Leave Salary Calculation for West Bengal Government Employees

In terms of Rule 168(2) of the WBSR part 1 reads with finance department Order No 4625-F, dated: 26/5/1999 Govt. of West Bengal, after retirement or death of a Government Employee his/her unutilized earned leave may encashment up to 300 days. Leave salary calculation should be done on the basis of last month pay of the employee.

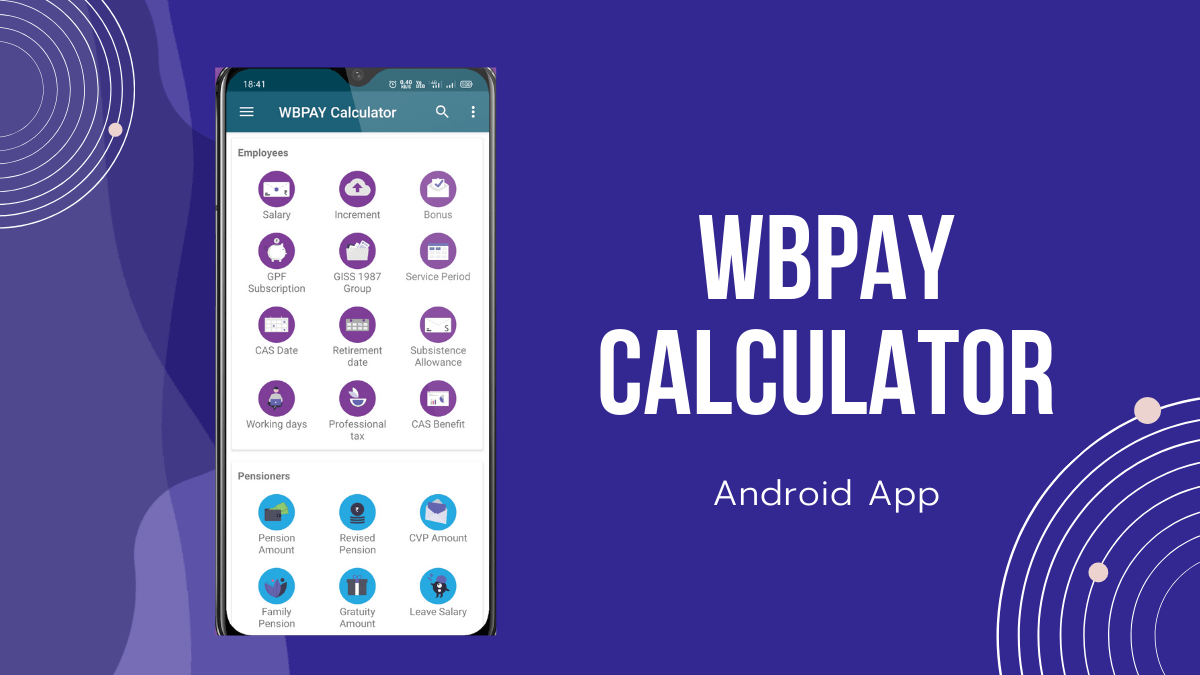

In this leave salary calculator, an employee can easily get his/her amount of leave salary amount.

Get more calculators here:

Pension Amount CalculatorReviced Pension Calculator

Gratuity Calculator

CVP Calculator

More Details about Leave Salary Rules:

Leave Encashment—{Rule 168A, 168B & 168C of W.B.S.R. Part-I)

When an employee retires on superannuation, dies while in service, the leave sanctioning authority will grant him leave encashment upto the period of 300 days or leave due whichever is less as per GO. No. 3453-F dt. 28.3.2001. Power to sanction leave encashment has since been delegated to Head of Office. (No. 4794F dt. 6.5.94 )

An employee who retires while on suspension will be eligible to leave encashment, if the suspension was wholly unjustified.

An employee who retires by giving notice to Govt. or is retired by Govt. by giving him notice or pay and allowances in lieu thereof will get leave encashment in respect of EL and also half pay leave at credit provided the total period of such leave does not exceed his normal date of retirement. An employee who retires on invalidation from service is also entitled to leave encashment on the same principle but temporary employees are not entitled to half-pay leave facility.

If leave salary for half-pay leave component fails short of pension and other pensionary benefits, cash equivalent for half-pay leave shall not be granted. (because pensionary benefits are deducted from half-pay leave).

In case an employee resigns or quits from service, he will be granted leave encashment for a period not exceeding half the E.L. due not exceeding 150 days. Cash Equivalent = ( Pay + DA + MA }/30 X Unutilized Earned Leave subject to a maximum of 300 days.)

No HRA, Hill Allowance. Fixed T. A. etc. is admissible. The same may be drawn under the head “2071-Pension and other retirement benefits – 01-Civil-115-leave encashment benefit (FA)-04 Pension and Gratuity” (GO No. 1863-F dt. 15.2.2001)

Cash equivalent of leave salary in case of death in service of a Government employee shall be paid to his family. The term family in this rule shall mean and include the following: (1) Wife or husband as the case may be, (2) minor sons and miner unmarried daughters including adopted sons/daughters, (3) dependent mother. (4) dependent father.

Cash equivalent shall not be payable to more than one member of the family at the same time. It shall first be admissible to the widow(s) / widower / and then to the children in equal shares and thereafter to the mother and lastly to father. Where a govt. employee / survives by more than one widow, such leave salary shall be paid to them an equal share. (If there is none in the family mentioned above the same may be paid against succession certificate subject to the approval of Finance Department)

Kinds of leave due and admissible: [Rule 166(viii)]

i. Earned Leave

ii. Half Pay Leave

iii. Commuted Leave

iv. Leave not due

v. Extraordinary Leave

View: All Calculators

Very useful

Thank you very much

An employee joint as LDC on superannuation w.e.f 09/11/2021. his old basic pay Rs. 37,600/- and after fixation his basic pay as on 09/11/2021 Rs.39800/ after retirement 300 days EL credit to his account. calculate his leave sanary