GISS Bill Preparation process in WBIFMS for WB Govt Employees

GISS Amount Calculation and Sanction Order generation is now functional in WBIFMS Portal for Newly retired employees of West Bengal Government. Please go through the process flow as mentioned below to generate sanction order and GISS Bill preparation.

What is GISS?

The full form of GISS is Group Insurance cum Savings Scheme. It is a savings with insurance scheme for West Bengal Government Employees. After the retirement or death of the employee, the savings amount will refund with the interest.

How to prepare GISS bill in WBIFMS | GISS Bill Preparation process

This article shows the step-by-step process of GISS bill preparation in WBIFMS.

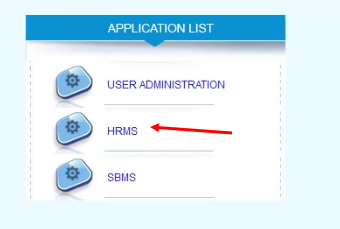

1) Login with HOO Operator/Approver credential from WBIFMS Portal.

2) Click on HRMS and Select Roll as HRMS HOO Approver.

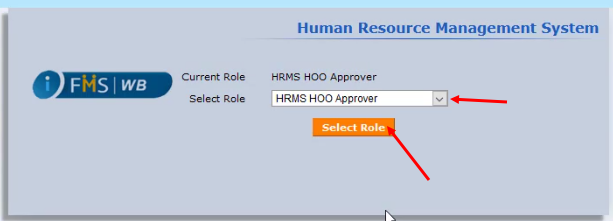

3) Click on Exit Management > GISS Calculation/ Sanction Generation.

4) Select Type of cessation as Retirement / Death/ other as per applicable for GISS Bill preparation. Search the desired employee in the List of Values (LOV). An employee who has been retired or is going to retire on superannuation within next one month. From the system date or died in service will appear in the LOV, provided his/her bill for GISS claim has not been prepared yet. If the ‘Other’ cessation type is selected, all the employees tagged with the sanctioned strength of the concerned Head of Office/Head of Office(Controlling) will appear in the LOV other than the employees who has been retired on superannuation or died.

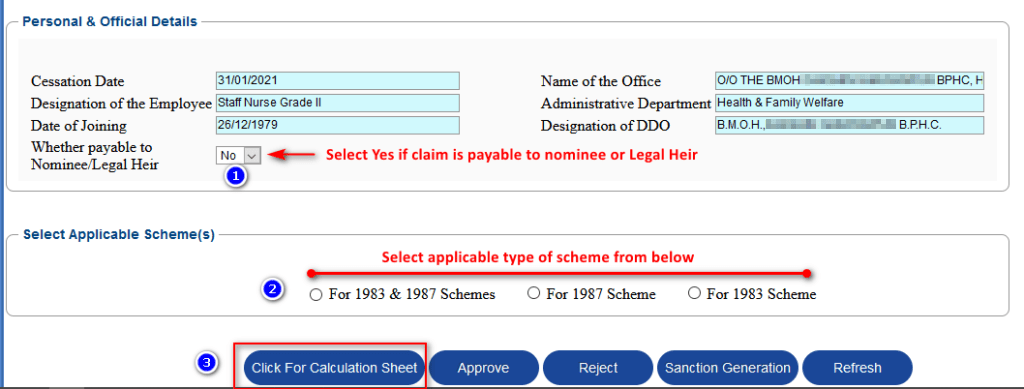

5) Below stated form will appear after selection of employee and clicking on the Search button.

6) Select option as per above image which is applicable and click on Click For Calculation Sheet option.

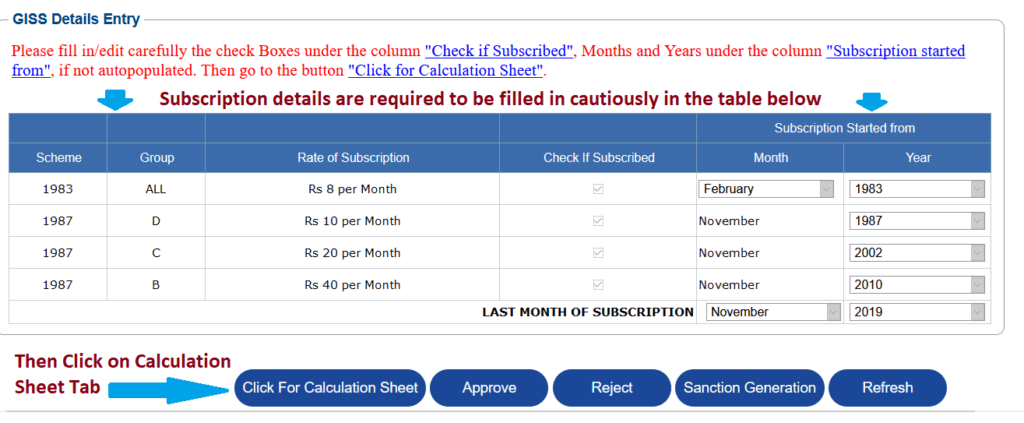

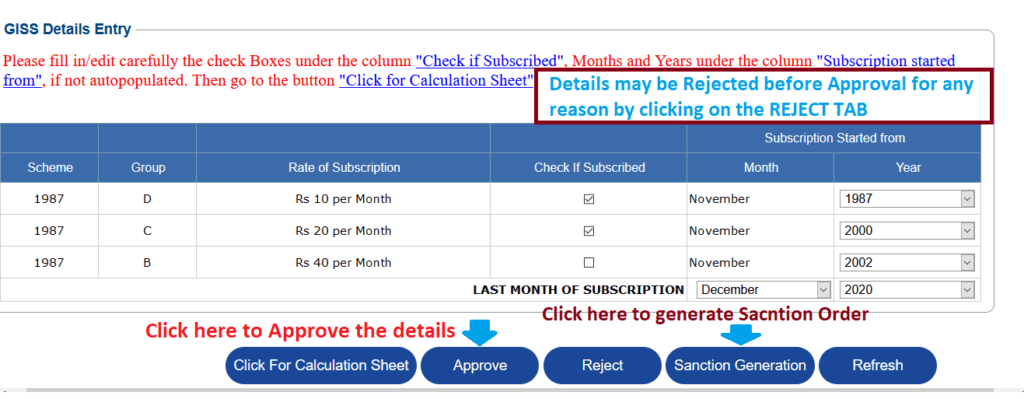

7) GISS subscription details will be auto populated in the GISS Details Entry form, provided e-Service Book of the concerned employee has been approved otherwise blank fields will required to be filled in manually for GISS Bill preparation.

8) To calculate the GISS claim amount click on the tab Click For Calculation Sheet. Amount payable will be auto calculated.

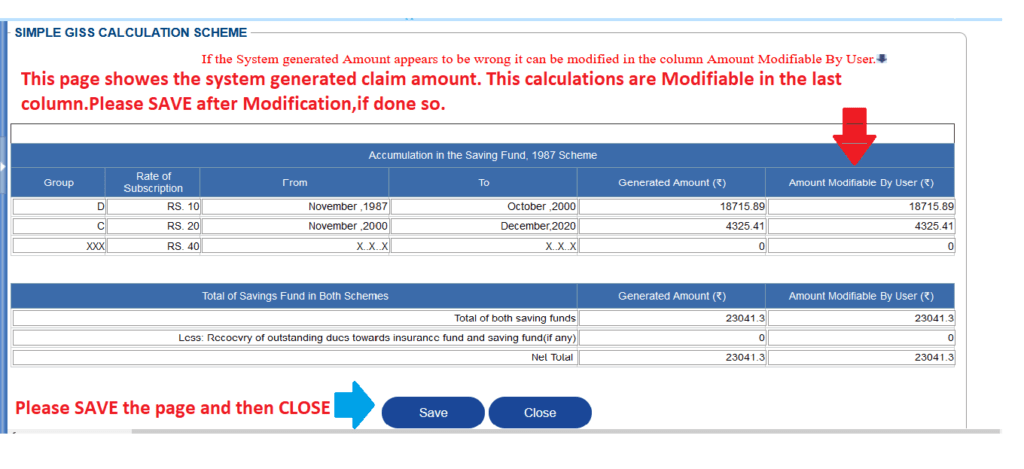

9) Check and Save the calculation. If any calculation is appears to be wrong, calculated figures may be modified in the Column Amount Modifiable By User.

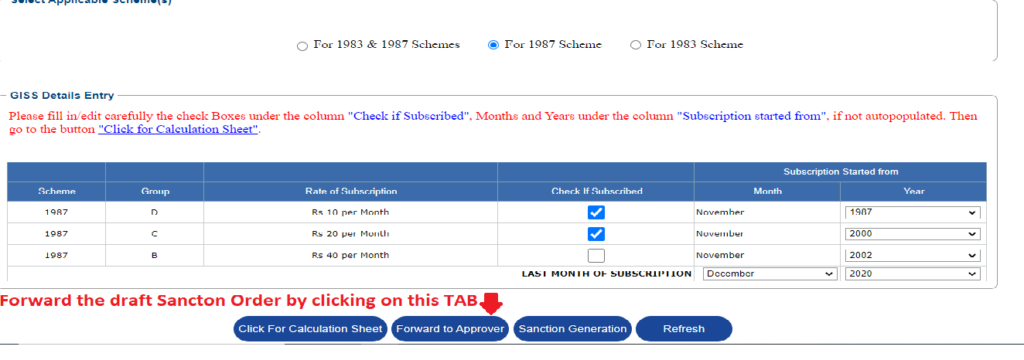

10) On clicking on the ‘Close’ button, previous form will appear again as per the image below:

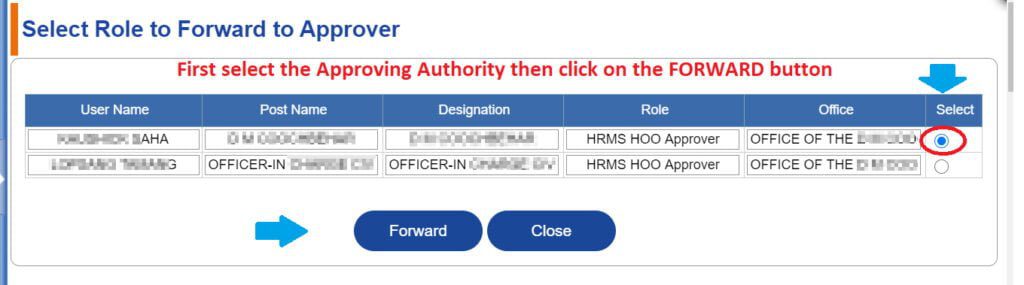

11) For forwarding the draft sanction order to the Head of Office for necessary approval click on the tab Forward to Approver (For Operator’s log in) .On clicking on the Forward tab a form will appear where Approving Authority is to be selected as per the image below:

12) Draft sanction order forwarded by an operator will be available in the Inbox of the Head of Office approver for approval/rejection. Click on the hyperlink to proceed further. A form will appear as per the image below:

13) For approving the draft sanction order click on the tab Approve (For Head of office Approver’s log in only).

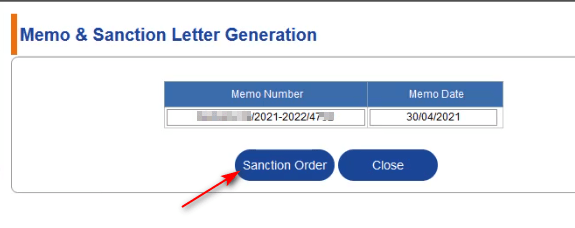

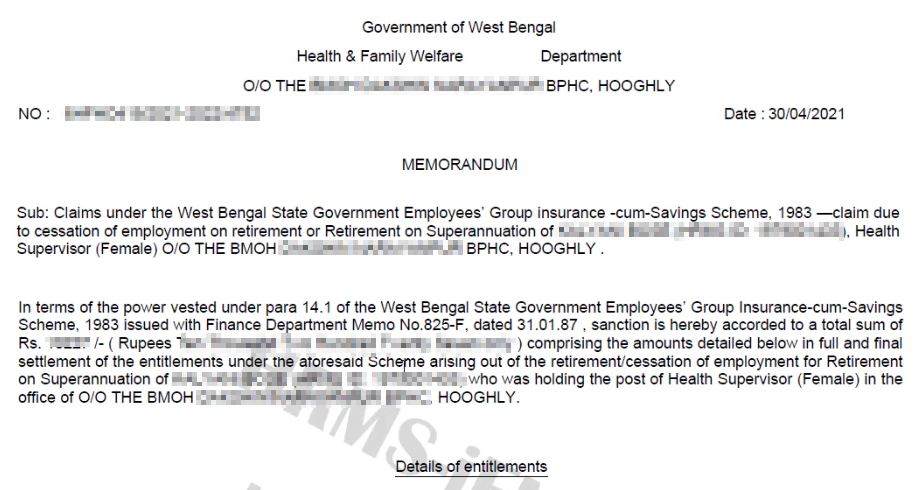

14) For generating Sanction Order with system generated Memo No. & Date click on the tab Sanction Generation at HOO Approver log in. A new form will appear as per the image below:

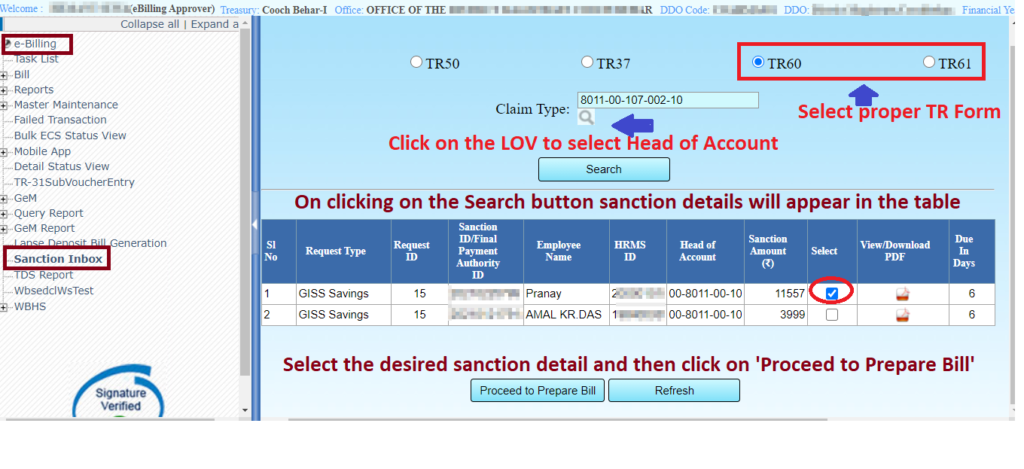

15) Now log in as DDO. After generation of the sanction order the same will be available in the menu Sanction Inbox under e-Billing Module for generation of Reference No. of bill for GISS Bill preparation. Please see the image below:

16) Bill Reference no. is to be generated in the tab “Proceed to Prepare Bill”. A new form will appear as per image below:

17) After generation of reference No. go to the Task List for further processing of the bill. Click on the Reference no. hyperlink to have the final Bill preparation form as per the image below:

Thanks for visiting wbpay.in . Visit this site daily for more update and orders.

View order for online GISS and Leave Salary bill preparation

Download WBPAY Calculator Android App from Play Store

FAQs

What is GISS?

The full form of GISS is Group Insurance cum Savings Scheme. It is a savings with insurance scheme for West Bengal Government Employees.

What is the full form of GISS?

The full form of GISS is Group Insurance cum Savings Scheme.