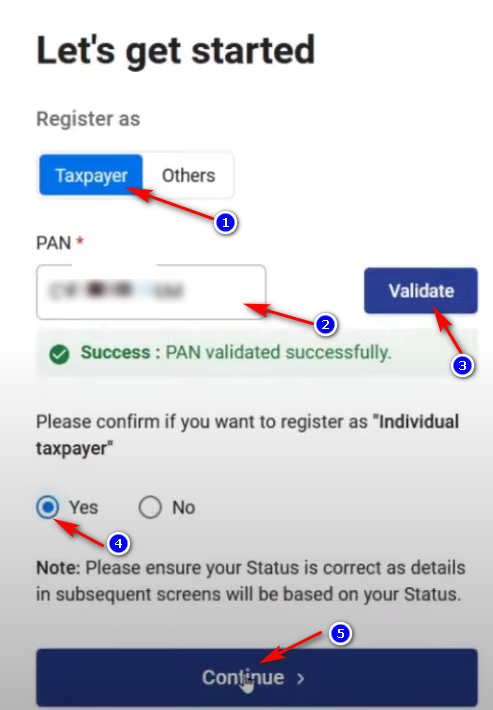

- Select register as Taxpayer.

- Enter your PAN number.

- Click on Validate button.

- Select Radio button as Yes for Individual taxpayer.

- Click on the Continue Button.

- In the next page enter basic details like Name, Gender, Date of Birth, Resident type.

- In the contact details tab enter Mobile number, Email ID, and Postal Address details.

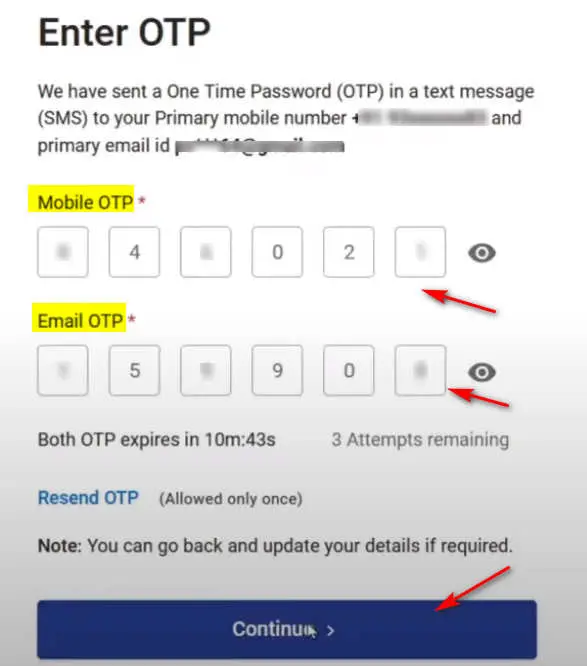

- After clicking the continue button, you will receive two different OTP, one in the provided mobile number and another in the provided email ID.

- Enter two OTP in appropriate field.

- Verify your details provided by you, if anything wrong find and correct this.

- Set a strong password: don’t create a simple password. Always create a complex non-guessable password.

- Set your personalize message. This message will help to identifying your own account and enhance security. Don’t type your password here.

- Click on the register button.

- Now you will get a successful message in the screen as well as mobile and email.

Step 3: Login with created ID and Password

- Go back to the Home page of income tax e-filing portal.

- Click on the login button in the upper right corner.

- Enter PAN number as user ID, then click on the Continue button.

Step 4: Select suitable ITR form:

- Now your ITR dashboard will open.

- Click on the File Now option for current assessment year.

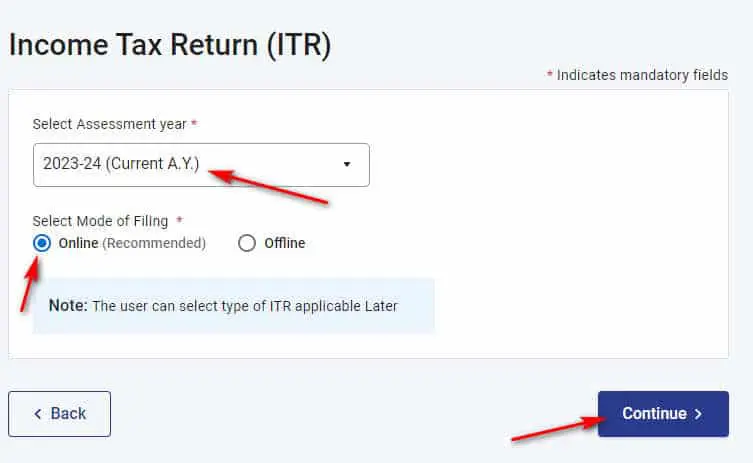

- Select Current Assessment Year, Click on the Online mode option and click on the continue button.

- Click on Start New filing.

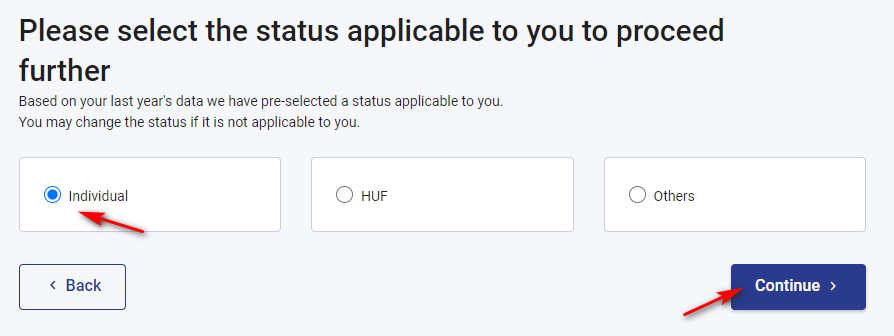

- Select Individual and click on continue button.

Download All in one Income Tax Calculator for FY 2023-24

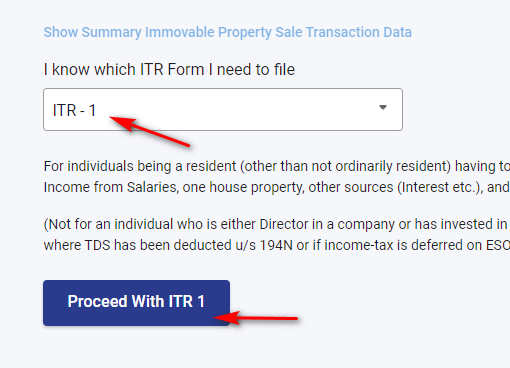

- Select ITR 1 form for individual salaried person. (West Bengal Government Employees)

- Click on Preceded with ITR 1 button to start e-filing.

- Click on Let’s get started option.

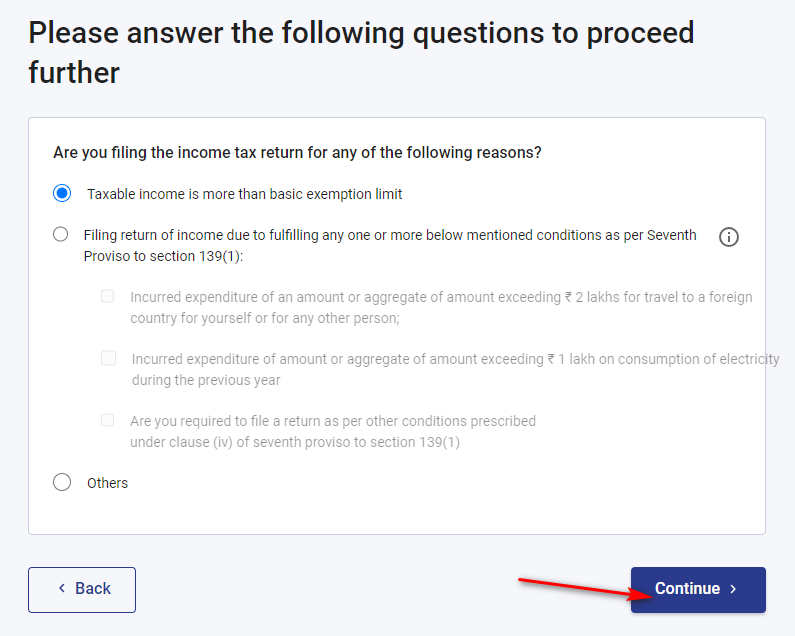

- Select a suitable answer for the question and click on the Continue button.

Step 5: Edit and Validate pre-filled data

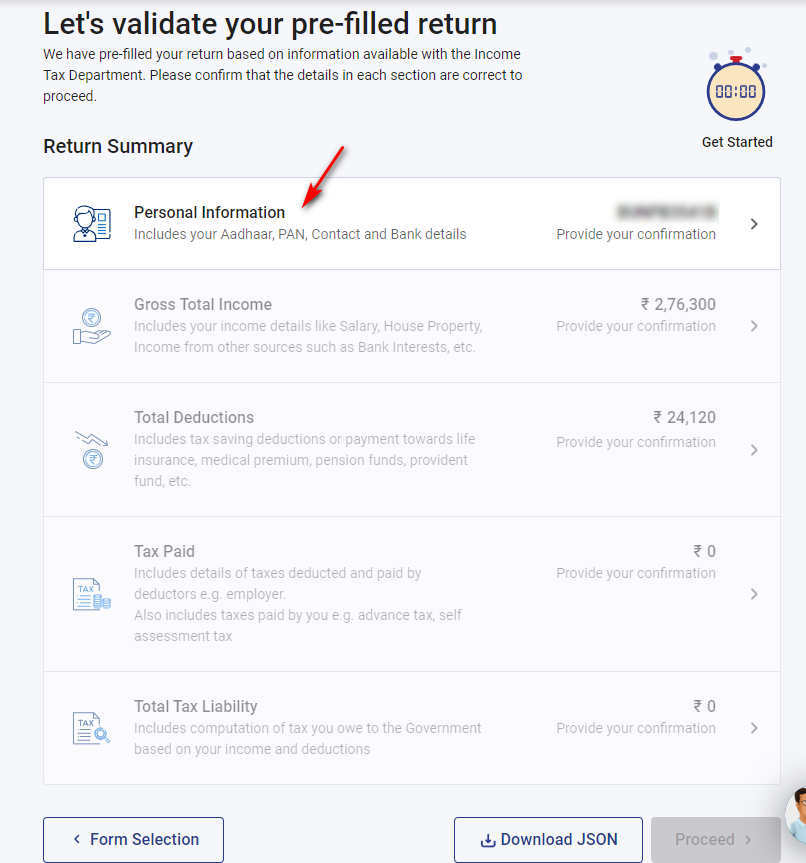

If you find all the details are pre-filled, click on every field and validate the information. If no data is available or partially available, you have to put the details and validate every option.

- Personal Information: Click on the personal informational option to validate and edit the information.

- Verify name and address.

- Select nature of employment as “Stete Government” for West Bengal Government Employees.

- Filing section will be 139(1) if you’re filing the ITR before the due date.

- Select new or old regime as your choice.

- Select a bank account number for refund, if any, which is showing there.

- Then click on the Confirm button.

- The personal information tab will confirm now.

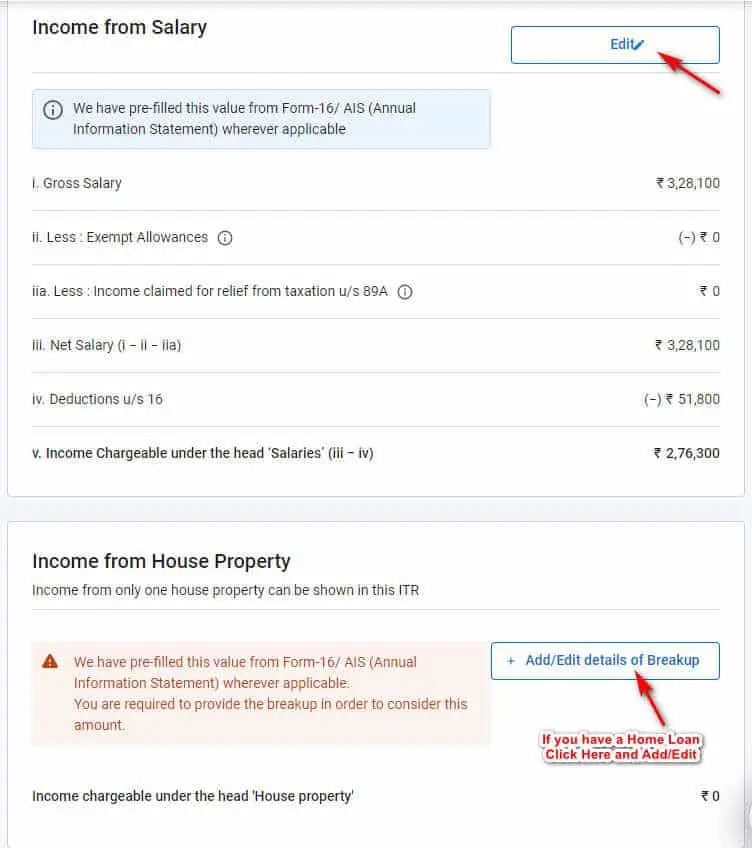

- Gross Total Income: Click on the Gross total income option to edit, enter and validate this.

- In this page some question may be asked, select yes or no as per your option.

- In the next page, check the pre-filled data and edit/ add the details if any.

- If you have a Home loan / House building loan, click on the Add/Edit option shown in the image below and add details.

- Add other income if any.

- Enter exempted income if any.

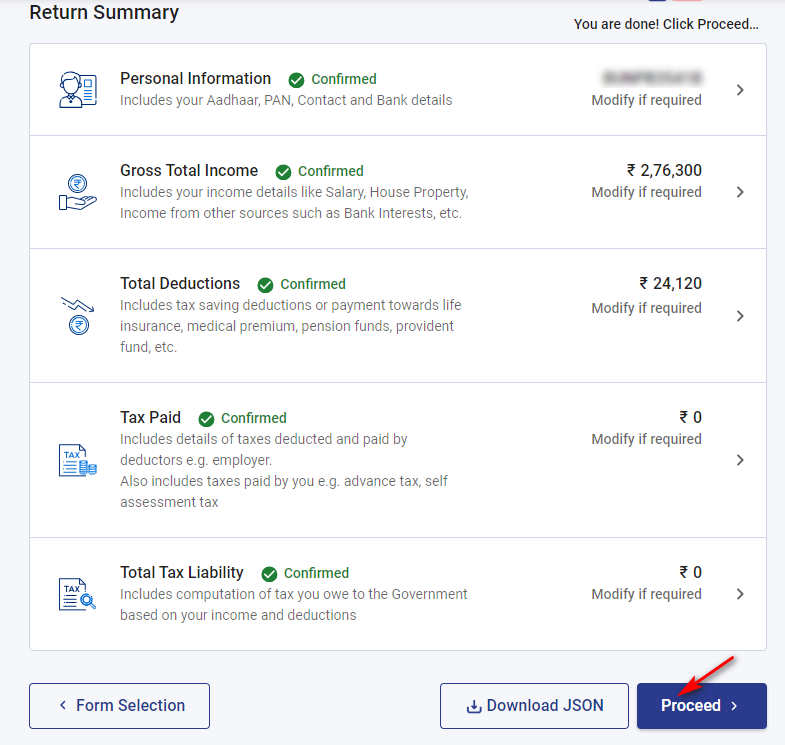

- Total Deductions: In this option, total deductions under section 80C and others should be found and added.

- Answer the questions in the following page as per your criteria and click on the continue button.

- Edit or add and verify the deduction details as applicable.

- Click on the confirm button.

- Tax Paid: In the tax paid option, total tax paid in the financial year should be added or edited.

- Edit the information if needed any changes.

- Click on the confirm button.

- Total Tax Liability: Total tax liability will auto compute by the portal.

- If required, edit the details of tax relief field.

- Fill the 10 E form in case of any past arrear salary received.

- Click on the confirm button.

Step 6: Preview and validate your return:

- After confirming all the details tabs, click on the Proceed button.

- Click on the preview return button.

- Check the declaration check box and click on Proceed to Preview button.

- Preview the form, if you find anything wrong, click on the back button and edit details.

- To continue, please click on the “Proceed for validation” button if everything appears to be in right.\

- Validation successful message will appear.

Step 7: Submit and e-verify Income Tax Return.

The last step for e-filing is to submit and e-verify the return.

- Clock on the Proceed to Verification button.

- Select e-Verify Now option to verify the details electronically by using Aadhaar OTP or Pre-validated Bank Account.

- Select a verification method, assuming the use of Aadhaar OTP.

- Generate Aadhaar OTP and Fill the OTP to e-Verify the return.

- If you select to verify later, you need to e-verify the details within 30 days.

Other ways to file Income Tax Return

There are additional options to file your Income Tax Return (ITR) online through third-party websites such as ClearTax and TaxBuddy. However, if possible, it is recommended to file your return independently using the online e-filing system.

FAQs

Who is required to file income tax returns in India?

Anyone whose income exceeds the basic exemption limit of the Income Tax Act in India is required to file income tax returns.

What are the benefits of filing income tax returns online?

Online filing of income tax returns can provide proof of income to banks and other financial institutions, which can help in securing loans. Filing income tax returns online may also result in a refund if tax has been deducted at source (TDS) for any transactions or income. From the government’s perspective, income tax filing helps with welfare management passively.

How do I file an income tax return online as a West Bengal Government employee or pensioner?

he article provides a step-by-step guide for West Bengal Government employees and pensioners to file their income tax returns online in seven simple steps, starting with gathering the required documents and information and ending with submitting and e-verifying the income tax return.

What is the last date of ITR filing?

The last date for filing Income Tax Return (ITR) in India for individuals is usually July 31st of the assessment year. However, the deadline can be extended by the government if required.