The filing the TDS Return in FORM GSTR-7 can be done both through the online mode in the GST portal. In this post showing the process of GSTR7 filing using online mode.

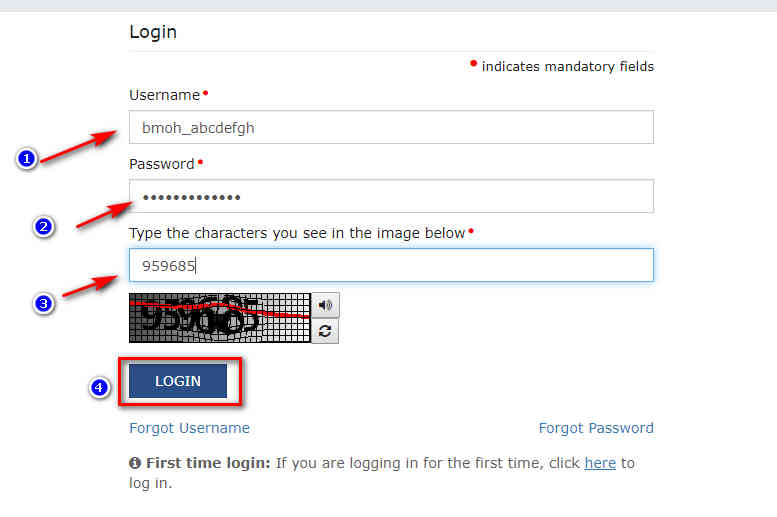

Login using GST Login ID and password from GST Portal https://www.gst.gov.in

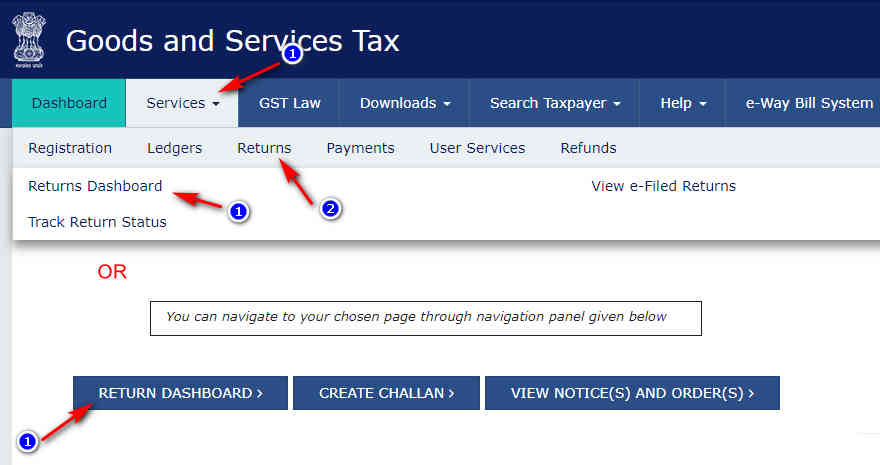

Click on Services ⇒ Return Dashboard

or

Click on the Return Dashboard button

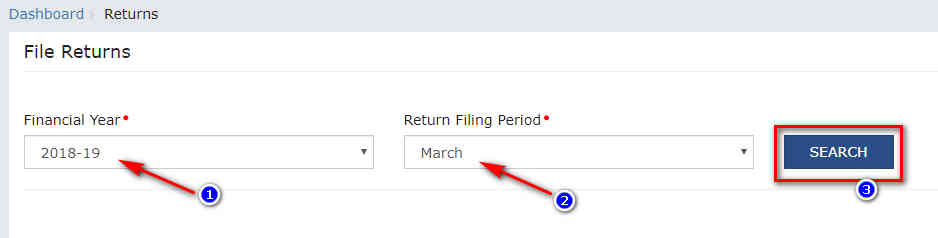

Select Financial Year and Month and Click on Search

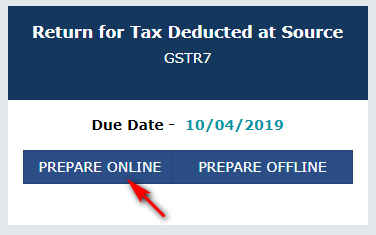

Scroll down and click on the Prepare Online option

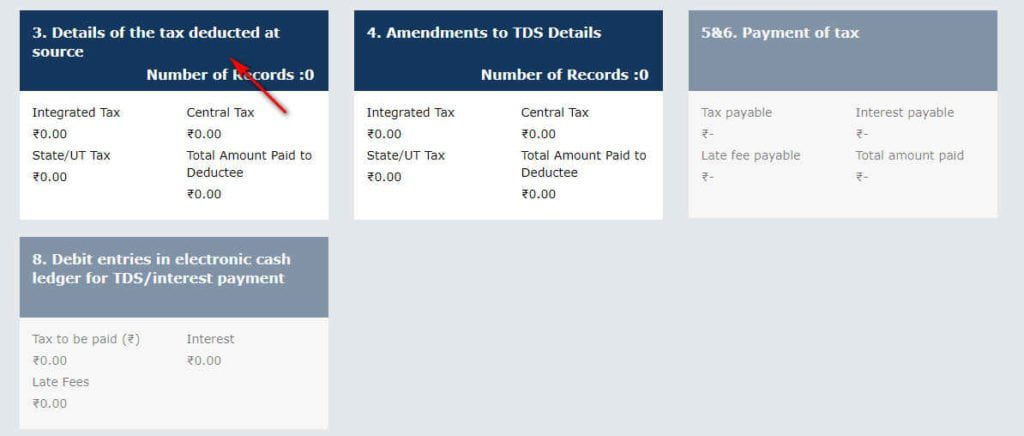

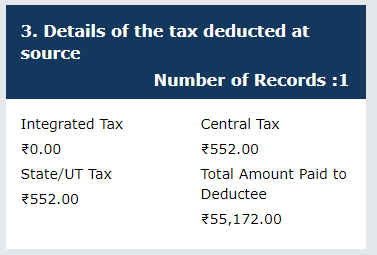

Click on the No 3. option Details of tax deducted at source

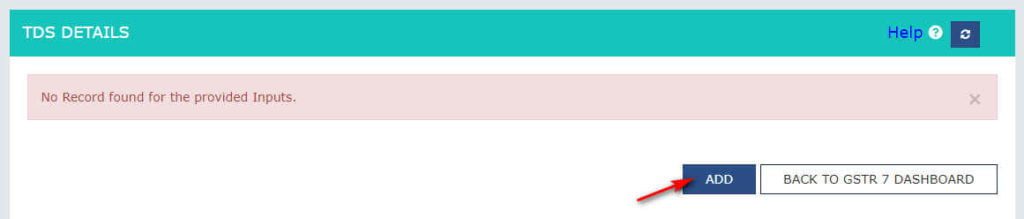

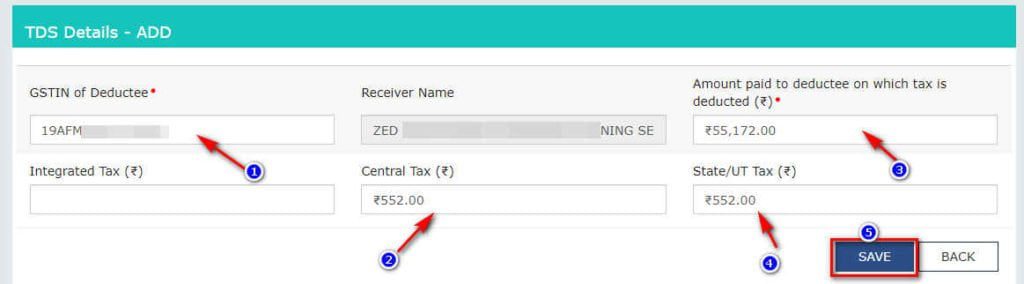

Click on add button and add the details and click on the Save button

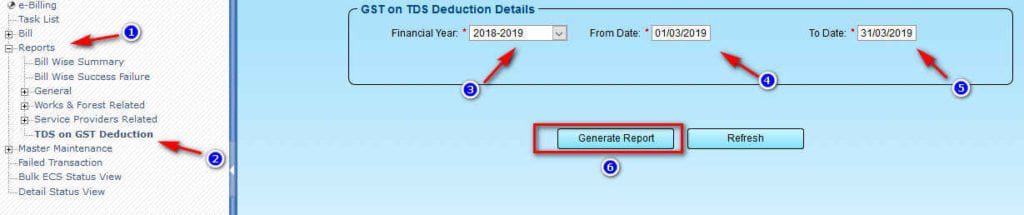

For finding the details of GST TDS you can use the TDS on GST option from DDO Login (for WB govt office only.)

Click on Back to GSTR7 Dashboard

You can now view the updated amount is reflected on the no 3. Option

Click on proceed to file button.

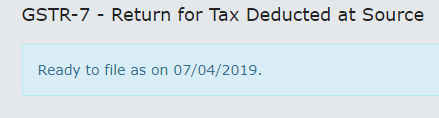

Wait for a minuite and click on the refresh icon untill the text shows “Ready to file as DD/MM/YYYY”

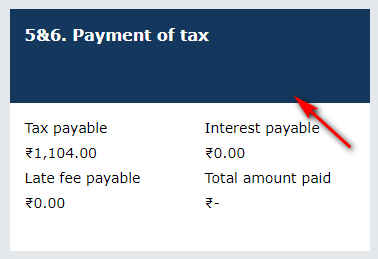

Click on payment of Tax option (no. 5&6.)

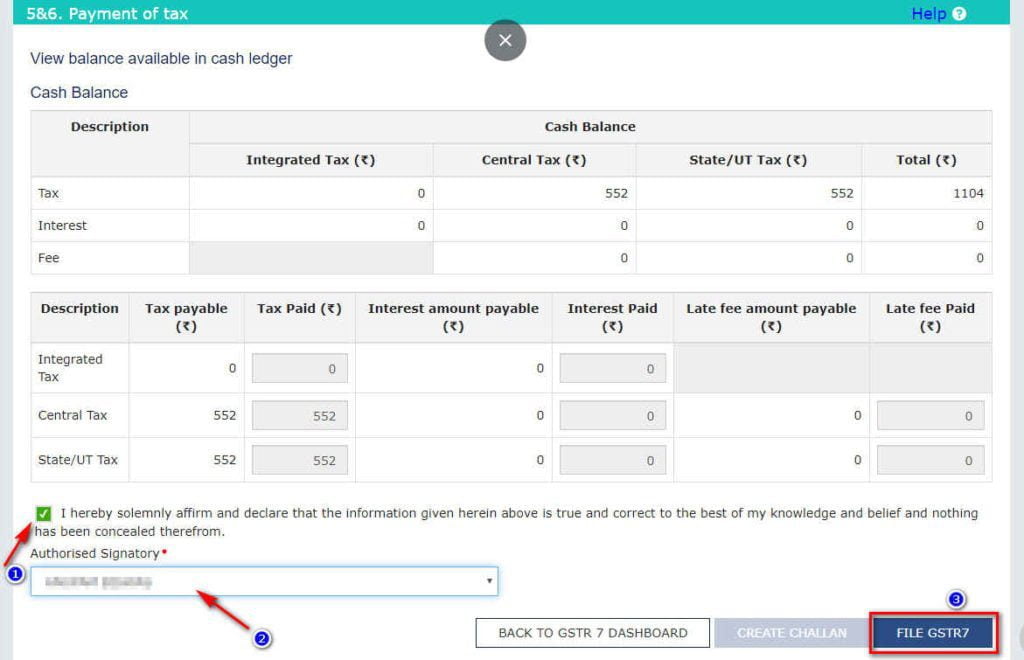

Agree the declaration, Select the authorized Signatory and click on the FILE GSTR7 button

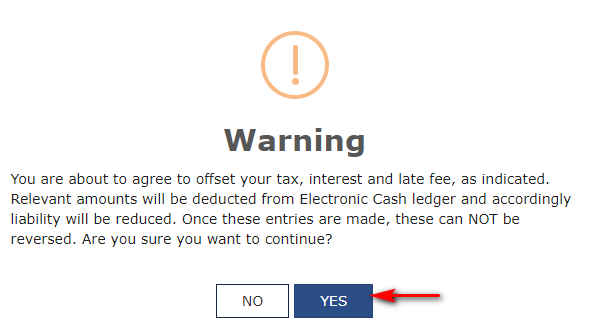

An warning message will appear

Click on Yes.

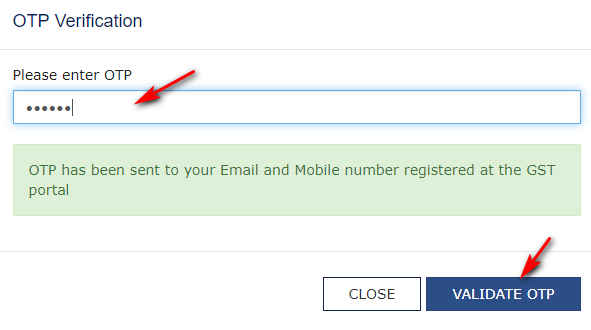

You have to verify the identity using either DSC (Digital Signature Certificate) or EVC (Electronic Verification Code- by OTP on mobile or email). I am using the second one here.

After entering the OTP Click on VALIDATE OTP button

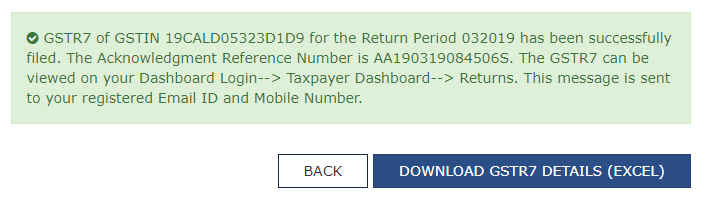

Now you can go back and download the GSTR7 details as PDF.

Thank you for visiting 😊