Vide order of the Finance Department now an employee of West Bengal Government can send the Income Tax deduction request through e-Services of Employees login of WBIFMS portal. Here in this article showing the process of sending online request of deduction of Income tax.

Important points must know before submitting online Income Tax deduction request

- This functionality enables the employee to view his/her earlier Income Tax deduction amount and to send request to his/her DDO from his/her own login (i.e., ESE/ employee’s login) regarding the amount of income tax which is to be deducted from the next month of Salary.

- If a draft Pay bill is generated for a particular month, no request can be sent for deduction of income tax for that month.

- When the DDO will approve this request, the income tax deduction component in respect of that employee will be automatically updated.

- If any such request lies in the Inbox of DDO, the name of the employee will not appear in the salary bill unless this request is either approved or rejected by the DDO.

How to Send Income Tax Deduction request online

Here is the step by step guide to send the Income Tax Deduction Request online:

1. Log in to the e-Services for Employee (ESE) Login with your Employee ID and password.

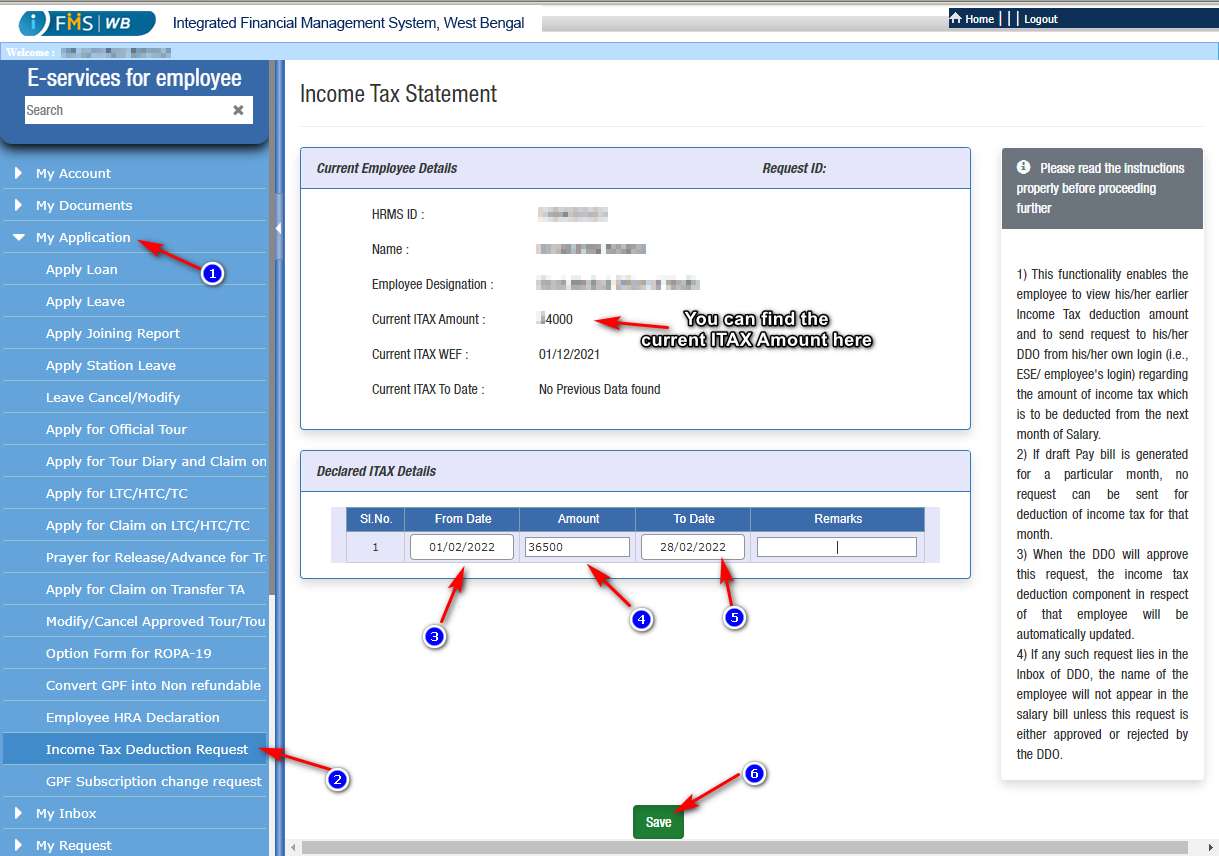

2. Click on My Application then Income Tax Deduction Request.

3. You can now find the current Income Tax deduction amount with effect date and up to a perticular date if available.

4. Now, in the next table select From Date which you want to change the Income Tax Amount and then enter the amount of your choice which you want to deduct and optionally you can add the To Date for the effective ITax Amount.

5. Then Click on the Save button at the bottom.

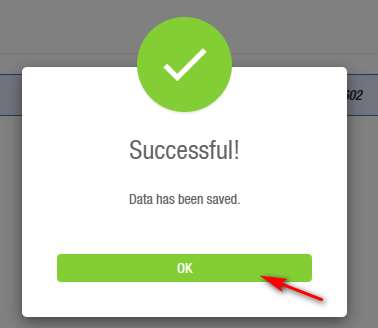

6. Now, a confirmation dialogue will pops up with the message “Data has been saved”. Here, you just need to click on OK.

Save/ Forward or Reject the request

7. Finally, you need to click on the Forward button to forward the request to your Drawing and Disbursing Officer or DDO for Approval. If you want, can save this by clicking on the Save Button which will letter be found from the My Inbox ==> Inbox menu. Or you can reject it before forwarding by clicking the Reject button if anything wrong.

Check Status of Income Tax Deduction Request

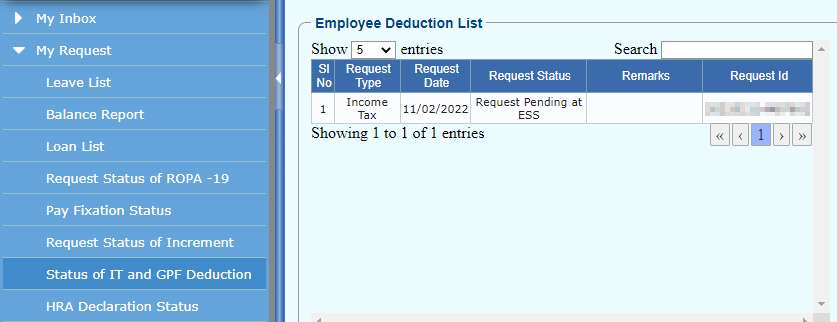

8. For checking the status of the income tax deduction request, you need to click on the My request ==> Status of IT and GPF Deduction.

FAQs

Why Employee name not included in the Salary Bill in WBIFMS ?

If an employee submitted request for changing Income Tax, HRA Declaration, GPF Subscription request or Family Information, and the same is pending in the inbox of the DDO/ HOO, it may be the cause of this.

Is it mandatory to submit an Income Tax deduction request online?

No, this is not mandatory. An employee can send the offline application as well to change the income tax amount.