User Manual for “Sanction Inbox” Facility to DDOs in e-Billing Module of IFMS

User Manual for “Sanction Inbox” Facility to DDOs in e-Billing Module of IFMS

❖ APPLICABLE IN CASE OF TR FORMS-

✓ All categories of sanctions related to TR-50.

✓ All categories of sanctions related to TR-37 (except sanctions related to AIS officers of West Bengal cadre).

✓ All categories of sanctions related to TR-60.

✓ All categories of sanctions related to TR-61.

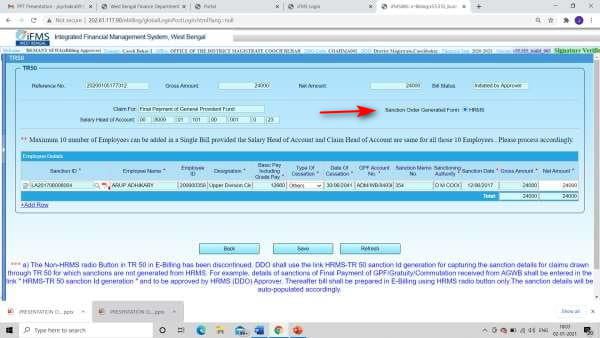

❖ Presently, the GPF claims related to TR-50, i.e., Final payment of GPF (excluding Group-D employees), Refundable, Non-Refundable Advance and 90% withdrawal of GPF fund etc. are drawn by DDOs by selecting the “HRMS” radio button after the advances are sanctioned by the Head of Office in HRMS module. Final payment of GPF of Gr D employees are drawn by DDOs by selecting ‘DPPG’ Radio button after payment authority is issued by DPPG, WB online. In case of payment of Retiring Gratuity, Death Gratuity and CVP, after obtaining the authorities from A.G., W.B., and for Leave Salary, after getting the sanction order manually prepared by the Head of Office, the Sanction IDs are generated by the concerned DDOs in HRMS having entered the sanction details. Thereafter the DDOs draw the bills by selecting the ‘HRMS’ Radio button and tagging the Sanction ID.

❖ In case of claims related to TR-37 i.e., House Building Advance, Computer Advance etc. are drawn by DDO by selecting the “HRMS” radio button after the loans and advances are sanctioned by the Head of Office in HRMS module.

❖ In case of claims related to TR-60 and TR-61, sanctions are prepared manually by the respective Head of Office and tagged with the TR form manually when submitted to treasury.

But it is often found that DDO has to prepare such bills in E-Billing without viewing such sanctions in the system. So, in order to make it more user friendly, Sanction Inbox facility in E-Billing is now introduced to view all the sanctions generated from a) Online GPF Module (by DPPG for Gr D employees), b) HRMS Loan Module c) TR 50 Sanction ID generation, d) GISS Sanction and pending for billing.

Introduction of Sanction Inbox facility in E-billing module will also discontinue both the “HRMS” radio button and “DPPG” radio button with immediate effect.

✓ In order to prepare the bills related to TR-50, TR-37, TR-60 and TR-61, the following actions shall have to be taken by DDO-

1. DDO shall login in E-Billing system and shall get a new menu namely “Sanction Inbox”. Clicking on the menu, a screen will be opened containing the following details-

2. Once the appropriate Radio Button is selected by the user, an input field will appear in the screen as “Claim Type”. Selection of claim type remains optional for DDO while searching for the sanctions lying in the sanction inbox.

3. Once the user clicks on search button with or without selecting the Claim Type, a new screen will be opened containing the detailed information regarding the sanctions generated from HRMS of different employees belonging to the establishment.

4. Once the user is satisfied with all the relevant details of the sanctions, the user can select one or multiple sanctions at the same time provided-

• The nature of the claims remains same in each of the selected sanctions e.g., sanctions related Final Payment of GPF in respect to Group-A, B and C cannot be selected with a sanction related to Final Payment of GPF of Group-D employees. In other words, claims related to multiple Head of Accounts cannot be tagged in a single bill.

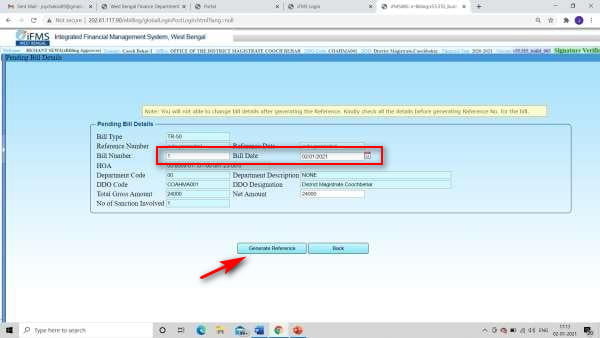

5. After the user selects the sanction(s), user shall click on “Proceed to Bill Preparation” button in the screen. A new screen will appear which looks alike the Bill Entry/Modify page in E-Billing module (where the user clicks to prepare all types of bills). System will allow the user to enter the ‘Bill Number’ and ‘Bill Date’ only.

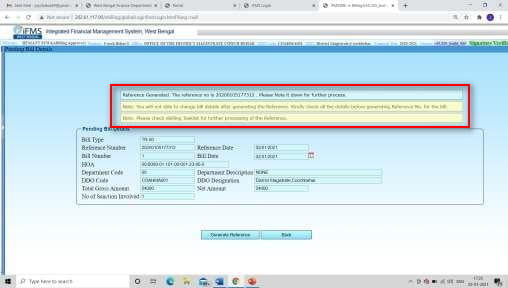

6. Once the user is satisfied with the bill details, user shall click on “Generate Reference” button below the screen to generate the reference which will depict the same result when a bill details is saved from Bill Entry/Modify page.

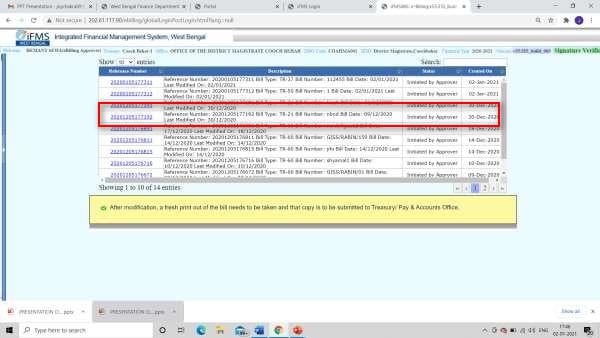

7. The message envisaged in the screen should be properly read out. Once the reference is generated, the same reference shall be available in the Task List menu.

8. Once the reference is clicked, system shall direct the user to enter into the bill page. No modification will be allowed in any of the fields in the following screen. However, facility to reject the draft bill has been provided in the same screen. If the draft bill is rejected, then the sanction tagged with the bill will be auto- populated in the Sanction Inbox again.

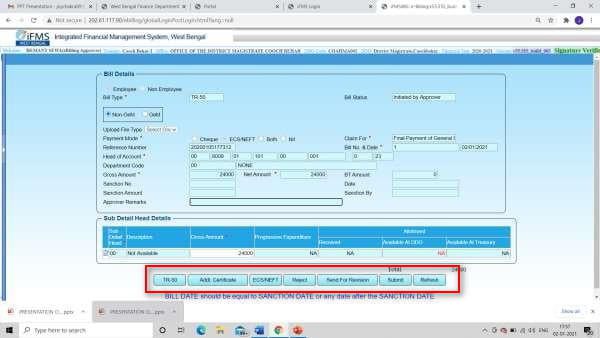

9. On clicking TR-50 button at the Bill Entry/Modify page, the system shall auto- populate the sanction as tagged with the bill. Neither the selection of ‘HRMS’ or ‘DPPG’ radio button will be required nor the selection of sanction from any LoV will be required henceforth.

10. Saving the bill details and submission of the bill to the treasury shall be done as per the existing modality.

11. Generation of Sanction Order from HRMS login of DDO shall continue to operate even with the development of the Sanction Inbox at DDO E-Billing login.

12. As the ‘Sanctions’ are generated against the HRMS ID, no separate SANCTION ENTRY/APPROVAL process shall be required further in CTS. Treasury while processing those bills in CTS can see that SANCTION ID is already tagged with the Bill/Token. Treasury shall just only verify the physical copy of the authority/Sanction.

13. Note: This process shall be applicable only for those employees against which HRMS ID is available in IFMS. If it is found that claim of such employee is required to be drawn in TR Form No.50 who has no HRMS ID due to reason that the employee has retired/expired prior to introduction of HRMS or otherwise, such cases shall have to be referred to the mail address of e- Governance Group along with the details of DDO Code, DDO contact Number, Employee details (Name, Office, DOR/DOD, Claim Type etc.)

Mail Address: [email protected], [email protected].

Sir/Madam,

I am a student of Moulana Azad College. I just passed class 12 last year. I was eligible for Swami Vivekanand Merit Cum Scholarship and i also filled up it and i include all details which was needed, everything was fine. But yesterday i got a massage that WBIFMS has released Rs. 12000 (Scholarships and Stipends) from Calcutta PAO-III Treasury and is scheduled to be credited to Bank, but i did not get any response from my bank.I think the money goes to a another account because The WBIFMS has sent the money is 13 digit bank account number but my bank account number is 14 digited.

Please go through the matter quickly.

Please communicate with the concern office.

How to generate Sanction Order for payment of Group Insurance-cum-Savings Scheme, 1983/1987 Bill.