WBIFMS-West Bengal Integrated Financial Management System

What is WBIFMS?

Full form of WBIFMS is “West Bengal Integrated Financial Management System“. WBIFMS is a web portal of the Government of West Bengal for the real-time management, monitoring, and control of all fund allocation and financial transactions in different departments and their subordinate offices under the State Government.

As part of the goal for adopting e-Governance, Government of West Bengal has introduced significant computerization at various levels in several Government Departments, Directorates and down-level Offices. IFMS or Integrated Financial Management System controlled by the Finance Department of this Government for online integration and management of Financial Systems and Human Resource Systems has now playing an integral part of Office Management of almost all Government Offices. As such at present acquiring adequate skill on IFMS has become essential for all Office Assistants of any Government Office.

Development of WBIFMS : Brief History

Feb-2014:

Notification for Introduction of IFMS issued vide G.O. No. 2088-FB dt.28.02.2014. Initially, CTS & e-Bantan Module became mandatory with effect from 01.04.2014.

Jun-2014:

Guidelines regarding e-Bantan procedure issued vide G.O. No. 2863-F(Y) dt.02.06.2014.

Feb-2015:

Order for Implementation of e-Pradan (e-Payment) module of IFMS issued vide G.O. No.1179-F(Y) dt.25.02.2015.

e-Pradan Module using DDO’s DSC (Digital Signature Certificate) became mandatory with effect from 01.04.2015.

Jun-2015:

Implementation of e-Billing Module became mandatory for some type of Bills in addition to e-Pradan vide G.O. No. 4879-F(Y) dt.14.06.2015.

Aug-2015:

Order for the inclusion of some more TR forms under e-Billing module of IFMS and its mandatory submission vide G.O. No. 6295-F(Y) dt.20.08.2015.

Dec-2015:

Order for implementation of Pay Roll Processing Sub-module of HRMS-IFMS became mandatory with effect from 01.01.2016 vide G.O. No. 8531-F(Y) dt.18.12.2015.

Oct-2016:

Rolling out of New GRIPS Module into IFMS Portal done vide G.O. No. 5504-F(Y) dt.24.10.2016.

Mar-2017:

Order for implementation of HRMS in all Offices of Government of West Bengal with effect from 01.04.2017 issued vide G.O. No. 1242-F(Y) dt.01.03.2017. Stakeholders, Leave, Loan & TA/DA Modules introduced on the live server.

May-2017:

Stakeholders, Leave, Loan & TA/DA Modules became mandatory with effect from 01.06.2017 vide G.O. No. 3130-F(Y) dt.19.05.2017.

Mar-2018:

Order for implementation of Sanctioned-Strength, Transfer, Pay-Fixation, Non-Functional Promotion, Training, Confirmation and Exit-Management Modules issued vide G.O. No. 1276-F(Y) dt.05.03.2018. All Modules will become mandatory with effect from 01.05.2018

Dec-2018:

Introduction of Web-socket based Digital Signature Certificate (DSC)or D-Sign or IFMS-Signer in IFMS vide G.O. No. 7791- F(Y) dt. 17/12/2018

WBIFMS Portal Homepage:

Block Diagram

Modules available on WBIFMS Portal

The IFMS or Integrated Financial Management System has been introduced by Finance Department of this Government during April-2014 in order to make several office procedures online through the URL www.wbifms.gov.in. Finance Department have issued several Orders to implement different Modules and SubModules of the System from time to time like Fund Distribution, Salary Billing, Online Billing, Stakeholder Mapping, Leave, Loan, TA/DA, LTC/HTC/TC, e-Services for Employees etc. Finance Department in their G.O. No. 3130- F(Y) dt. 19.05.2017 have ordered to implement all these sub-modules mandatory with effect from 01.06.2017 by all offices of Government of West Bengal. HRMS or Human Resource Management System is a part of IFMS. Some other Modules like Sanctioned-Strength, Transfer, Pay-Fixation, Promotion, Confirmation, Exit-Management (Pension) are also done mandatory with effect from 01.05.2018 vide G.O. No. 1276-F(Y) dt.05.03.2018. Highlights of different Modules of IFMS are given below.

e-Bantan:

This is meant for distribution of Funds against the subordinate offices under the control of the User. There is a separate Login Id and Password for this Module. The Login Id is provided by the concerned higher Authority/Fund Provider.

GRIPS (Government Receipt Portal System):

This Module is used for Payment of Taxes and Non-Taxes Revenue to State Government by the Citizen/NGO/Government-Organization. Several Reports on Revenue deposited during a period may be generated by the concerned Department.

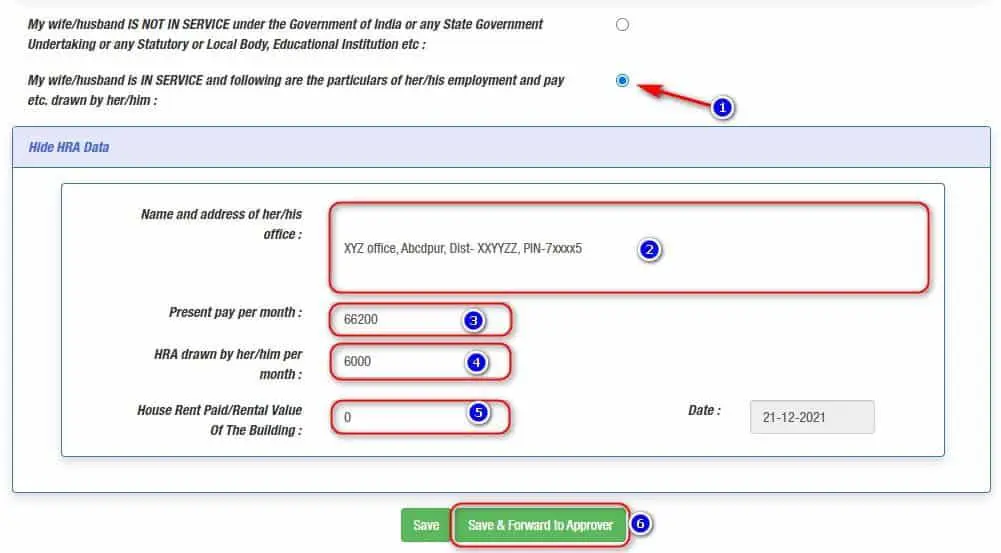

e-Services for Employees:

An Employee can Register his/her Name to utilize the Services provided by the Module. Your Employee Id will be the Login Id and the Password will be provided by the System when you’re registering your Name for this Service.You can view/print/download your Payslips, Income Tax Statements etc. from this. All applications like Leave, Loan, Tour etc. are to be sent to your HOO (Head of Office) through this for further processing.

DDO:

There is a separate Login Id and Password for this Module. The Login Id is provided by the corresponding Treasury/PAO of the DDO. The DDO will have a DSC (Digital Signature Certificate) of his own which looks like a Pendrive. Sometimes this is also called Dongle. This DSC is required to digitally sign a Bill by the DDO while submitting the same to Treasury/PAO. After Logging in as DDO you will find following Sub-Modules.

DDO – User Administration:

DDO can create Operators under his control for the preparation of Bills etc. Operators will prepare the Bills at their end and finally send the same to the DDO for final submission to Treasury/PAO using DSC. Operators are not allowed to use DDO’s DSC.

DDO – e-Pradan:

With e-Pradan Sub-Module, a DDO can Manage the Beneficiaries under his control for making different Payments. Failed transactions, Beneficiary Transfer can also be managed. Several Reports can be generated as and when required.

DDO – e-Billing:

With e-Billing Sub-Module, DDO can prepare a Bill and submit the same to Treasury/PAO for making Payments.

DDO – HRMS:

With this Sub-Module, DDO can prepare, manage and submit Salary Bills, Arrear Bills, Festival Advance Bills and Adhoc Bonus Bills of the Employees including Wages Bills for listed Casual Workers.

HRMS:

There are separate Login Id and Password for this Module. The Login Id is provided by the corresponding upper-level HOO. Two Roles are provided by this Module – HOO & AA. HOO stands for Head of Office. AA stands for Appointing Authority.

HRMS : HOO:

This is defined to be the Officer who can Sanction Casual Leave and recommend all types of Leaves. Employees are to be kept Tagged with any HOO, otherwise Salary Bills cannot be generated. Stakeholders can be managed by this Module. HOO can issue Sanction Orders for GPFLoans/Withdrawals & Festival Advance of Employees. Employees TA/DA, LTC/HTC/TC can be sanctioned by the HOO. HOO can manage and sanction Casual Leave of the Employees.

HRMS : AA:

This is defined to be the Officer who can Sanction all types of Leaves other than Casual Leave. Stakeholders can be managed by this Module. AA can issue Sanction Orders for all Loans other than GPF & Festival Advance. AA can manage, approve and sanction all types of Leaves other than Casual Leave of the Employees. Controlling of Sanctioned-Strength, Transfer, Pay-Fixation, Promotion, Confirmation, Exit-Management (Pension) are also done by the AA.

IFMS Login Ids:

e-Bantan- Two Ids provided by the concerned Higher Authority/Fund Provider – One for User Administration & the other for Budget Distribution,

GRIPS – One Id provided by Finance Department for the concerned Department,

DDO – One Id provided by the concerned Treasury/PAO,

HOO/AA – One Id provided by the concerned Higher Level Authority.

DDO : General Working Interface

User Administration:

This interface is used for managing and creating different Users under DDO who will act as Operators on behalf of DDO. To create a Login Id for any User, the HRMS Id of that User will be required. So, a DDO cannot assign a person as a User who is not a Regular Employee of this Government. Operators can generate different Bills but cannot approve or submit the Bills to Treasury using DDO’s DSC (Digital Signature Certificate). In such cases, operators will forward their Bills to the DDO for taking further action by the DDO. Operators will not get access to this Module. The User Id which is of no use can be deactivated but can never be deleted. If any User forgets his/her Password, the Password can be Reset by the DDO. In this case, the New Password will be sent to the User’s Mobile by the System.

e-Pradan:

This Module is mainly used for Beneficiary Management like the addition of New Beneficiary or deactivation of existing Beneficiary, Manage Beneficiary Transfer if a Beneficiary is already existing with a DDO or Sending a Beneficiary to other DDO, Manage Failed Transactions and some Bill preparations if prescribed by the concerned PAO/Treasury. Several Reports can be generated from its Report Menu.

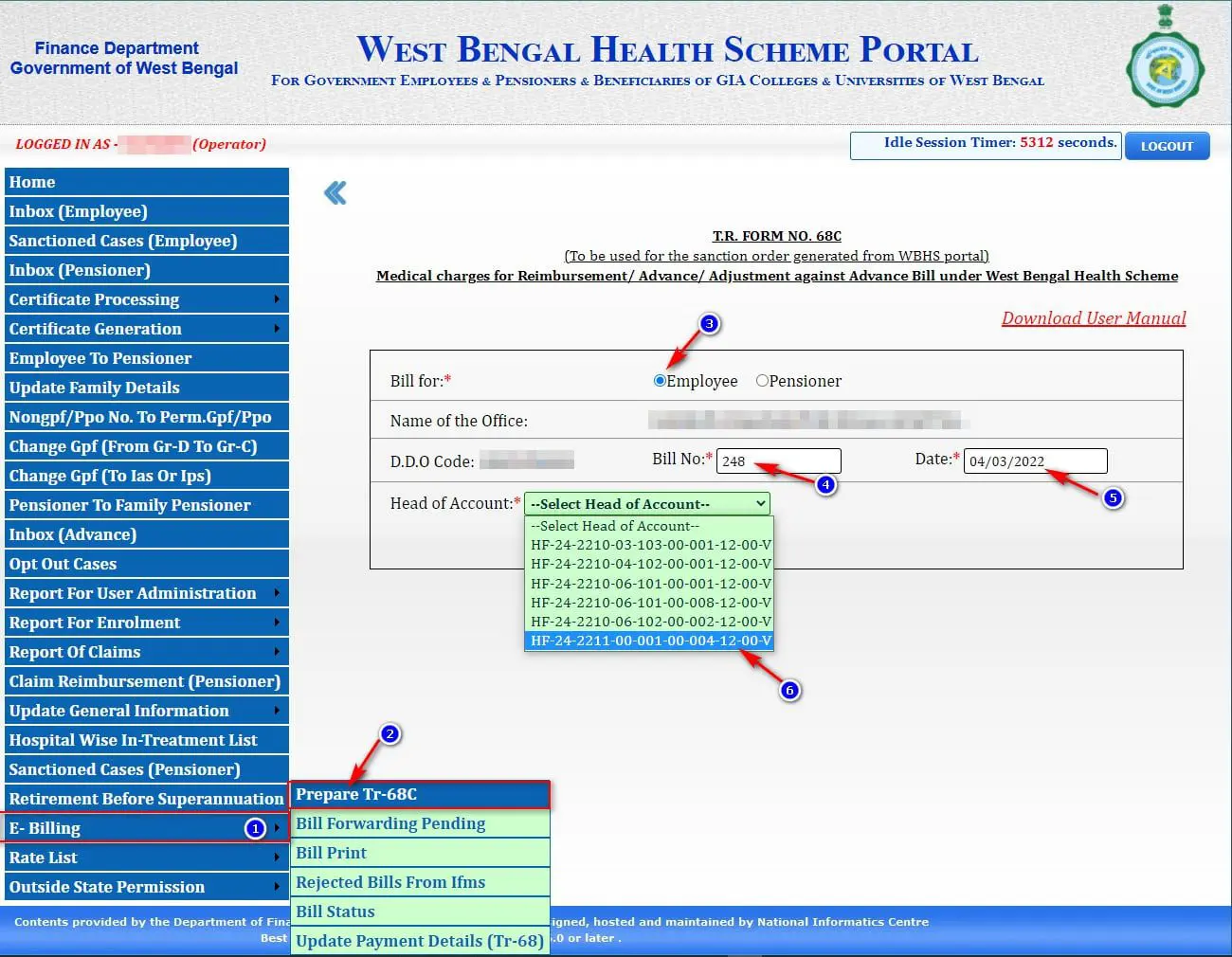

e-Billing:

This Module is for preparation of different types of Bills for submission of those to the concerned PAO/Treasury for Payments. Several important Financial Reports can be generated from its Report Menu.

HRMS:

The HRMS Module of DDO is for preparation & management of Salary Bills, Arrear Bills, FestivalAdvance Bills & Ad-hoc Bonus Bills for Regular Employees and Wages-Bills for Listed Casual Workers. Any change in the Employees Database should always be Approved by the DDO using the DSC. If no DSC is used the information will be saved temporarily in the Inbox of the DDO for future approval using DSC. If any Operator makes such changes, the information will go to the Inbox for Approval by the DDO using DSC.

One point is to be kept in mind that the Employees Database maintained by the DDO for Salary Billing is not a mere Pay-Bill database but the original HRMS Database of the Employee which contains all other Service related information of the Employee. Any change in the Service related information of an Employee has to be maintained by the DDO correctly. This Database is linked to the HOO & AA to which the DDO is concerned. HOO can merely Tag an Employee but cannot modify any information of the Employee in this Database. Concerned HOO must be selected by the DDO at its interface otherwise HRMS Database will not be related to HOO.

HOO : General Working Interface

Masters:

This Menu is meant for Setting up the HOO Approver System. This Menu is not available to HRMS HOO Operators.

Inbox:

You can see all types of Applications like withdrawal of GPF, Tour, Leave etc coming from the Employees through eServices of Employees Module. Some of these can be opened directly by clicking a Button on it but applications like Tour etc can’t be opened directly. These are to be opened from the Request Status Menu. Inbox will be cleared only when actions on the Applications stored in it are taken or processed. Applications can never be Deleted from Inbox.

Loan:

HOO can Sanction/Approve only 2 (two) types of Loans viz. Festival Advance and GPF

Loans/Withdrawals. All other Loans are Sanctioned and Approved by the Appointing Authority.

Loan /Advance Application:

If any Employee is unable to send his/her Applications through e-Services of Employees, you can generate his/her Application for withdrawal of GPF, Tour, Leave etc from this. Employee Id may be required. You can have the Employee Id from the “Head of Office Employee Mapping” Module.

Festival Advance Sanction:

Click on this for Festival Advance Sanction. Click on the LoV for DDO Code and select your DDO. Click on Search. Fill in requisite information on the Page and click on Search. A List of the Employees who have applied for Festival Advance Loan and Approved by the HOO will appear on the screen. Provide Sanction Order No. & Dt. and Save/Approve the Sanction Order. While generating Festival Advance Bill, DDO will get this Sanction Order No. and Reference Id through LoV. Loan Application Report: A Report or Hard Copy of any Loan Application can be generated through this Module. Employee Id will be required. Festival Advance Sanction Order Report: Click on the LoV for Sanction Order to get Hard Copy of the Approved Festival Sanction Order. DDO will require this Hard Copy for submission of Festival Advance Bill.

Loan Sanction Order Report:

Provide Employee Id No. and l on Search to generate Loan Sanction Order Report for GPF Loans/Withdrawals. This Hard Copy will be required by the DDO for submission of respective Bill(s).

Reject Approved Loan:

Provide Employee Id No. and click on Search to Reject any Approved Loan.

Leave:

HOO can Sanction/Approve Casual Leave only. All other Leaves will be Sanctioned/Approved by the Appointing Authority.

Reports:

Legacy Report:

Provide Employee Id No. and click on Show Report to generate Leave Legacy Report of any particular Employee.

Leave Balance Report:

Provide Employee Id No. and click on Show Report to generate Leave Balance Report of any particular Employee.

Apply Leave:

If any Employee is unable to send his/her Leave Applications through e-Services of Employees, you can generate his/her Leave Application. Employee Id No. will be required.

Joining Report:

If any Employee is unable to send his/her Joining Applications after availing of any Leave through e-Services of Employees, you can generate his/her Joining Application. Employee Id No. will be required.

Leave List:

Provide Request No., Employee Id No. and Year then click on Search to generate Leave List for any particular Employee.

Leave Legacy:

Provide Employee Id No. and other Info as required then click on Search to input Balance Casual Leave available for that particular Employee as on the given Date.

Leave Scheduler:

This Module is meant for re-scheduling the Casual Leave at Credit to an Employee. Click on this Module and Fill in necessary information as required including Employee Id. Click Search Button. Then Click “Run Schedule”.

Cancel/Modify Leave:

This Module is meant for Cancelling/Modifying any Casual Leave Sanctioned earlier.

Leave Deduction:

This Module is meant for Deduction of Casual Leave for Late Arrival, Early Departure etc.

Request Pulling:

This Menu is meant for Assigning some old pending matters from previous HOO to current HOO.

TA/DA:

Tour:

Application Request:

Provide Employee Id No. and Click Search to get Application Request Screen. Fill in necessary information about Tour and Click on save as Draft. This will go to Request Status Menu for approval by HOO. After Approval, Application No. will be generated.

Claim Request:

Click the LoV for Application Id to choose desired Application Id then Click Search. Generate Claim and save it for approval by HOO. Once the Claim Request is approved by the HOO Claim Request Id will be generated. This Id will be accessible by the tagged DDO for preparing TA Bill.

Report:

Tour Application Report:

Provide Employee Id No. and Application No. to generate Application Report.

Tour Diary:

Provide Employee Id No. and Claim No. to generate Tour Diary.

Sanction Report:

Provide Employee Id No. and Claim No. to generate Tour Sanction Order.

LTC/HTC Application Report:

Provide Employee Id No. and Application No. to generate LTC/HTC Application Report.

Release Application Report:

Provide Employee Id No. and Application No. to generate LTC/HTC Release Application Report.

Request Status:

Select Application Status or Claim Status Tab one by one the Click on the Icon in respect of the Sl. No. of the Employee you want to approve. Click Save & Approve to approve.

LTC/HTC/TC:

Application Request:

Provide Employee Id No. and Click Search to get Application Request Screen. Fill in necessary information about LTC/HTC/TC and Click on save as Draft. This will go to Request Status Menu for approval by HOO. After Approval, Application No. will be generated.

Claim Request:

Click the LoV for Application Id to choose desired Application Id then Click Search. Generate Claim and save it for approval by HOO. Once the Claim Request is approved by the HOO Claim Request Id will be generated. This Id will be accessible by the tagged DDO for preparing LTC/HTC/TC Bill.

Transfer:

Transfer Advance:

Provide Employee Id No. and Tick on Manual or System Radio Button then Click Search to get Transfer Advance

Screen. Fill in the necessary information and Click on Save. Transfer grant Claim Id will be generated.

Claim Request:

Provide Employee No. and Select Transfer Details. Click the LoV for Transfer Claim Id to choose desired Application. Now approve and save the Claim for preparing Bill from DDO end.

AA : General Working Interface:

Masters:

This Menu is meant for Setting up the HOO Approver System. This Menu is not available to HRMS AA Operators.

Inbox:

You can see all types of Applications like Earned Leave, Commuted Leave, Child Care Leave etc and Loan Applications other than GPF & Festival Advance forwarded by the HOO. Open the Applications for taking action as AA. Inbox will be cleared only when actions on the Applications stored in it are taken or processed. Applications can never be Deleted from Inbox.

Loan:

AA can Sanction/Approve all Loans except 2 (two) types of Loans viz. Festival Advance

and GPF Loans/Withdrawals which are Sanctioned/Approved by the HOO.

Loan Application Report:

You can generate any Employee’s Loan Application Report from this Module. Employee Id No. will be required.

Generate Intimation Letter — Intimate Intimation Letter:

This Module is meant for generating and intimating the concerned Employee about his/her Loan Application Status.

Generate Intimation Letter — Modify Intimation Letter:

This Module is meant for generating and intimating the concerned Employee about Modification of his/her Loan Application Status.

Loan Sanction Order Report:

This Module is meant for generating the Loan Order Report.

Reject Approved Loan:

This Module is meant for Rejecting any Approved Loan.

Leave:

AA can Sanction/Approve all types of Leaves other than Casual Leave. Casual Leave is Sanctioned/Approved by the HOO.

Reports – Legacy Report:

Provide Employee Id No. and click on Show Report to generate Leave Legacy Report of any particular Employee.

Leave List:

Provide Request No., Employee Id No. and Year then click on Search to generate Leave List for any particular Employee.

Leave Legacy:

Provide Employee Id No. and other Info as required then click on Search to input Balance Casual Leave available for that particular Employee as on the given Date.

Leave Scheduler:

This Module is meant for re-scheduling the Casual Leave at Credit to an Employee. Click

on this Module and Fill in necessary information as required including Employee Id. Click

Search Button. Then Click “Run Schedule”.

Request Pulling: This Menu is meant for Assigning some old pending matters from previous AA to current AA.

Promotion:

This Module is meant for handling Departmental Functional & Non-Functional Promotion of Employees.

Transfer:

This Module is meant for handling the Intra-Departmental Transfer of Employees.

Pay-Fixation:

This Module is meant for doing Pay-Fixation of Employees.

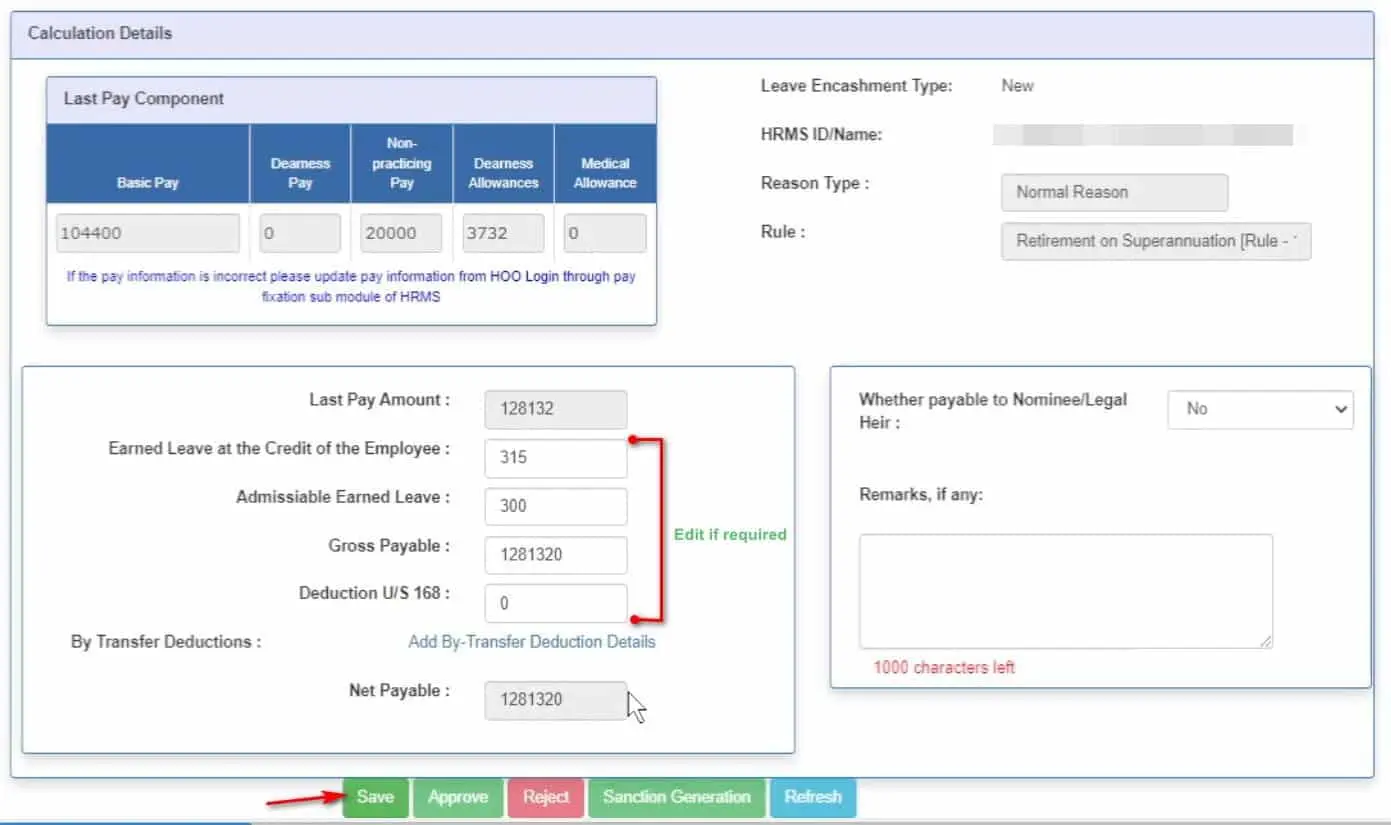

Exit Management (Pension):

This Module is meant for handling Pension of Employees.

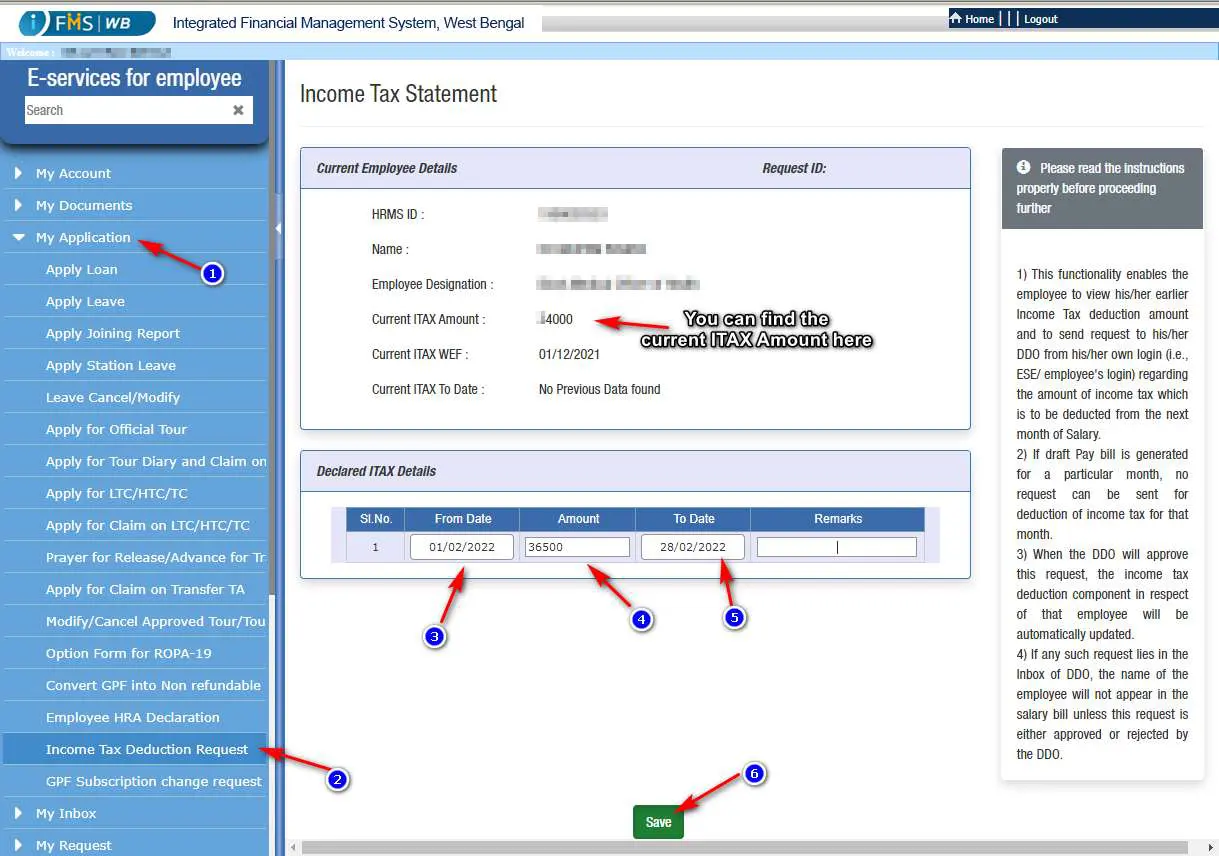

e-Services for Employees

In order to get several e-Services of IFMS, an Employee can Register his/her Employee Id to Login to IFMS. Services like monthly Pay-Slips, I-Tax Statement, Arrear Statement, Apply for GPF & Other Loans, Apply for Leave, Joining Report, TA Claim, LTC/HTC/TC Claim etc. can be obtained from anywhere over the internet.

How to Register:

Open www.wbifms.gov.in and mouse over to the Logo titled “e-Services for Employees” then Click on “Signup for Registration”. A new Window will appear. Enter your Employee No., Mobile No. & the text appeared in Captcha and now Click on Register. You will now be prompted to enter the OTP sent by the System to your registered Mobile. Complete the process – after some time a message will come to your Mobile with your Login Id (i.e. your Employee No.) and a Password. Now, Click on “Sign in” and Login to the System providing Login Id (your Employee No.) and Password. First time you will be prompted to change your Password. If your name is “Bivas” and your year of birth is 1992 then you may choose your new Password. The choice is yours but for Password, there should be at least One Capital Letter, One Small Letter, One Numeric Character, and One Special Character and total length should not exceed 15 Characters or below 8 Characters.

Click Here to view How to register in WBIFMS

The Services you will get:

– Monthly Pay-Slips,

– Income-Tax Statement (Salary Statement At-a-Glance),

– Arrear Salary Statement (if any),

– Application for GPF Loan,

– Application for Official Tour,

– Application for Leave,

– Joining Report,

– Application for LTC/HTC/TC,

– Claim for Official Tour,

– Claim for LTC/HTC/TC,

– Family & Nominee Declaration,

– GPF Final Payment Application if you are going to retire within next 3 months.

Some Important IFMS Issues : Solved

1. The GPF Subscription of an Employee is not being shown in TR-18 Inner Sheet though GPF Subscription of the Employee is correctly entered in the Salary Component Module.

Solution: Please check whether End of Service entry in General Information has been changed. GPF subscription will automatically be stopped before three months of End of Service.

2. Can’t enter an Old HBL Interest Schedule in Deduction sub-module of Salary Component. When tried, some error messages are being displayed.

Solution: First Untag the Employee from Post Code then Untag the Employee from HOO. Now enter the Deduction Schedule. Save it with DDO’s DSC. Now Tag the Employee with HOO. Re-generate Post Code. Similarly, you can generate Manual Deduction Schedules like Computer Advance Interest, Motorcycle Advance Interest, Car Advance Interest etc. which are not generated by the System automatically.

3. After TA Bill (HRMS) generation at DDO’s e-Billing module, I have discovered that there should be some changes in the TA Bill (TR-21). What to do now.

Solution: Reject the Bill at DDO’s end. At HOO’s end, change the entries in Claim Request accordingly and approve it again. Regenerate the Sanction Order from HOO. Now prepare a new TA Bill in e-Billing module at DDO’s end.

4. While making LPC Out of an Employee, some error messages are being displayed like “TA Bill pending with the Employee” but the Employee is confirming that he has got all his pending TA Bills. What is the solution?

Solution: Employee has got some Approved Claims but for those Approved Claims no Bill has been generated at DDO’s end. Go to the HOO’s TA/DA Request Status. Open Official Tour of that Employee and select Claim status Tab. There must be some Approved Claims. Open these and Reject all of these.

5. I have wrongly entered Sanctioned Strength in AA module and generated Post Codes for employees. Some employees have already been tagged with Post Codes. How to resolve.

Solution: Open the Sanctioned Strength module concerned. Tick the Select radio button. Click on Tag Employee. Select the tab Tagged Employees (Approved). Untag all Employees. Back. Now you can delete the Sanctioned Strength Entry. Regenerate the Sanctioned Strength Entry afresh. Generate Post Codes again for the existing Employees.

6. One of our HRMS HOO Operator has generated Post Code for a newly joined Employee in existing

Sanctioned Strength. Saved it. But when forwarding it to the HOO Approver from Pending Request to be Approved, some System Error Message is being displayed. The Employee could not be tagged with a new post Code even by the HOO Approver. How to solve it.

Solution: Open the Sanctioned Strength module concerned by the HOO Operator (not HOO Approver). Click on Pending Request to be Approved Tab. Now boldly Delete the Request. Leave the Module and Logout. The HOO Approver will now be able to Tag the Employee with a Post Code.

7. A new Employee has joined and his Salary Bill database has been prepared afresh. But when PAN is being entered a System error message is emerging “PAN No. is already tagged with a DDO”. How his PAN can be entered.

Solution: The Employee has already drawn his Salaries from another Department of this Government and he has quitted from the previous Service and his previous Department has terminated his Service. Collect the previous HRMS Employee No. from the Employee. Enter that No. in Previous Unique Id No. in General

Information sub-module. Enter PAN. Save and approve with DDO’s DSC.

8. An Employee has been transferred from other DDO. His Salary Bill database is showing perfectly in My Employee. But when a draft Bill is being generated, his name is not showing in TR-18 Inner Sheet. What to do.

Solution: Perform the Joining In of the Employee again. The Problem will be resolved.

9. A Draft Salary Bill has been generated for checking in the mid of a month. Within a few days, DDO has changed and a new DDO has joined with new DSC. Now, while trying to change any Salary Bill Data, no component can be modified for the current month and while generating a new Salary Bill no data is coming. Previously generated Draft Salary Bill could not be rejected as the Reject Button is not showing active. How to sort out the Problem.

Solution: Note Down the Request Id of the Draft Salary Bill. Open Request Pulling. Tick Self Assignment. Click Search Button at the bottom. The Bill Information will be displayed. Tick Mark and Click Self Assignment. Now open the Draft Bill – you will see that the Reject Button is active. Reject the Bill and do continue your work.

10. A Group-A Officer is going to submit his SAR online. How he can submit it online.

Solution: The Officer concerned has to Login through e-Services for Employees with his Login Id (HRMS Id). Click on Appraisal->View/Create Appraisal Hierarchy->Select Year->Search->Insert. Enter From Date & To Date. Tick SAR Required. Enter HRMS Unique Ids for your (a) HRMS REPORTING OFFICER Approver, (b) HRMS REVIEW OFFICER Approver & (c) HRMS ACCEPTING OFFICER Approver. Search their Cadre & Designation through LoV. Click Save. Back to Left Menus. Click Initiate Self Appraisal. A Table will appear. Click on Initiate Icons and fill in the Forms. Finally Submit.

FAQ

What is the Full form of WBIFMS?

Full form of WBIFMS is ” West Bengal Integrated Financial Management System” which is a financial management portal of West Bengal Finance Department.

What is the office address of WBIFMS?

WBIFMS is a part of Finance Department of West Bengal which is located at NABANNA, Howrah- 711102, West Bengal.

How to register on wbifms?

An employee can register by clicking on the E-Services for employee option from the official website of WBIFMS.

Thank You 😊

How up date E L every 6 months and C.L every year

Pl. do the needful.

In Wbifms portal there are two request id created by mistake, against the one unique id,

how to delete one request id?

In connection to ” SAR “, if by mistake the previous hierarchy has been copied and saved and reference id issued.Is there way to modify or change the previous hierarchy to new hierarchy.

I am trying to take EL but every time a pop up showing that “Employee sanctioning authority not tagged” . Pls say some solution.

Since last three months I am failing to login my Wbifms account.Even tried to use forgot password.Unfortunately that has also been failed.Resulting suffering a lot for different services including submission of SAR.Please help.

Please use Forgot password option from Home Page.

I want to learn IFMS Module fully. I do not know from where I should learn it.

Please help in this regard.

Please go through this website, and visit our YouTube channel: WBIFMS HELP, Also you can join our Facebook group named WBIFMS HELP.

please let me know date of implementation of the following e-bantan , Centralised Treasury System (CTS), e-receipt, e-Pradan, e-Billing, HRMS